|

Getting your Trinity Audio player ready...

|

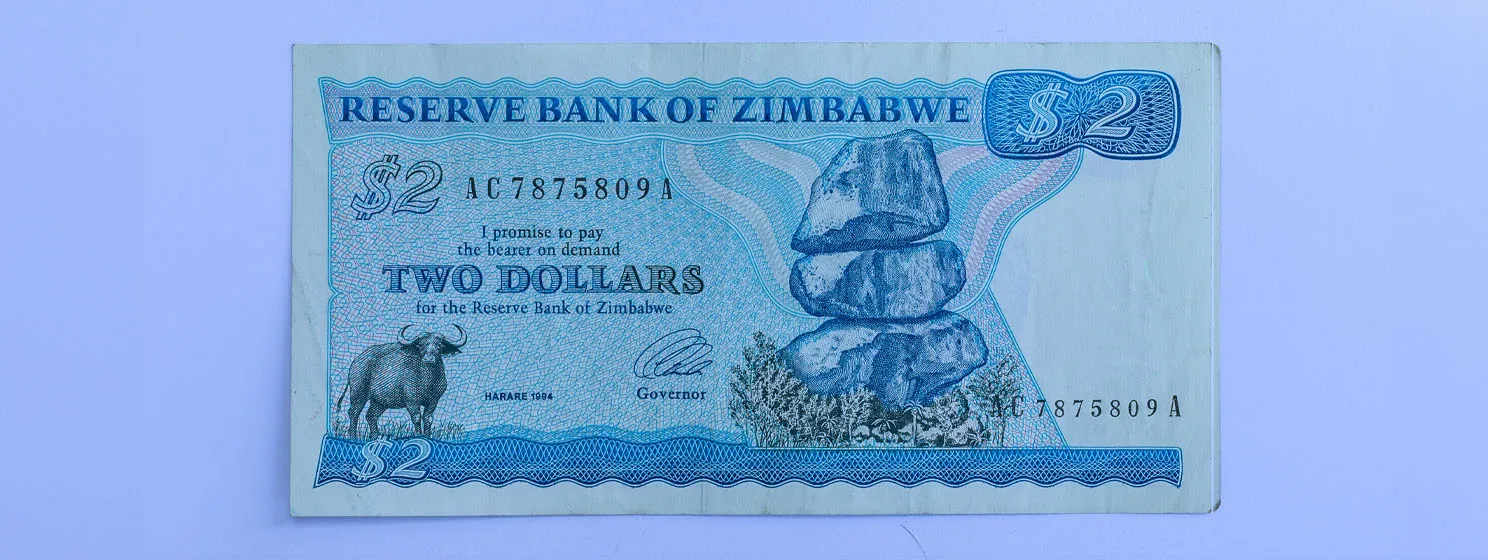

When the Reserve Bank of Zimbabwe (RBZ) introduced the Zimbabwe Gold, or ZiG, as the new currency last April, it promised it would be the ultimate solution to a two-decade currency crisis. However, less than a year later, ZiG has been disastrous, like all its predecessors, and now, Zimbabweans are turning to outlawed night vendors for their groceries and other shopping needs.

When it launched in April, ZiG’s exchange rate to the United States dollar was set at 13.56. But even before the new notes started circulating, the rate had shot up to 23. Bad as it was, ZiG’s depreciation was still not as high as its predecessor: the Zimbabwe dollar (ZWL). Between January and April last year, ZWL’s exchange rate to the dollar surged from 11,500 to 40,000.

Zimbabweans feel the pinch, turn to illegal vendors

As the exchange rate spikes, Zimbabweans are feeling the pinch. The most affected are the retail stores, which are mandated by law to accept ZiG, which trades at artificially low official exchange rates on formal channels. To make ends meet, these stores are forced to hike their prices, which alienates the consumers. In turn, these consumers are heading to informal street vendors, which the government has outlawed, but is unable to effectively crack down on due to their sheer numbers.

The Retailers Association of Zimbabwe has decried the situation, warning that more retail stores are likely to shut down as the country’s business environment is “clearly untenable.”

Last October, Pick n Pay, the South African retail giant that operates over 70 stores in Zimbabwe, announced that it had written off its investment in the country due to the “deteriorating economic conditions.”

The big winners are the street vendors who are able to price their items competitively, ditching ZiG for the U.S. dollar. These vendors display their wares on sidewalks, open car parking spaces, and any other available space on the busy streets. Since they are outlawed, they mostly go into business in the evenings when there’s less police scrutiny.

The vendors’ main attraction is their low prices. According to the Associated Press, they offer their items at a fraction of the price in the retail stores. One customer told AP that shopping worth $20 on the streets was enough to sustain him for a week, while in the retail stores, it only got him “meat and spices, and they were not even that much.”

“I got everything I was looking for, and the pricing is really affordable. I actually managed to buy a handful for just $20. I even got my washing powder and dishwashing liquid. I think I will do this more often,” the customer said.

Beyond the lower prices, consumers prefer the vendors as their USD prices are consistent. With the ZiG, the customer has to calculate the value of the items anew each time they visit the stores as the value fluctuates wildly so often.

The 2-decade currency crisis

The slow death of the retail industry is emblematic of a two-decade currency crisis that has plagued the Southern African nation. In the mid-2000s, Zimbabwe’s economy was on the ropes, and the currency was the first casualty. It completely collapsed in 2009, and the country turned to the greenback as legal tender. At the time, Zimbabwe’s inflation stood at a staggering five billion percent. The situation was so bad that, in some cases, the money would lose value while Zimbabweans were queuing to pay for groceries, forcing them to return home hungry.

Since then, the USD has been legal tender, with the South African rand among the other popular options. However, starting in 2019, the country reintroduced its local currency, culminating in the ZiG, which, despite being purportedly backed by gold in reserve, has failed to hold its value.

Formal businesses are feeling the heat the most as they are forced by law to accept ZiG, a massive cost that their informal competitors don’t have to deal with.

Grift Mugano, a local economics professor, explains: “In every transaction a business is doing in the formal setup, it’s making an exchange rate loss that cannot be compensated. The major issue here is a currency crisis.”

The crisis is exacerbated by the country’s struggling economy, spiraling debt (over $21 billion), sanctions and unemployment.

“The situation is not sustainable. Not while Zimbabwe has economic growth of probably 3%, whilst money supply is growing at a rate of over 500% per annum. There is no way ZiG or the foreign exchange rate can be stable,” says Victor Bhoroma, an economist based in the capital, Harare.

The country has weighed making BTC legal tender to ease the currency crisis, but there’s enough evidence from El Salvador to show that this would just fan the flames. Citizens have also turned to other digital assets, including BSV’s micropayments, but infrastructural constraints have limited the impact.

Watch: Improving logistics, finance with AI & blockchain

09-15-2025

09-15-2025