|

Getting your Trinity Audio player ready...

|

https://youtu.be/tSC4sChdvuw

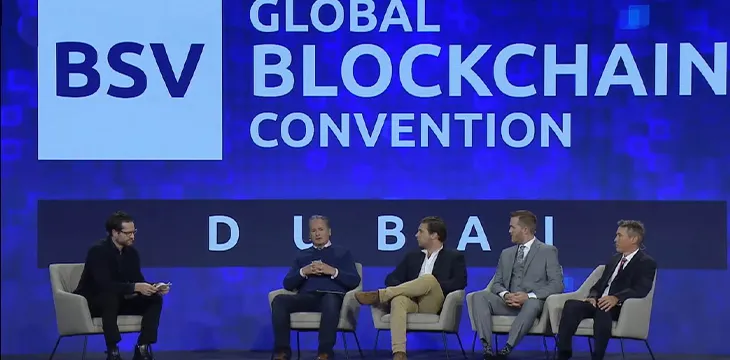

The days of voluntary carbon emission disclosures are behind us now, and all over the world, regulators are cracking down on corporates as we strive toward cutting down on global greenhouse gas emissions. At the BSV Global Blockchain Convention, three experts from various sectors took to the stage to discuss how blockchain can change the field of environmental, social, and corporate governance (ESG) when digital assets have been deemed environmentally unsustainable.

To keep up with the new carbon offset requirements, almost every other company relies on carbon offsets, leading to parabolic growth of this sector in the past decade. And it’s only the beginning, with nChain’s Director of Communications Sean Griffin, who moderated the panel, noting that Bank of America has predicted the market will need to grow 50x more to accommodate the growing demand.

On stage were Brian de Clare, a natural resource trading industry veteran and the CEO of Ackareen Inc.; Andrew Parker, the EVP for hydrocarbons at SPL; Thomas Giacomo, the head of product development at TAAL (CSE:TAAL | FWB:9SQ1 | OTC: TAALF); and Kevin Stower, the CEO of Sand Dollar Ventures.

Brian has spent over four decades in the commodities markets and the last 15 in the carbon markets. As he told the audience, the latter faces more problems than there was time to discuss. However, there are two that blockchain can easily solve, the first of which is the allocation of capital. Blockchain can also help the carbon offsets industry “with pricing and the associated risks around legal, ownership, title, etc.”

Sand Dollar’s Stower has been helping several companies adapt to changing tech for the past two decades, and as he told the audience, he believes the time has come for blockchain in the carbon credit industry.

Blockchain will make the industry “stable, constant, global, accessible and attestable. That’s going to be critical.”

For the longest time, ESG compliance has been a top-down approach, with the executives at the top not being concerned about how their juniors handle it. However, regulators are favoring the bottoms-up integrated approach nowadays and demanding data on every step of the value chain.

This need for authentic data is the biggest reason blockchain technology is required in the ESG sector, SPL’s Parker believes. Parker has been working with fossil fuels and energy sectors for years, focusing on carbon emissions.

“ESG is data, at its core,” he stated. “I think the ability to apply a technology like blockchain makes a lot of sense to track those pieces of data as they change provenance. And then you have the added advantage of the blockchain being immutable,” he added.

One of the biggest benefits of more credible data would be the standardization of the global carbon credits market. Being still nascent, this market is very fragmented between different countries and regions. As Brian observed, sometimes you’ll find that offsets for a ton of carbon are over 100 euros in Europe, but it’s just $5 in some Asian markets. There are even disparities within some countries between states.

Brian believes that blockchain is the best solution if we’re to have a common price for carbon credits globally, which was one of the goals set at the 2021 United Nations Climate Change Conference, more commonly referred to as COP26.

“If we can track the emission right away from the source and incorporate it into the price itself in a direct manner, then all of a sudden we have clarity and the ability to price this properly,” he noted.

The carbon emissions and offsets sector may sound like it’s reserved for the big corporates, but as the panelists noted, it’s affecting all of us in one way or another. When you purchase a bottle of water, for instance, you’re charged a recycling fee which is your contribution to this industry. As such, we must all be concerned about it and demand accountability from the corporates.

And while blockchain in carbon credits and the commodity industry as a whole is a godsend, it will take some time to be accepted and integrated by the incumbents, the panelists concurred. After all, they have been used for different business models over the past two decades or so, and as such, disruption will not be as easy.

But the revolution will come, and the logical starting point is education. Stower called on the audience and every blockchain fan out there to spread the word about how blockchain can change the sector and, if in a position to, demand authentic and provably credible data, which can only be done on the blockchain.

Watch the BSV Global Blockchain Convention Dubai 2022 Day 1 here:

https://youtu.be/ggbZ8YedpBE?t=35357

Watch the BSV Global Blockchain Convention Dubai 2022 Day 2 here:

https://youtu.be/RzJsCRb6zt8?t=35746

Watch the BSV Global Blockchain Convention Dubai 2022 Day 3 here:

https://youtu.be/RzSCrXf1Ywc?t=34381

09-09-2025

09-09-2025