|

Getting your Trinity Audio player ready...

|

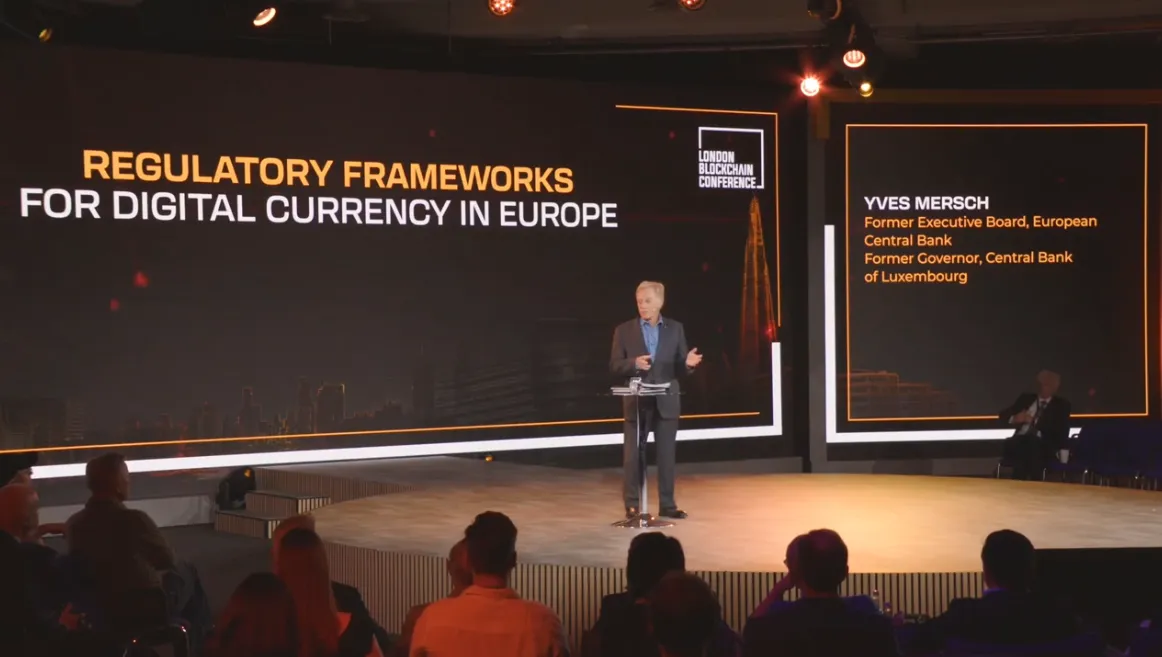

The energy was high in the QEII conference center on day two of the London Blockchain Conference 2O23 (LBC), despite evening drinks shared by attendees and guests the previous night. Following a brief Day 2 opener to hype the crowd, economist Yves Mersch took to the stage for his keynote talk on European Union regulatory frameworks.

“When we talk about regulatory change, I think we always talk about three, four different basic tenets. One is regulation coming in too early, and then coming too late on the back of a number of scams and fraud, which would have consequences undermining the trust of people. Another is if regulation is too intrusive at the beginning, it will be an element that does not support innovation, but if it is too lax, it will have the same effect as having the absence of regulation,” he stated.

Mersch has firsthand experience of these difficult regulatory dilemmas from his time as a member of the ECB executive board, which he left in 2020. He also previously served as the first Governor of the Central Bank of Luxembourg from 1998 to 2012.

“Before we move forward, we always need to better understand the risks and the benefits of innovation, the welfare effects of crypto assets,” said Mersch, who suggested that the incoming Markets in Crypto Assets (MiCA) regulation in the European Union will help to address some of these risks, while also preserving innovation.

When it comes to MiCA, Mersch stated two key factors were considered. First was “harmonization,” to unify disparate approaches to digital assets amongst the EU’s 27 member states; the second objective was to support innovation.

When it comes into force in 2024, MiCA will bring digital assets, issuers, and service providers under a broad regulatory framework. Digital asset service providers, such as exchanges and wallet providers, must obtain a license from national regulators to offer services to EU citizens. Along with license mandates, MiCA will provide new classifications for different digital assets, rules specific to those assets, proof-of-funds requirements for stablecoin issuers, and the requirement for any company seeking to issue digital assets/coins to publish a white paper containing information about the project, including possible risks.

“MiCA is not trying to reinvent the wheel but build on existing regulatory frameworks that people know inside the European Union,” Mersch explained. “There is a requirement regarding the issuance of crypto assets. There will be capital requirements and governance that is an authorization procedure as well as the supervision of issuers and certain service providers…and there will be reserve requirements for stable currency issuers. For example, they are requested to have a one-to-one reserve ratio for permanent redemption rights.”

This discussion of MiCA was fortuitously timed, coming just a day after the landmark bill was signed into law on Wednesday by European Parliament President Roberta Metsola and Swedish Rural Affairs Minister Peter Kullgren; MiCA passed its final vote this April and got approval from European member state finance ministers in May.

The packed conference room also heard Mersch’s take on the issue of systemic risk related to digital assets; his take on the issue might have put some minds at ease. While he acknowledged the risks of businesses whose collateral is based on “unbacked crypto assets with no intrinsic value,” he stated that only a few internationally active banks have digital currency exposures.

“By and large, the market is still not very large. Therefore the risks to financial stability, at least in Europe, are measured,” he noted.

Mersch did suggest that there is a higher share of alternative investment funds active in the digital currency world, what might be referred to as ‘shadow banks,’ however, these tend to not be the largest in the market. Thus the risks are still negligible.

When it comes to addressing the risk that does exist, “there are still gaps, in my opinion, in MiCA,” admitted Mersch, but it will be an essential first step towards a more reliable and secure digital asset space, and perhaps broader uptake of the technology. As Mersch stated when summing up, “Money is about trust, and money is also about maintaining value.”

London Blockchain Conference Day 1 Highlights: Revenue generation with blockchain tech

09-06-2025

09-06-2025