|

Getting your Trinity Audio player ready...

|

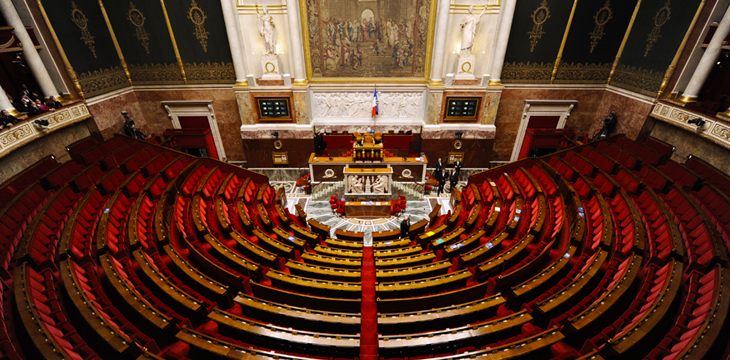

The Finance Committee in the French National Assembly has called for the banning of anonymous cryptocurrencies. In its report, the committee stated that these coins pose a big risk to the financial services industry. The 148-page report further highlighted the risk that cryptos, in general, pose to regulators globally.

In the introduction to the report, the committee’s chairperson Éric Woerth mentioned Zcash and DeepOnion as some of the anonymous cryptos whose use should be banned. He stated:

“It would also have been appropriate to propose a ban on the dissemination and trade in cryptocurrencies built to ensure complete anonymity by preventing any identification procedure by design. This is the case for a certain number of cryptocurrencies – Monero, PIVX, DeepOnion, and Zcash – whose purpose is to bypass any possibility of identifying the holders. To date, regulation has not gone that far.”

While he even mentioned the so-called privacy coins by name, Woerth was vague regarding the ban. He didn’t specify whether he meant a complete ban from use in France, or if it was just from being listed on French crypto exchanges.

Woerth was also critical of cryptos in general, saying they are a headache to regulators everywhere. In his opening remarks, he stated, “We must be aware of the problems that cryptocurrencies can pose in terms of fraud, tax evasion, money laundering or fraud, or energy consumption.”

He did, however, give a lifeline to the crypto community in France by calling for more precise regulation targeting the industry. This regulation should find a common ground that doesn’t infringe on the security and privacy of the users.

Despite France being one of Europe’s financial giants, it has used a hands-off approach to cryptos. While the country hasn’t outright banned the use of crypto, it has refrained from implementing a legal framework for the industry. This hasn’t dampened the country’s entrepreneurs from forming blockchain startups. Together with Germany, France has continued to explore the use of blockchain technology especially in the tracking of agricultural produce.

03-09-2026

03-09-2026