|

Getting your Trinity Audio player ready...

|

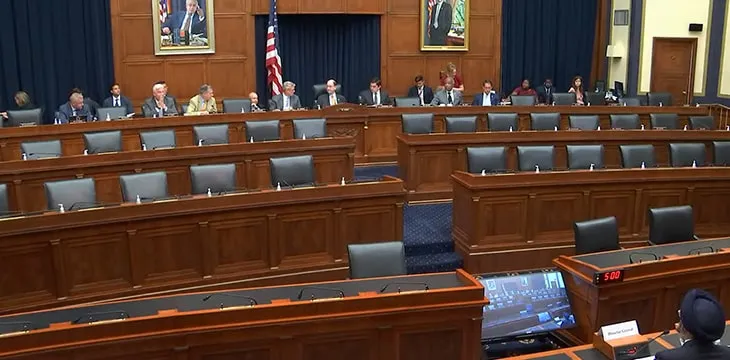

Gubir Grewal, director of enforcement at the U.S. Securities and Exchange Commission (SEC), appeared before a House subcommittee on Tuesday, facing questions over the SEC’s lack of enforcement against digital currency sector’s biggest crooks.

In Grewal’s opening comments to the U.S. House Subcommittee on Investor Protection, Entrepreneurship and Capital Markets, he set the scene by repeating the SEC’s mandate.

“Throughout its 85-year history, the SEC has stayed true to its three-part mission: protecting investors, maintaining fair orderly efficient markets and facilitating capital formation. Central to that is the work of the enforcement division,” Grewal said.

Subcommittee Chair Brad Sherman (D-CA 30th District) remarked in response that clarity is needed over what assets qualify as securities, particularly in regard to so-called ‘crypto’ assets. Investor protection, he said, is the best thing to do for capital formation.

“It may be a hassle for the individual issuer, but when we build a system where investors are confident, that’s what causes people in this country to invest in growing businesses,” Sherman said.

The chair raised questions about the SEC’s approach to digital asset exchanges and with particular reference to the troubled XRP project, which is currently the subject of SEC enforcement over its status as a security.

“If XRP is a security, and you think it is and I think it is, why are these crypto exchanges not in violation of law and is it enough that the crypto exchanges have said, ‘Well having committed tens of thousands of violations in the past, we promise not to do it anymore.’ Is that enough to get you off the hook for enforcement?” Sherman said.

The lawmaker touches on the uncomfortable and often ignored truth underpinning the fight over which assets are securities and which are not: if even a fraction of the digital assets straddling the line between being a security and not turn out to indeed be securities, then the industry’s biggest exchanges have been breaking the law on a massive scale.

In line with the SEC’s track record for opacity in its regulatory decision-making, Grewal declined to comment on any specific projects, including XRP. He did say that the SEC has been ramping up its enforcement actions against exchanges, pointing to Poloniex, but Sherman cut the witness off.

“It’s easy to go after the small fish, but the big fish operating the major exchanges did many tens of thousands of transactions in XRP, you know it’s a security, that means they were illegally operating a securities exchange. They know it’s illegal because they stopped doing it, even though it was profitable,” Sherman said. “So, if they know it’s illegal, and you know it’s illegal, and I know it’s illegal, I hope you focus on that.”

Sherman also called Tether a money market mutual fund in ‘every way,’ and wondered aloud why the SEC went after Terra but not the much larger project.

Concern was also expressed by Rep. Bill Huizenga (R-MI 2nd District), who remarked on inconsistencies in the way SEC officials think about digital assets.

Though the Subcommittee members were not perfectly aligned over their thoughts on the SEC’s enforcement track record, a lack of clear consistency within the SEC’s approach to digital asset enforcement was a common thread. It’s an issue which appears to have broad recognition among U.S. lawmakers, with a number of initiatives currently underway aimed at shoring up the regulatory regime governing digital assets.

If Sherman’s attitude impresses upon the SEC, there’s no such thing as ‘too big’ when it comes to taking action against non-compliant exchanges. The hearing will also provide an uncomfortable reminder to any exchange who has knowingly listed non-compliant assets: there’s an outstanding legal bill which could come due at any moment courtesy of the SEC.

Watch: The BSV Global Blockchain Convention panel, Law & Order: Regulatory Compliance for Blockchain & Digital Assets

https://www.youtube.com/watch?v=R58jiNcC5mA

08-16-2025

08-16-2025