|

Getting your Trinity Audio player ready...

|

Duping investors in the United States is about to become a whole lot more difficult—or at least, that’s the plan—after the U.S. Securities and Exchange Commission (SEC) has come out with an ingenious way to guide prospective investors on looking for red flags on initial coin offerings (ICOs).

The securities regulator recently launched a highly useful ICO web page to demonstrate potential investment victims what are the obvious signals of frauds and scams in connection with these investments.

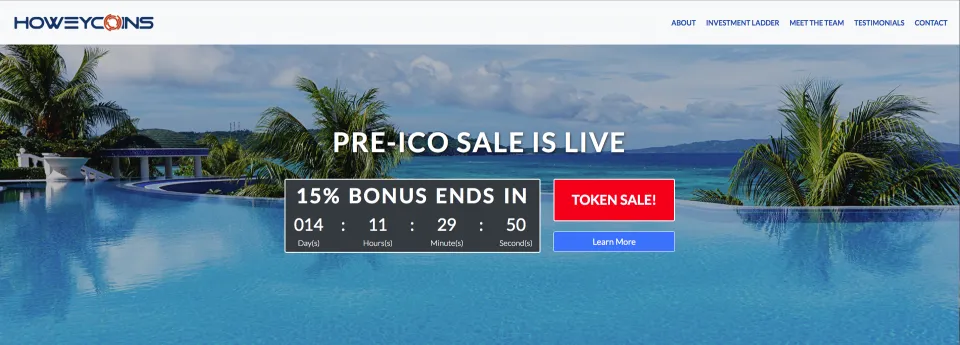

The spoof ICO is called HoweyCoins and is artfully presented as a method to invest funds in the luxury travel market. The bogus ICO, which promises a 25% discount to early bird investors through its site, is certainly an excellent way to educate unsuspecting investors who otherwise would be totally duped into investing into such coins.

The fake HoweyCoins is derived from the famous four-part Howey test, which determined what a security is way back in 1946. In its ongoing process for the regulation of cryptocurrencies, the SEC has recommended that exchanges use this test as a guide for determining whether a coin falls under existing security regulations. The securities regulator also created a dedicated cyber unit whose purpose is to combat fintech as well as cyber-related crimes. Its main focus so far has been on ICOs, which appear to be the largest potential threat to investors at the moment.

When entering the website, the HoweyCoins looks as legitimate as any other ICO landing page with the usual features such as a countdown clock that indicates how much time is left for your investment to cash in on the discounted coin as well as a scale of investment levels. The obligatory images of luxury such as champagne bottles and wonderful beaches but upon pressing the Invest Now button, the user is shown the intrinsic details of the scam including a list of fake celebrity investors. It warns visitors that if they responded to a site similar to this, they could have been scammed.

SEC Chairman Jay Clayton was positive about the project and was effusive about the site’s potential to reduce the possibility of investor scams, saying, “The fact that our staff could put together something that looks just like an ICO in very little time and with very little resources shows how little you have to put into this to market a token. Buy at a 25% discount today because tomorrow it’s going to be full value? Are you kidding me?”

ICOs, or token crowdsales, remain a very popular way for start-up businesses that intend to raise funds although this method is still unregulated. Notwithstanding this, ICOs have raised no less than $12 billion in revenue in 2018 alone. They are also a much-travelled route for scammers to dupe investors who are not market savvy by offering excessively high returns and not to miss out on the FOMO created. Many investors have found that this method is a true way of losing out spectacularly with millions of dollars lost to scams and other fraudulent schemes.

07-02-2025

07-02-2025