|

Getting your Trinity Audio player ready...

|

Until recently, stablecoins were a bit of a lackluster product. Their primary use case was to give cryptocurrency traders a safe haven asset they could easily move into when exiting a trading position and out of when they were ready to re-enter the market. Beyond that, real-world use cases were few and far between. Some traders liked holding sizable stablecoin positions because they could earn interest by staking them, but in the United States, staking quickly became illegal in many states, which caused that use case to shrink.

However, in 2025, things started to shift. Stablecoins exploded in popularity, not just in crypto circles, but across traditional finance, too. Practically overnight, it felt like every major company was announcing a stablecoin launch or stablecoin support.

The profit and policy shift fueling the stablecoin boom

The newfound interest in stablecoins can be boiled down to profit and regulations.

Launching a stablecoin is relatively easy (if you have decamillions or more). Once a company launches one, exchanges, wallets, and other partners need to buy it for operational reasons, providing the issuer with immediate customers and demand. From there, the issuer rakes cash from holding customer deposits in safe, yield-generating assets like U.S. Treasury bills. As long as the stablecoin is fully backed 1:1 with real dollars or short-term treasuries, it’s a low-risk, high-profit business model. From the issuer’s side, the fact that stablecoins are reliable money makers is enough incentive for any big name to launch one.

On the regulatory side, strict policies around the banking and finance industry made it almost impossible for traditional players to engage with blockchain technology—including stablecoins—in any meaningful way. But now, under a new administration that is actively deregulating parts of the banking and payments sectors, the obstacles that once prevented the cross-pollination of blockchain and the traditional financial system are beginning to fade away, and even more, barriers are expected to be dismantled over the next four years.

A turning point for crypto and traditional finance

These two elements, the regulatory shift in particular, enabled blockchain goods and services to integrate into the traditional financial system. Circle saw this shift happening–and to be fair, they were probably benefiting from their relationship with the White House and U.S. President Donald Trump—and moved fast, taking an approach to stablecoins different from the run-of-the-mill safe haven use case. Instead, the company began making an effort to use blockchain infrastructure to power global payments for banks and institutions.

Circle first broke this news when they recently announced the launch of the Circle Payments Network (CPN), a global payment system that runs on blockchain rails and settles payments with stablecoins. From the looks of it, Circle designed this product to disrupt the legacy payment networks that have historically been the backbone of domestic and international finance.

How Circle Payments Network works

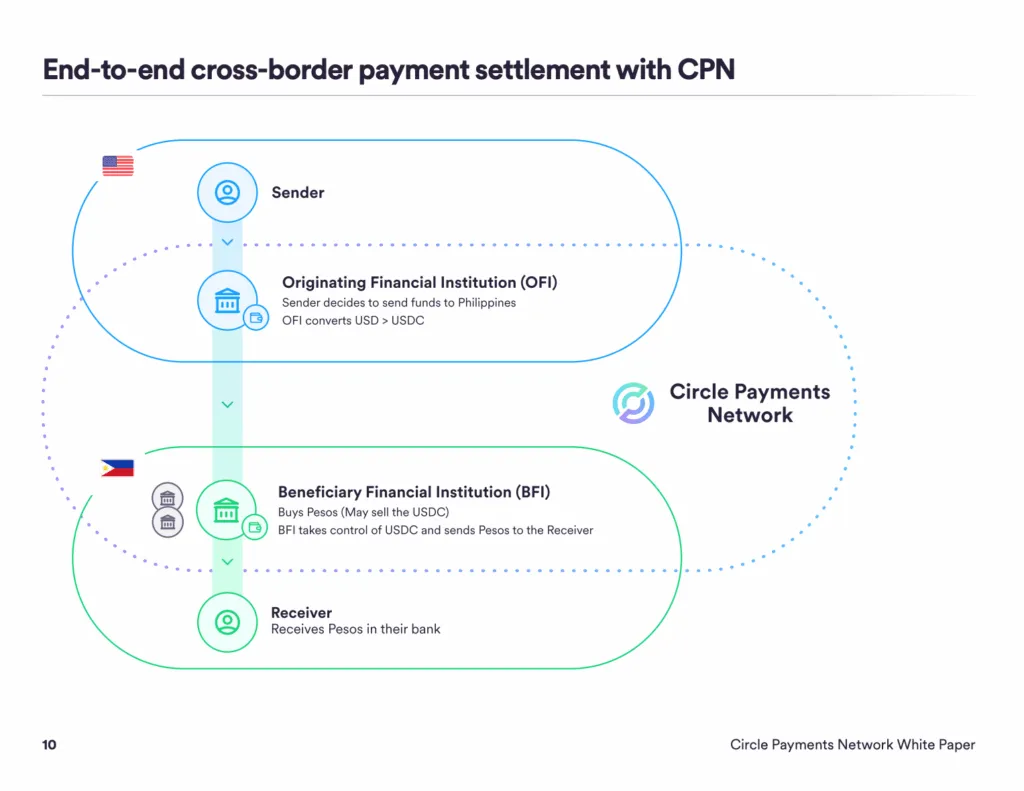

Operationally, the Circle Payments Network is similar to a blockchain transaction you might already be familiar with, but it’s been tailored specifically for financial institutions.

To kick off a transaction, a customer tells their bank or payment provider (called an “Originating Financial Institution” or OFI) that they want to send money to someone abroad. The OFI converts the customer’s dollars into USDC stablecoin. Then, using the CPN—which functions like a marketplace or coordinating protocol—the OFI finds a partner bank or payment company in the receiver’s country (a “Beneficiary Financial Institution” or BFI). The USDC is sent across a blockchain network to the BFI almost instantly. Once received, the BFI either converts the USDC into the local currency and deposits it into the receiver’s account or allows the receiver to keep it as digital dollars.

