|

Getting your Trinity Audio player ready...

|

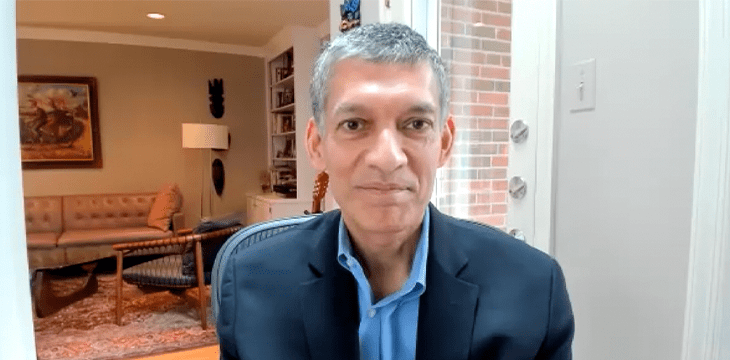

The invention of Bitcoin and the subsequent proliferation of cryptocurrencies will have a lasting impact on traditional finance, says Eswar Prasad, Tolani Senior Professor of International Trade Policy at Cornell University and author of “The Future of Money,” a book exploring how finance is changing in the digital age.

While he has his doubts about the utility of Bitcoin as a currency, arguing that it has largely become “a speculative financial asset” rather than the pseudonymous, peer-to-peer medium of exchange it was designed to be, he is confident its influence will change the nature of money for good.

“I think the emergence of cryptocurrencies… is lighting a fire into central banks to start issuing digital currencies of their own. So, this is the sense in which I think the cryptocurrency revolution is going to touch all of us, even if you and I might never own a Bitcoin,” he says.

Eswar predicts that we will soon see the end of cash, with it being replaced by central bank digital currencies (CBDCs) and privately run digital payment systems or some combination of the two.

He also believes that the creation of Bitcoin in 2008 sped up the FinTech revolution, a development which has democratised finance and made it more accessible, particularly in developing countries.

“The fact that even in low-income countries you now have people having very easy access to low-cost digital payment systems makes the life of consumers and businesses a lot easier,” he says.

He points to the Aadhaar biometric identification system in India as an example. The Aadhaar Act, which became law in 2016, makes it easier for Indians, especially those in rural areas, to verify their identity and open bank accounts, improving financial inclusion.

Figures show that the scheme has been game changing. In 2014’s Global Findex Database just 53% of adults in India had bank accounts, in 2017 that number had increased to 80%. That’s an extra 300 million accounts.

Talking to Charles Miller on CoinGeek Conversations, Eswar says he is impressed with blockchain technology and believes it will have a lasting impact. He sees it as not only the foundation for decentralised finance but also predicts that it will play a key role in innovations in public governance, something that we’ve already seen the BSV blockchain proposed for in Tuvalu.

But it’s not all good news where Eswar is concerned as he thinks the crypto mania that’s taken hold of our society has a darker side. “I think financial stability issues and investor protection, especially of unsophisticated retail investors who might be investing in cryptocurrencies, getting taken in by the razzle dazzle of the new technology and not understanding the risks… is a concern at the moment.”

There’s also a price to pay for the opening up of finance, according to Eswar, who warns that a reliance on digital payments could mean the end of anonymity. In the case of CBDCs this would mean the government playing an even more intrusive role in the economic lives of its citizens.

In the case of private payment systems this could lead to “even more concentration of economic and perhaps even political power,” like the monopolies that we are currently seeing in Big Tech.

Overall, he is cautiously optimistic about the impact the digital currency revolution will have on our lives, saying “I think there is a lot to look forward to in the new technologies but also a fair bit of fear.”

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Hear the whole of Eswar Prasad’s interview in this week’s CoinGeek Conversations podcast or catch up with other recent episodes:

You can also watch the podcast video on YouTube.

Please subscribe to CoinGeek Conversations – this is part of the podcast’s fourth season. If you’re new to it, there are plenty of previous episodes to catch up with.

Here’s how to find them:

– Search for “CoinGeek Conversations” wherever you get your podcasts

– Subscribe on iTunes

– Listen on Spotify

– Visit the CoinGeek Conversations website

– Watch on the CoinGeek Conversations YouTube playlist

12-16-2025

12-16-2025