|

Getting your Trinity Audio player ready...

|

Pays0, a licensed electronic money issuer and payment systems operator under the Bangko Sentral ng Pilipinas (BSP), the Philippine central bank, has announced a partnership with digital currency exchange Coins.ph to streamline the conversion between Philippine pesos (PHP) and digital currencies. The partnership is designed to enhance financial services for both corporate entities and individuals, including the millions of Filipinos working abroad.

The collaboration enables direct access to Coins. ph’s cryptocurrency solutions through Pays0’s system, providing a two-way PHP-to-crypto conversion channel. The companies say this will benefit a range of users, from businesses managing global payments to individuals transferring remittances to family members back home.

Seamless conversions and new settlement options

Pays0’s platform allows clients to move funds between traditional and digital finance systems. By integrating Coins.ph’s digital asset capabilities, users will be able to convert PHP into major digital currencies and vice versa directly from the Pays0 interface.

“The collaboration with Coins.ph is a key step in building a future-oriented, inclusive financial ecosystem,” Penny Jing, CEO and Founder of Pays0, said. “We have not only seen the urgent need for modern financial services in businesses, but also the strong desire from everyday users for compliant and comprehensive financial tools, including digital assets. We believe that through this collaboration, we can inject new momentum into the financial development of the Philippines and the world, opening a new chapter in digital finance.”

For corporate clients, this partnership opens up efficient settlement methods and cross-border payment capabilities. Blockchain-based remittances, particularly using stablecoins like USDT, enable faster and more secure transfers. This is expected to ease payment processes for companies working with overseas suppliers or engaging in international trade.

Empowering Overseas Filipino Workers

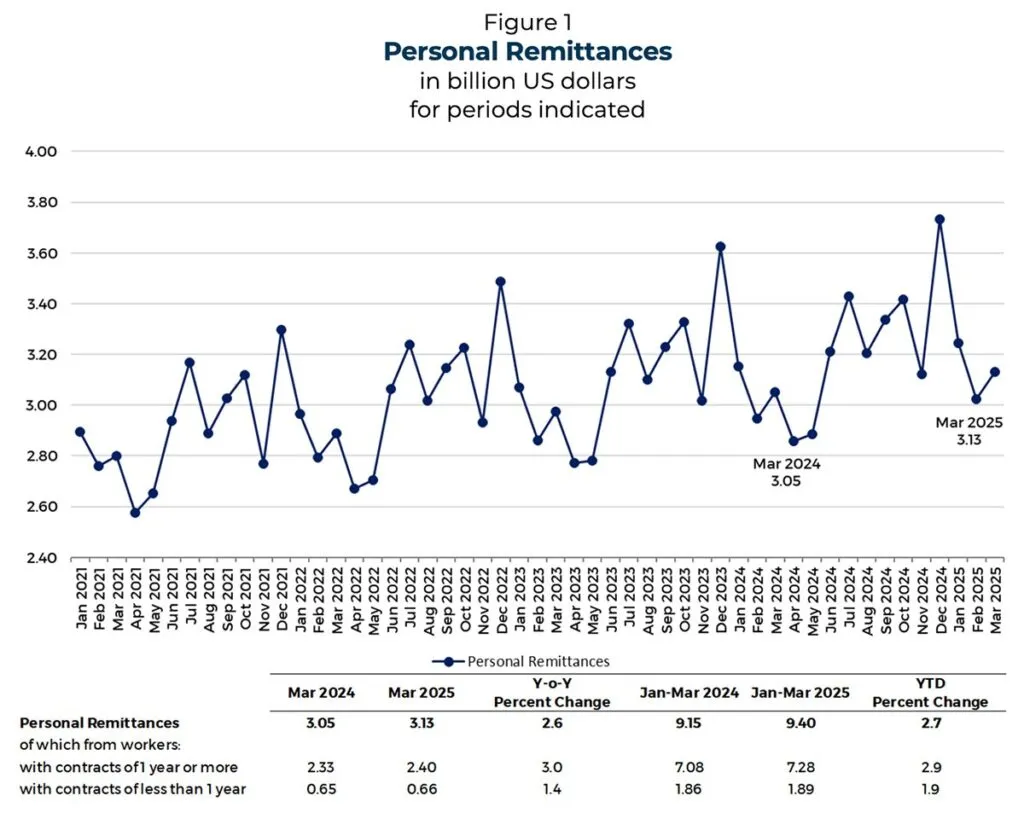

The partnership also targets a vital segment of the Filipino economy: remittances from Overseas Filipino Workers (OFWs). In March 2025 alone, personal remittances rose 2.6% year-on-year to $3.13 billion, according to the data from the BSP. For the first quarter of the year, remittances totaled $9.40 billion, up from $9.15 billion during the same period in 2024.

