|

Getting your Trinity Audio player ready...

|

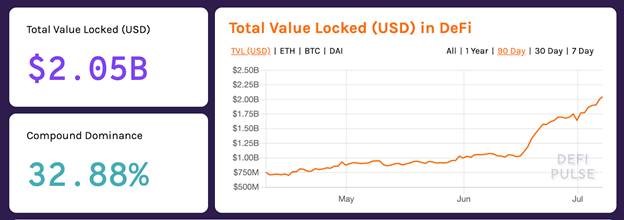

On July 6, the total value locked in decentralized finance (DeFi) protocols exceeded $2 billion.

DeFi apps are a set of financial instruments built on a blockchain that are usually facilitated by smart contracts. The most popular DeFi applications allow individuals to lend money and earn interest for lending or borrow money by taking out a digital currency collateralized loan.

Is DeFi the new ICO?

In a way, the current DeFi ecosystem resembles the initial coin offering (ICO) craze of 2017. People are pouring money into DeFi because they are finding it lucrative to lend and earn interest or to borrow and make arbitrage plays on other DeFi platforms. Some DeFi platforms have even begun launching their own “governance tokens” that allow their holders to govern their platforms; and most of these “governance tokens” rocket in value after they are released into the open market or when it is rumored that an exchange is going to add a governance token trading pair to their platform.

Similar to the ICO craze of 2017, the DeFi sector faces a lot of obstacles. For instance, it is becoming increasingly clear that many DeFi platforms are fundamentally flawed which has led to the exploitation of many DeFi platforms since the beginning of 2020.

DeFi hacks of 2020

Since the beginning of 2020, several DeFi platform exploits have taken place. Most exploits are conducted by individuals with a great technical understanding of how DeFi smart contracts work. The attacker uses their knowledge of the system to borrow, lend, or call functions in a way that lets them drain the platform’s entire balance—all without the attacker necessarily penetrating a database, breaching the system, or doing anything forbidden.

So far in 2020, we have seen MakerDAO’s CDP, Lendf.me, Uniswap, bZx, and Balancer exploited for over $4 million, $25 million, $300,000, $995,000, and $450,000 respectively.

The honeypot grows

It is alarming at how fast funds are pouring into these unstable platforms, in June 2020, the total value locked in DeFi platforms was $1.06 billion; in the subsequent 30 days, another $1 billion poured into DeFi platforms to bring the DeFi total value locked to where it is today at $2.05 billion. All of this money has poured in, yet, many of these DeFi platforms have not become more secure.

If you use DeFi platforms or have plans to use DeFi platforms, you should proceed with caution; because as the total value locked in DeFi platforms grows, more and more attackers are going to see DeFi platforms as a prime target.

03-03-2026

03-03-2026