|

Getting your Trinity Audio player ready...

|

Check this out 👉 – https://t.co/33TtQFsaGG . First ever bsv20 marketplace (beta) is live. Like & share. Drop your ordinal address for💥some OG bsv20 airdrops 🪂🪂🪂🪂

— ArrorLab Arts (@ArrorLabArts) July 8, 2023

Yet another Ordinals marketplace has launched on the BSV blockchain, interfacing with the global, on-chain order book. bsv20.fun is focused only on the BSV version of BRC-20 fungible tokens. The home page displays the top 14 coins in the order in which they have been deployed.

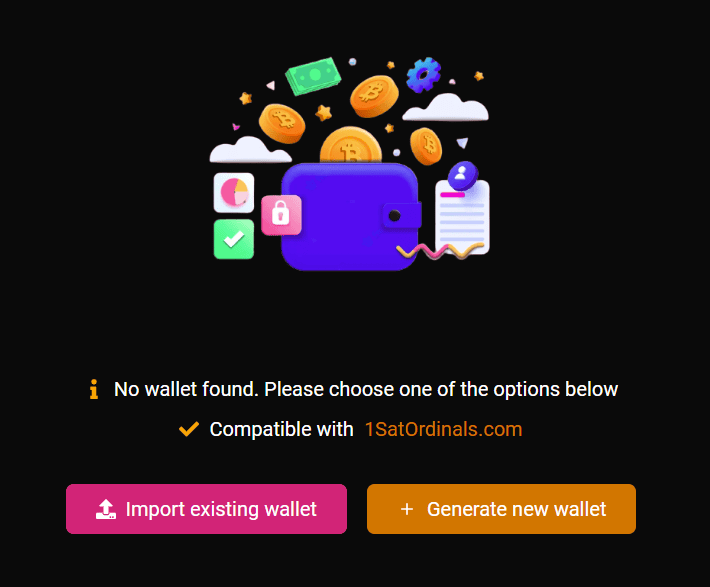

The market launches with an in-app wallet, where you can generate keys on the client side in your browser or import from 1satordinals.com, for example. This trend matches Ordinals markets on BTC, where users import keys across applications to list their Ordinals on various marketplaces without sending the tokens first. BSV blockchain does not yet have a browser extensions solution like Unisat or an interoperable wallet that can seamlessly integrate.

BSV-20 tokens kicked off initially on 1SatOrdinals.com, where most of the deployed tokens reside. However, that wallet does not yet have the functionality to send tokens. Therefore, users can import from 1SatOrdinals, so long as they trust bsv20.fun. While the trade-off is trust, the benefit is not waiting for 1SatOrdinals.com to develop the send feature to start listing their tokens. If trust is a concern, users can simply make a new wallet with a small amount of funds or tokens to start trading.

Utilizing the global order book, bsv20.fun can launch with instant orders available to purchase, with no need to go out of their way to obtain liquidity first. They are also taking the opportunity to show an improved interface for tickers. Aym initially launched with a BSV-20 market but has a more cumbersome interface where users must filter on the ticker without sorting versus having dedicated ticker pages. Of course, Aym could get away with this when they were the only shop in town. At the same time, bsv20.fun lowered their trading fee to 2% vs. Aym’s 5%.

This is an example of how common on-chain data standards incentivize competition in different areas. Instead of competing on liquidity, security, deposits, and custody, markets compete on user experience and fees, which tend to improve customer satisfaction, as evidenced here. Customers can easily migrate funds not just through withdrawals or deposits into custodial exchanges but also by logging in via private keys.

Like in the credit card industry, companies would prefer not to store any customer information linked to payments due to the associated risks. In this model, companies never have to take custody of funds, reducing those regulatory and security risks to zero. In fact, Satoshi Nakamoto highlighted this as one of the benefits of transacting with Bitcoin in the Introduction of the white paper.

Another benefit of launching with on-chain data is immediately sharing benefits with other ecosystem players. While bsv20.fun has its own Twitter bot (@BsvUpdates) to tweet sales of tokens, they did not have to as THE MORNIN’ RUN was already tweeting sales from the chain, as well as showing token sales history.

📢 Bsv20 Market update :

🚀 500 1SAT was traded for 💰1.25 BSV

⛵️ Marketplace : https://t.co/OHWtJ49h86— BSV Market Updates (@BsvUpdates) July 11, 2023

As the 1 Sat Ordinals protocol gains more adoption, look forward to more and more specialized marketplaces popping up and iterating on features very quickly due to the benefits of the global on-chain order book.

CoinGeek RoundTable episode 7: 1Sat Ordinals on Bitcoin

01-22-2026

01-22-2026