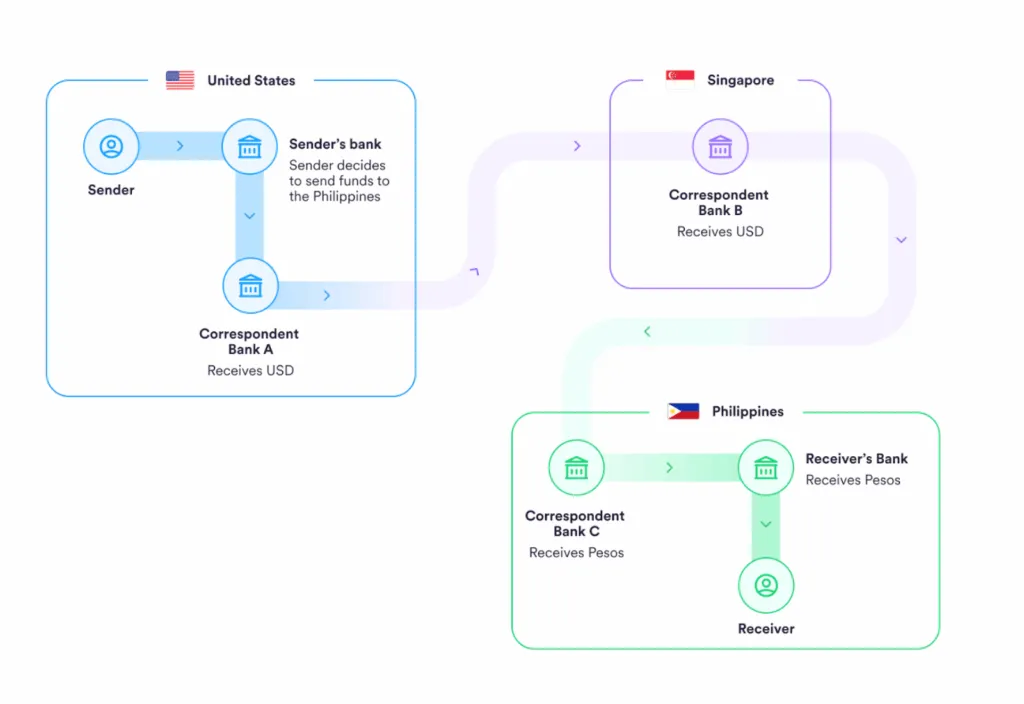

Compare that to the incumbent model in traditional finance, where a sender goes to their bank, requests an international wire transfer, and then the money hops through one to three intermediary banks before reaching the receiver’s bank. Each intermediary charges a fee and performs compliance checks, introducing additional time delays. If the transfer crosses time zones, occurs over the weekend, or involves currency conversions, it can take 2–5 days to complete.

The benefits of stablecoins in the banking system

In its whitepaper, Circle highlights four core benefits of CPN over traditional global payment systems: lower costs, faster settlement times, greater transparency, and the ability to continuously innovate. However, the two most compelling benefits are lower costs and faster settlements, which are the two factors that will most likely get banks and institutions to join the CPN.

According to McKinsey’s Global Payments Report 2024, the average cost of sending $200 internationally was 6.65%. Currency conversion fees, liquidity issues, and compliance checks all add to this burden.

By contrast, Circle’s Payment Network claims to significantly reduce these costs. While there are still some fees such as the payout fees to BFIs, FX spreads, and a CPN network fee, the overall cost is expected to be multitudes lower than incumbent methods.

On top of that, what currently takes 2–5 days to move through the incumbent system could happen almost instantaneously through the CPN. As you can imagine, the cost savings and reduced settlement times alone could be enough to incentivize banks, as it benefits both the banks themselves—lower costs—and their customers who will receive their money faster.

Could Circle’s Payments Network be blockchain’s killer app?

The Circle Payment Network’s development could be one of the most important milestones for the blockchain and digital asset industry. For over a decade, blockchain technology existed, but its real-world impact beyond trading and speculating was limited. Despite all the promises of disruption and innovation, blockchain and digital currency never quite became the core piece of infrastructure and technology its advocates preached that it would be.

However, CPN could change that. It can potentially be what I would call blockchain’s second killer app—that’s assuming trading and speculation is killer app #1—by embedding itself into the plumbing of the global financial system and becoming a viable alternative to giants like SWIFT and ACH.

Of course, the success of the Circle Payments Network hinges on adoption. If only a handful of institutions use it, its impact will be minimal. However, if a critical mass of major players, the world’s largest transactors by volume, start using CPN, the resulting cost savings, efficiency gains, and speed improvements could be significant.

If Circle’s payment network succeeds, it will do a lot in helping the blockchain and digital asset industry mature. To date, blockchain and digital assets have arguably been a bit of a joke to legacy players and operations in the finance industry. From their point of view, even though they would acknowledge the potential, blockchain and digital assets historically haven’t had much utility and often added unnecessary layers of friction to a process that oftentimes made it more complicated than just using fiat currency for a transaction. However, by giving institutions a legitimate value proposition that should at least get them to try the CPN, Circle could end up making blockchain technology a permanent fixture in the global financial system.

Watch: Blockchain is much more than digital assets

09-04-2025

09-04-2025