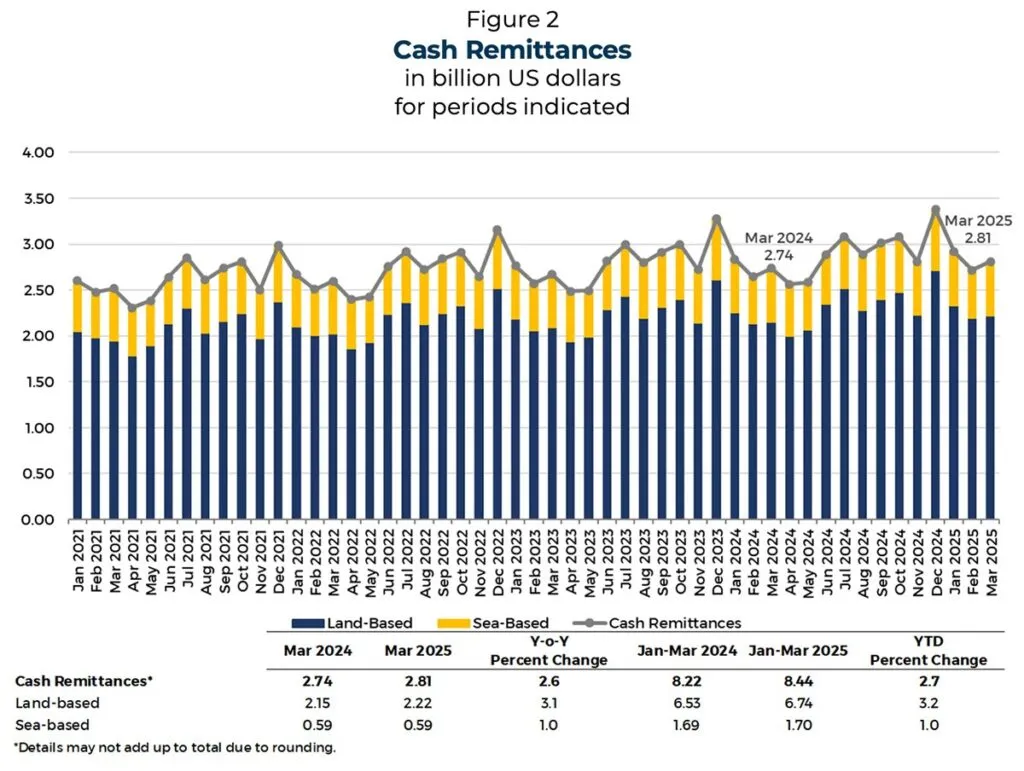

Cash remittances, which comprise the bulk of the total, also grew by 2.7% to $8.44 billion in January-March 2025. The increase was driven largely by remittances from the United States, Singapore, Saudi Arabia, and the United Arab Emirates. The U.S. remained the top source of cash remittances during this period.

“The sustained growth in personal remittances continues to support domestic consumption and economic activity in the Philippines,” the BSP noted in its statement. “The steady flow of funds from Filipinos overseas remains a critical lifeline for many families and communities across the country.”

Pays0 and Coins.ph aim to make that process even more efficient. With blockchain-enabled services, OFWs can now bypass traditional remittance intermediaries, reducing fees and improving speed.

“From businesses optimizing their financial operations to individuals seeking efficient remittance options, this partnership highlights how blockchain technology is leading innovation and enables more user-centric financial solutions,” Wei Zhou, CEO of Coins.ph, said.

The two companies emphasize that by using stablecoins as a bridge currency, users can minimize volatility risks and maximize fund value. The decentralized ledger technology (DLT) behind these transactions ensures that they are transparent, traceable, and resistant to tampering.

Lower costs, faster transfers, better security

Traditional remittance channels often involve several layers of intermediaries, each taking a cut from the transaction. The blockchain-powered system introduced by Pays0 and Coins.ph aims to eliminate most of these layers. As a result, recipients will receive a larger portion of the amount sent.

In addition to reducing costs, the partnership is promoting financial inclusion. Many Filipinos remain underbanked or unbanked, lacking access to traditional financial services. By allowing users to interact with digital assets directly through a licensed platform, the Pays0-Coins.ph partnership opens financial services to wider audiences.

Business use cases expand

On the business side, the joint service helps facilitate smoother and faster business-to-business (B2B) payments across borders. Companies working with foreign suppliers or partners can now settle invoices using digital assets, avoiding the often slow and costly process of converting currencies through traditional banking channels.

As the digital asset space continues to evolve, regulatory compliance remains a key factor. Both companies stress their commitment to working within the BSP’s regulatory framework. Coins.ph already operates under BSP oversight as a licensed virtual asset service provider (VASP), while Pays0 is authorized to issue electronic money and operate as a payment system operator.

The collaboration comes at a time when digital finance is accelerating rapidly in the region. The rise of mobile wallets, crypto payments, and cross-border blockchain settlements reflects a broader shift in how individuals and companies manage their finances.

Watch: The Philippines is moving toward blockchain-enabled tech

08-08-2025

08-08-2025