|

Getting your Trinity Audio player ready...

|

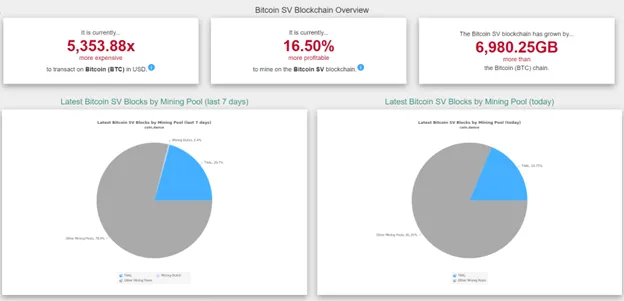

An unknown miner has been mining empty blocks on the Bitcoin SV blockchain with significant hash power lately, causing intermittent service disruptions and multiple orphaned blocks. This behavior has typically occurred when mining is more profitable on BSV than BCH or BTC. While that is the case recently, the miner has sustained majority hash power on BSV for some time.

In fact, this miner started accumulating BSV aggressively around September 9, just three days before the Hodlonaut trial began. They paused after the start of the trial and have now been furiously mining empty blocks since September 29. Typically this would be perceived as an attack on the network, but the miner appears to be holding the BSV.

This sustained activity can cause issues for service providers, where transactions do not properly relay across the network since the strongest and most connected “transaction processor” is not actually processing any transactions. Therefore, even if BSV supporting nodes such as TAAL (CSE:TAAL | FWB:9SQ1 | OTC: TAALF) or GorillaPool do mine a large 4GB block, but many empty blocks are mined in between for a time, external services and applications can have significant issues. Transactions may take much longer to confirm since processors are only winning blocks occasionally.

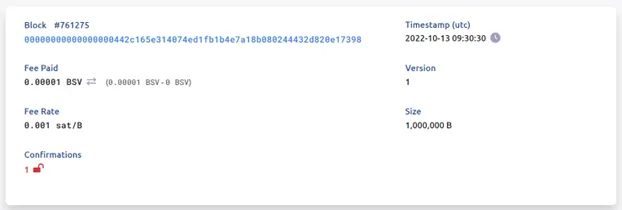

This activity is economical because the fee rate is so low on BSV. While the status quo fee rate is 0.05 satoshis per byte, miners such as TAAL appear to accept transactions much lower than that rate.

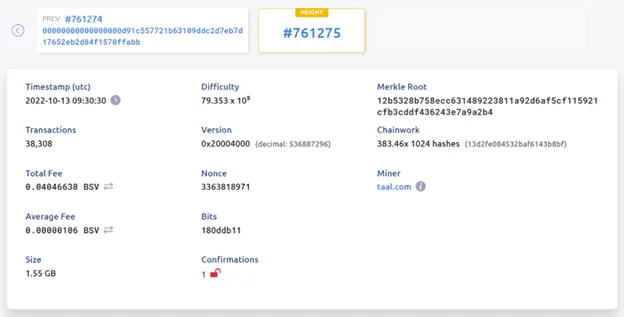

The above transaction was a 1MB file uploaded to the ledger for only 1,000 satoshis, a fee rate of 0.001 satoshi per byte, 50 times lower than the supposed status quo rate. TAAL mined this 1.55 GB block with many of these transactions, earning a measly 4,000,000 satoshis which is less than $2 of extra revenue at the current BSV price of $49 for processing such a large block. No wonder the unknown miner is reaving the chain without regard for including transactions.

If the proper fee rate was enforced (assuming an actual block full of these types of transactions), TAAL would have made 50x the total fee, which is 2 BSV. While still less than $100, the proportion to the subsidy of 6.25 is significant, at 32%. That high fee rate proportion disincentivizes empty mining as the node operator is losing out a significant amount of potential extra revenue. With fee rates being accepted so low, they have no incentive to increase their orphan risk by attempting to mine a large block for only 0.04 BSV when they can just take the subsidy amount of 6.25 BSV.

Being able to send transactions on the network for such a low fee rate appears to be a bug in the node software introduced some months ago. Frankly, that should be fixed as soon as possible, yet the fact that it has not been addressed for months indicates a lax attitude towards transaction processing by miners like TAAL, due to the paltry incentive.

Additionally, raising the status quo rate from 0.05 needs to be considered as well. Builders in the space are justifiably complaining about network instability, and even if the monetary fee is low, the cost to troubleshoot and resolve with human resources renders that a moot point.

Reliability > big blocks, low fees. Can't run until you know how to walk. This stuff is hard, can't skip steps. If you think the cost of a tx is $ 0.00008, you aren't paying attention

— Jackson Laskey (@JacksonLaskey) October 12, 2022

Will transaction processors finally step up and resolve these issues?

Watch: BSV Global Blockchain Convention panel, Proof of Work mining & energy innovation

08-26-2025

08-26-2025