|

Getting your Trinity Audio player ready...

|

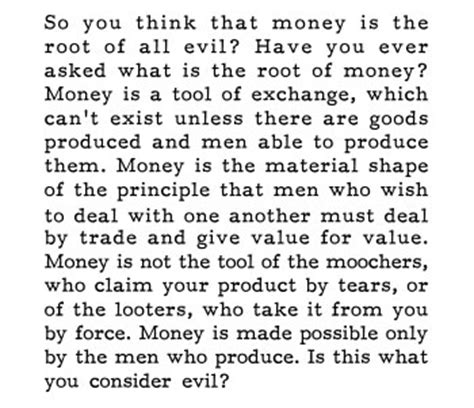

“Money is a living power that dies without its root. Money will not serve the mind that cannot match it,” spoke the character Francisco d’Anconia, an anti-hero, sometimes protagonist in Ayn Rand’s mid-20th century novel, Atlas Shrugged.

“Money is a living power that dies without its root. Money will not serve the mind that cannot match it,” spoke the character Francisco d’Anconia, an anti-hero, sometimes protagonist in Ayn Rand’s mid-20th century novel, Atlas Shrugged.

Alisa Zinov’yevna Rosenbaum escaped Russia just as it descended into Marxist hands. The great German thinker fancied his communism to root and flourish in what he described as cosmopolitan, industrial capitalist economies. That instead and in fact it rose and gave hope to unwashed, superstitious masses, tribes lining a loose confederation east of The Continent, never entered Karl Marx’s racist thoughts.

The rest of that sorry story lasts a few horrible decades, tens of millions of bodies stacked in its wake from cold and hot wars, purges, pogroms, gulags. The superstate lost a seemingly insignificant teen Jewess during its revolutionary fervor, who bounced to the United States on a family visitation visa, ending up in Chicago and then, later, Hollywood. She overstayed that visa as an illegal immigrant. She would never return to Russia.

The lottery

Writing was her calling, and she supposedly chose Ayn (like pine) Rand to Americanize her very Russian Jew-sounding name as neither were particularly well regarded in her adopted country. Legend has it Rand came from the typewriting manufacturer. Whatever the case, she became a famous, hated and loved, philosopher and novelist. Atlas Shrugged was her final novel, musings on what happens when the few geniuses of the world strike in solidarity.

Francisco d’Anconia in Atlas she fashioned as an heir, a playboy, presumed lout. There’s more there-there to him, of course, and his famous monologue at a social gathering, The Money Speech, has become something of legend.

It’s particularly insightful in light of recent goings-on in the United States, where lottery fever has officially taken over. Folks I’ve never heard speak of money, of wealth, have newly found enthusiasm for the subject, making for great conversation.

Thrift, savings, investment

The unsexy truth of the matter is wealth takes prudence, delay of instant gratification, and a longer time preference. What is earned must be spent wisely, choice by choice, between appreciating and depreciating assets. Income portions must be set aside, as a matter of course, and plugged into rigorous untouched boxes. That surplus, after living beneath our means, must be made to work while we work.

The unsexy truth of the matter is wealth takes prudence, delay of instant gratification, and a longer time preference. What is earned must be spent wisely, choice by choice, between appreciating and depreciating assets. Income portions must be set aside, as a matter of course, and plugged into rigorous untouched boxes. That surplus, after living beneath our means, must be made to work while we work.

Thrift, savings, investment. Master those, or get close, and you won’t ever be poor. In fact, there’s a better than even chance you’ll accumulate wealth if compound interest has a say in your financial affairs.

For those in my circle consumed with lottery talk, they regaled me with dreams of huge houses, mega cars, lavish vacations, and a kind of emotional security presumably unfathomable. The lottery plays on our envy, our anti-capitalist mentality so ingrained by government schooling. Wealth is luck. Wealth is inherited. Wealth is unfair.

North Carolina

Just this week, someone in the U.S. state of North Carolina took home the giant winnings, over one billion dollars. After taxes, the lottery lucky duck pocketed hundreds of millions. Friends were floored to learn this, being of two minds: one, my god how much the government claims; the other, well, who cares, they’re rich now! The assumption government has a right to wealth, especially wealth of the excessive kind, is never questioned. And the issue, if ever entertained, is only to confirm government’s need for fuel on its way to do benevolent and wonderful things.

What will become of the North Carolinian is actuarially knowable. Chances are good this person will blow sizeable chunks on frivolous nonsense. And who cares! Hundreds of millions of bucks means s/he can afford the fun. Maybe.

What will become of the North Carolinian is actuarially knowable. Chances are good this person will blow sizeable chunks on frivolous nonsense. And who cares! Hundreds of millions of bucks means s/he can afford the fun. Maybe.

To take up with the Randian character again, he explains, “When you accept money in payment for your effort, you do so only on the conviction that you will exchange it for the product of the effort of others. It is not the moochers or the looters who give value to money. Not an ocean of tears not all the guns in the world can transform those pieces of paper in your wallet into the bread you will need to survive tomorrow.”

Bull markets are cancerous

I won’t lie. A shit ton of money rolled my way during the crypto boom of late 2017. Cashed out enough to give my little family extras, doodads, treated the wife to some fun, and upped after school activities and even a week-long surf camp for my then 6 year old. I felt like a goddamn genius.

Friends back then thought I was a financial savant. Kelso has the key to getting rich! Kelso knows money! No, the truth of the matter is I am a colossal jackass. How bad am I at handicapping markets, at financial predictions? Well, we can examine my record in other popular wagers to reveal my now natural law like wrongness.

Friends back then thought I was a financial savant. Kelso has the key to getting rich! Kelso knows money! No, the truth of the matter is I am a colossal jackass. How bad am I at handicapping markets, at financial predictions? Well, we can examine my record in other popular wagers to reveal my now natural law like wrongness.

While El Donald Pussy Grabber Orange God of Thunder was running away with the 2016 presidential election, I was sure, sure as I was of anything, Bill Clinton’s wife would eventually take it. Even as President Elect Trump ascended the hotel stage to claim his crown, I was adding up states. Yeah, I am that guy. I also predicted with retard confidence McGregor trouncing Mayweather. Uh, no.

Crypto speculation, lottery are sides of same evil coin

The crypto boom erased all of that, and a new found confidence overcame me. After a few months of double digit gains, I got used to the divine compounding. A sincere part of me believed this would go on in perpetuity.

Until it didn’t. The crypto market bottomed under the weight of economic reality, a crashing back to earth badly needed … even if it mean stinging me something fierce. I won’t ever celebrate someone losing their wealth, but this was a good thing for economic maturation. It was for me too. I was forced to revisit my assumptions, to heed d’Anconia’s warnings, to again practice thrift, savings, and wealth.

Until it didn’t. The crypto market bottomed under the weight of economic reality, a crashing back to earth badly needed … even if it mean stinging me something fierce. I won’t ever celebrate someone losing their wealth, but this was a good thing for economic maturation. It was for me too. I was forced to revisit my assumptions, to heed d’Anconia’s warnings, to again practice thrift, savings, and wealth.

Cryptocurrency will be the greatest wealth transfer in human history. It has already started. Those kept from access to capital, to investment, for their own good by regulators, will continue to seek out the refuge that is decentralized digital cash. But will we be ready for the challenge anew? Will we understand it is not the token, the code, but the community and brick and mortar things that constitute bitcoin cash’s value? Grow those. Invest in them, and a responsible, tidy, long term bull jog, bull sache, a bull power walk will be ours.

C. Edward Kelso is a financial technology journalist based in Southern California. Follow him on Twitter.

02-18-2026

02-18-2026