|

Getting your Trinity Audio player ready...

|

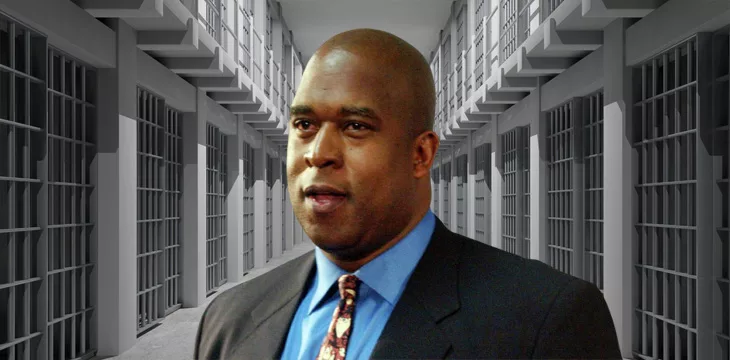

Reginald Fowler, the former minority owner of the NFL franchise Minnesota Vikings, has been sentenced to over six years in prison for offering shadow banking services to digital asset firms.

Fowler was sentenced to 75 months behind bars by Judge Andrew L. Carter Jr. of the Southern District of New York. Judge Carter also ordered him to forfeit $740 million.

The U.S. Department of Justice (DoJ) has been pushing for a long sentence “to properly reflect the seriousness of Fowler’s criminal conducted.” Fowler’s lawyer, on the other hand, has been pushing for probation. Judge Carter determined that 75 months was the right balance and ordered that he be remanded immediately. DoJ had claimed in court that Fowler was a flight risk.

However, as journalist Matthew Press revealed, Fowler’s lawyer successfully argued that he should be given more time to wrap up a three-person business he currently conducts in Arizona (his dog was also cited as an additional reason). He has been given 21 days to self-surrender in Phoenix.

“Reginald Fowler evaded federal law by processing hundreds of millions of dollars of unregulated transactions on behalf of cryptocurrency exchanges as a shadow bank. He did so by lying to legitimate U.S. financial institutions, which exposed the U.S. financial system to serious risk,” U.S. Attorney Damian Williams commented.

Fowler founded Global Trading Solutions in 2018 to offer financial services to digital asset firms. He worked with several related companies to provide these services, the most famous being Crypto Capital. He opened dozens of bank accounts at U.S. banks using falsified information to process the transactions for ‘crypto’ firms.

According to the DoJ, he processed over $750 million through U.S. banks in one year. At no point did he or his companies register as money-transmitting businesses.

Fowler was at the heart of the $850 million Bitfinex exchange lost and attempted to cover up by borrowing from Tether, its sister company. The two companies got away with their crimes and only paid a paltry $18.5 million in penalties.

Follow CoinGeek’s Crypto Crime Cartel series, which delves into the stream of groups—from BitMEX to Binance, Bitcoin.com, Blockstream, ShapeShift, Coinbase, Ripple,

Ethereum, FTX and Tether—who have co-opted the digital asset revolution and turned the industry into a minefield for naïve (and even experienced) players in the market.

09-05-2025

09-05-2025