|

Getting your Trinity Audio player ready...

|

Big tech companies may have set in motion the wheels that would help bolster the Philippines’ fintech sector, but not without help from startups, the dark horses of the local economy.

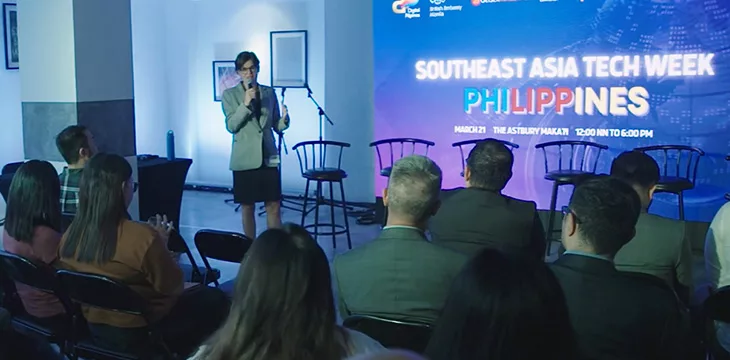

The first-ever Southeast Asia Tech Week hosted by Digital Pilipinas at The Astbury, Makati City, showcased how startups are shaping the fintech industry with support from relevant government agencies, including the Department of Trade and Industry (DTI), the organization overseeing the country’s business sector.

The event was organized in collaboration with the U.K. Embassy, represented by its ambassador Laure Beaufils, who, in an exclusive interview with CoinGeek, emphasized the importance of cross-border partnerships in supporting micro, small, and medium enterprises (MSMEs) nationwide that would, in turn, help startups achieve unicorn status.

Recent data shows that the Philippines has over 2,000 startups by the end of 2022, a significant jump from 273 in 2017 and 700 in 2021. Of this number, nearly 400 came from the fintech sector, while only two have been accorded the sought-after unicorn status—Mynt and Voyage Innovations.

DTI Undersecretary Rafaelita Aldaba is optimistic that the Philippines could mint a wave of unicorns through government-backed initiatives and funding.

“We’ll be working together with Digital Pilipinas in order for us to support the growth and development of more startups, but in particular those that are coming from the regions. We are providing trainings, along with mentorships” to support this ambition, said Aldaba.

She added that the DTI has set up a venture fund to assist startups in their operations.

The Philippines is looking at ride-hailing app Angkas, e-commerce firm Great Deals, B2B platform Growsari, and video-sharing platform Kumu as the country’s next unicorn.

Event convenor Amor Maclang, meanwhile, said blockchain-enabled platforms also have the potential to become a leader in the fintech space amidst challenges in the ecosystem brought about by the implosions that rocked the space last year.

Maclang believes that the mass adoption of non-fungible tokens (NFTs) would help revive the public’s faith in the blockchain industry, a point seconded by Global Blockchain Business Council Philippine Ambassador Maria Gaitanidou.

To aid its goal, the Philippines will participate in the London Tech Week from June 12-16, a high-level event that would see inspirational founders and business leaders convene to discuss the future of the global fintech industry.

Startups wishing to participate in the event could visit the London Tech Week website for more details.

Watch: BSV Stories Episode 9: Blockchain technology is more fun in the Philippines!

08-09-2025

08-09-2025