|

Getting your Trinity Audio player ready...

|

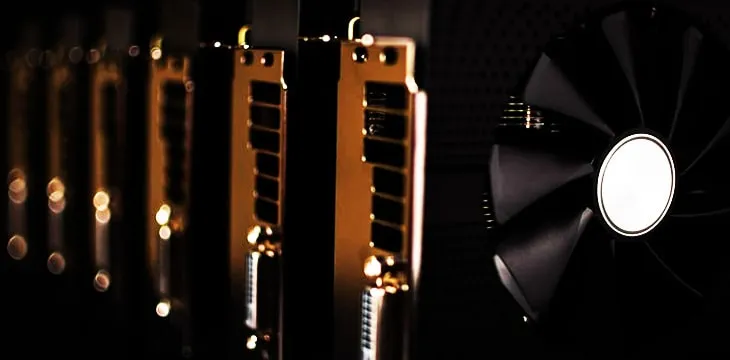

Core Scientific and Bitmain Technologies jointly announced a partnership agreement that will see the purchase of 17,595 units of Bitmain’s S19 Antminer machines by the Bellevue-based block reward mining operator.

Neither company disclosed details on the final purchasing amount, but the mammoth sale might cost up to $43 million based on the current $2,407 per unit selling price on Bitmain’s website. Core Scientific set the import delivery date for the ASIC mining rigs over the next four months, shipped to the company’s data centers throughout the United States.

Core Scientific is a key player in the North American block reward mining sector. The scaling of their fleet comes when Chinese rivals have a clear advantage because of proximity to hardware suppliers, government incentive schemes, and cheaper electricity prices.

The purchase agreement marks another chapter in the expanding relationship between the two organizations. In May, both companies announced the launch of the Ant Training Academy (ATA) certification program in Dalton, Ga. The program is set to kick this fall and is the only one Bitmain offers outside of China.

Core Scientific is one of the more advanced block reward mining operators. Although they mine several digital currencies, including Bitcoin SV (BSV), their de-risking business model is like gambling. They examine all the market trends, then allocate resources based on which digital currency offers the largest potential payoff. They base this high stakes ‘game of chance’ on the community’s ability to generate enough FOMO to get others to buy in so traders can then drive up prices.

Blockchain infrastructure organizations should pay attention to forward-thinking groups like TAAL, which laid the foundation for maturing into a transaction processor capable of supporting enterprise blockchain adoption. Their shift is indicative of what is happening amongst those that genuinely support Satoshi’s vision of Bitcoin and understand the industry they are in.

TAAL CEO Jerry Chan recently said, “We’re seeing a growing demand from businesses looking to process large transactions, and we’ve taken steps to meet that demand by increasing our ability to handle higher volumes of data …Now, TAAL can compete and outperform networks while maintaining cost-effective economies of scale for our clients.”

The block reward mining realm continues to be a murky sector driven by digital token price manipulation. Any shadowy organization or rogue nation can catapult to the top virtually overnight. The entire BTC ecosystem is on life support, praying for a miracle to stay relevant. It’s over-investment in an irrational concept will be one of the reasons for its failure.

The COVID-19 pandemic and blockchain halving should have forced block reward miners to re-think their business model. Bare minimum operational practices and speculative trading should no longer be the foundation they build their business on. Some companies are more ideally suited to make this transformation than others. They will continue throwing money behind a fictional narrative, hoping it doesn’t come crashing down around them.

08-27-2025

08-27-2025