|

Getting your Trinity Audio player ready...

|

Locking up coins has been a controversial discussion in the BSV blockchain community lately. This article will lay out four concrete use cases to make use of this obscure, underused feature of Bitcoin’s protocol.

Using Bitcoin’s original scripting capabilities, developers can implement scripts that unlock only after a certain time has passed. These scripts are publicly on-chain, so other developers can build applications around who has locked how many coins for how long.

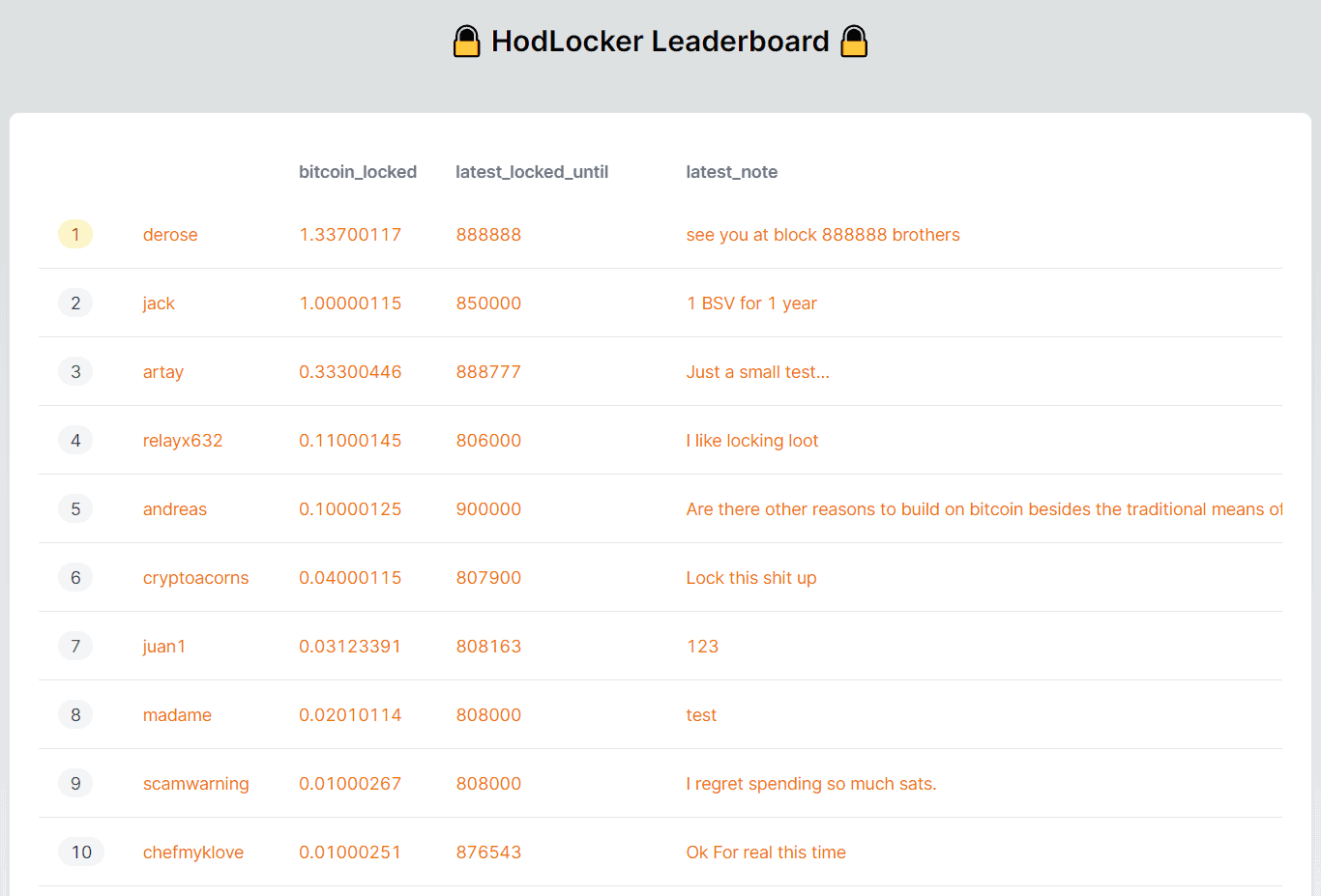

1. Public leaderboard of locked coins

The first use case discussed on socials is a leaderboard that aggregates locked coins scripts by a common owner, displaying an order based on some calculation of time locked multiplied by the number of coins. RelayX appears to be working on this, but another developer has already released a bare-bones version.

Gamifying the lockup can incite FOMO and others to join in. Users may just lock up because they see their friends doing it, which would lead to the intended outcome of this experiment, to send a signal. If successful, while the BSV price is near all-time lows, the leaderboard filling up would indicate hardcore believers are still willing to save their coins for the future.

2. Tiered social media interactions

Based on the public leaderboard, thresholds can be leveraged for private chat groups, for example, where only those HODL’ers who have locked 21 BSV for over a year can join.

Only 1 million ppl max can ever be in the 21 BSV club

100,000 ppl max in the 210 BSV club

10,000 max in the 2100 BSV club

These numbers are likely far lower given number of lost coins, supply not fully minted out yet & some individuals holding way more than 2100 BSVs already

— Bitcoin Intern (@1bitcoinintern) September 1, 2023

This exclusive club could only hold 1 million people maximum at a given time, but practically far less due to lost coins and existing distribution. Critics may point out this is elitist, but companies hold private meetings for stockholders above a certain threshold to discuss sensitive matters. This is similar, except across the entire community. Moreover, individuals could do this with their social graphs, where they only accept direct messages or public interactions from those who have locked above some threshold.

The same concept can be applied to NFTs and PFPs as well. Groups can form around those who have locked their NFT for some time and can be leveraged as much more secure PFP verification. Some collectors may lock their favorite NFTs forever (maximum block height).

3. Earning revenue directly to time-locked script

The locked script can be leveraged to implement a vesting schedule for entrepreneurs and creators. When artists sell NFTs, some may be looking to make a quick buck and sell digital currency for fiat. However, if the creator earned where 50% of revenue is sent to a one-year time-locked script, consumers may feel more confident participating in the initial sale.

Again, this concept is not new. Such a model exists for shares of companies where founders’ or advisors’ shares are locked or do not vest until a few years have passed. This is similar, except at a more micro level and public.

4. Security trigger (Credit to Dr. Craig Wright for this use case)

What if a thief breaks into your home and wants your seed phrase? What if, upon the alarm trigger at break-in, the software sends all cold storage coins to a time-locked script a few days in the future? This is possible to implement where no one, not even the victim, can access the coins until the time has elapsed. The thief may be able to rob other things, but not the precious Bitcoin!

nLockTime has been an odd quirk in Bitcoin’s protocol from the beginning, so much so that BTC Core developers implemented a custom script operation (CLTV) to lock coins on-chain instead of for offline use, which was Satoshi Nakamoto’s initial intent of the feature. With script unlocked and the ability to build around those public scripts, the possibilities are only bound by our imaginations.

Watch The Bitcoin Masterclasses Workshop #2 on nLockTime: Using time-locked DFAs for processes

09-14-2025

09-14-2025