|

Getting your Trinity Audio player ready...

|

During the ‘crypto winter’ in the wake of the FTX collapse in 2022, many began to wonder what blockchain was really all about beyond the hype and buzzwords.

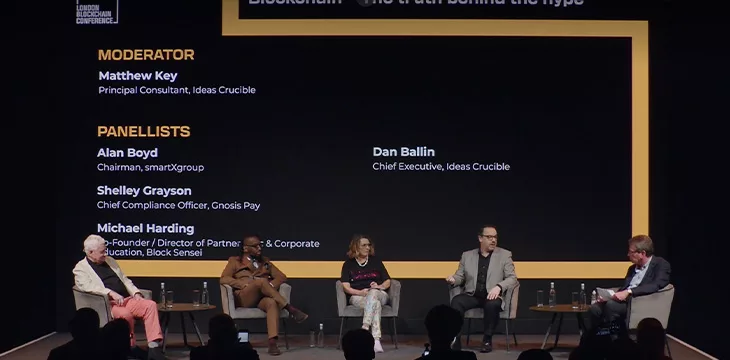

At the London Blockchain Conference 2024, Matthew Key from Ideas Crucible hosted a panel exploring blockchain beyond the hype. Joining him were Ideas Crucible CEO Dan Ballin, smartXgroup Chairman Alan Boyd, Blockchain Sensei co-founder Michael Harding, and Gnosis Pay CCO, Shelley Grayson.

The utility of blockchain technology

Before the panel discussion begins, Key gives a presentation outlining some of the real-world use cases for blockchain technology and how it could specifically apply to different industries such as healthcare, financial services, Web 3.0, natural resources, and others.

Healthcare – Blockchain is the ideal record keeper and is inherently more secure than centralized databases. Therefore, it can protect the healthcare supply chain, enhance data management and sharing, and help healthcare professionals track diseases and outbreaks.

Financial Services – Central bank digital currencies (CBDCs) have been a hot topic recently, but the automation of processes, the tokenization of assets, and faster payments can all come as a result of blockchain, too.

Web 3.0 – JPMorgan (NASDAQ: JPM) and others are piloting activity in remittances, but blockchain can be used to streamline asset swaps, make patent filings more efficient, enhance AR/VR applications, and in conjunction with AI.

Natural Resources – From developing secondary and alternative markets to auditing, tracking, and tracing, blockchain has many applications in relation to natural resources.

Other Areas – Personal data security, shipping, and educational credentials on the blockchain are all ways in which blockchain technology can be applied for the good.

What went wrong in the crash that led to the latest ‘crypto winter?’

Keys begins by noting that in 2023, VC raised $10 billion in the industry, down by ⅓ from 2022. FTX collapsed, Sam Bankman-Fried went to jail, and Changpeng Zhao pled guilty to money laundering and sanctions violations. What went wrong?

Ballin says we had the convergence of a new emerging technology, but people didn’t fully understand. Chaotic events such as wars and a pandemic distracted governments, and there were not many regulations. We messed up, and it taught us that a strong, well-regulated structure is a good thing.

Grayson mocks Bankman-Fried by saying it’s never OK to have an investor call while sitting on a beanbag. Regulators were too slow to move, and people took advantage of that. The investors were also at fault.

Harding agrees, noting that many investors don’t do proper due diligence in this industry. In 2022, many of them just followed big players like Sequoia Capital. Ultimately, it’s one of the best things that has happened because it taught us valuable lessons.

Boyd believes the blame lies squarely on the shoulders of investors. While Sequoia’s founder, Don Valentine, made savvy investments into Atari and Apple (NASDAQ: AAPL), his successors blew hundreds of millions in client money due to failure to do proper research.

Was it flawed business models, weak regulations, or a combination of both?

Ballin points to the lack of regulation and readiness. He says many business models still have issues, such as companies promising a service and raising tokens through another adjacent company. In this industry, many investors still don’t do proper due diligence.

Grayson says 35 years of regulation in traditional finance have happened in just four years in the blockchain and digital currency industry. Everything that went wrong was foreseeable, she says. There was too much focus on applying rules like the Travel Rule rather than big-picture rules that could have prevented the disaster or mitigated the damage.

Harding says financial literacy is essential, and the lack of it may have played a role. You need a CFO, but many startups don’t even know that. He likens it to the blind leading the blind.

Boyd says that many regulators were fully in the loop regarding FTX, and there are even rumors that some benefited from its collapse. He urges the industry to find the right balance between over- and under-regulation.

Is there some scope to harmonize regulations and penalties in Europe and even globally?

Ballin answers that many of it will come down to guidelines and standards. It will take a long time, but it’s possible.

Grayson already sees some global standardization happening. It’s not due to regulations but rather vendor stipulations and contractual obligations.

Harding agrees that it’s already happening. He points to the Crypto Asset Reporting Framework (CARF) as one example, noting that Glassnode will soon cover 200 altcoins in addition to Bitcoin.

Boyd says that, in time, apps and AI will replace smart contracts. Thanks to AI, eventually, each transaction will be able to self-regulate.

Watch: Showcasing power of blockchain tech with nChain Web3 event app

09-06-2025

09-06-2025