|

Getting your Trinity Audio player ready...

|

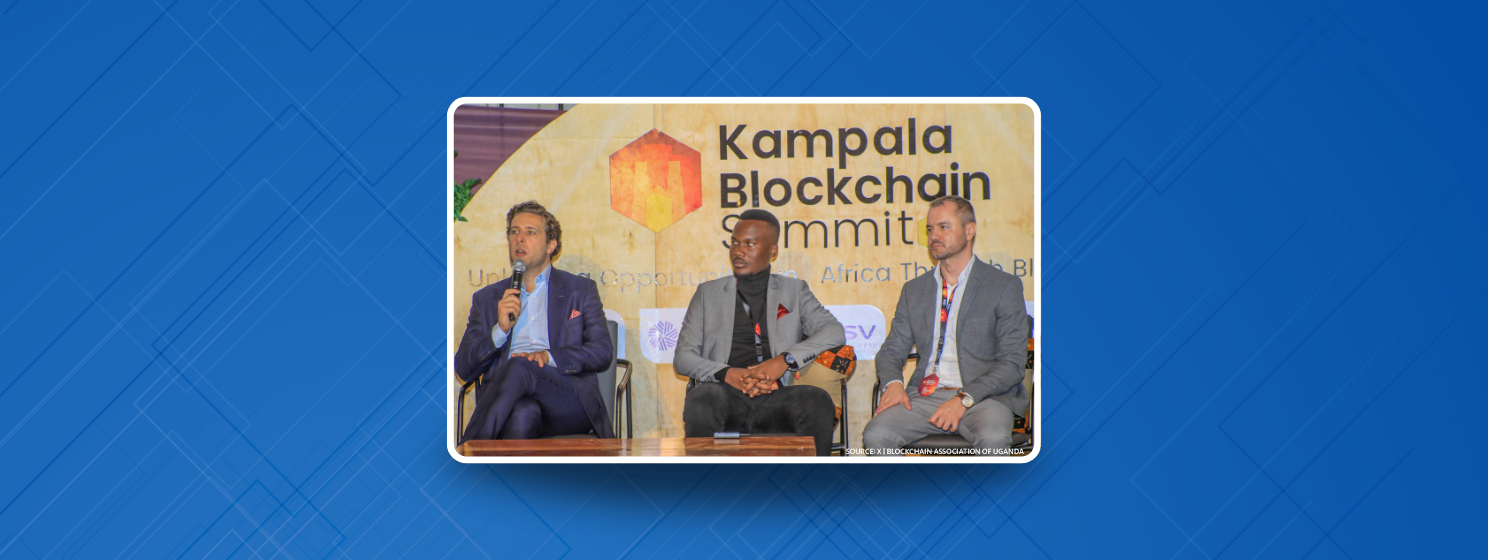

Blockchain can boost financial inclusion, improve the efficiency of mobile money, and make securities transactions faster and cheaper. This was the overarching message at the Kampala Blockchain Summit 2024 in Uganda, where experts from the blockchain world, tech innovators, finance industry thought leaders, and regulators converged to chart the technology’s future.

The Blockchain Association of Uganda (BAU) organized the event under the theme ‘Unlocking Opportunities in Africa Through Blockchain.’ Deputy Governor of the Central Bank of Uganda, Michael Atingi-Ego, delivered the keynote address.

“This summit is about equipping our young people for a world that is changing at lightning speed,” stated BAU President Reginald Tumusiime. “With Sub-Saharan Africa’s working population projected to form over 25% of the global workforce in the coming decades, we must act now.”

BSV powers Uganda’s blockchain revolution

The speakers delved into the various sectors blockchain can revolutionize for the East African nation. One of these is mobile money, which most Ugandans rely on for financial services. According to a FinScope survey last year, 66% of Ugandans use mobile money regularly, compared to a meager 13% who said they use traditional banking services. This makes mobile money the lifeblood of the Ugandan economy and a critical tool in the government’s drive for financial inclusion.

Thomas Giacomo, Director of Utilization at the BSV Association, represented the BSV ecosystem at the event. In a panel discussion, he lauded the strides that Uganda’s mobile money sector had made in recent years.

“You are far more advanced in mobile money here than in Europe, and blockchain could be the next iteration of this system,” he noted.

Despite this surge in mobile money usage, the sector is still costly, especially for small payments. Speakers at the event expressed their belief that blockchain could solve this challenge.

“Imagine sending as little as 10 shillings. With blockchain, microtransactions become a reality, and we can move money at the speed of the internet,” Gyewava Jonathan Kasule, the project lead at KitePesa, told the attendees.

KitePesa is a company that launched a stablecoin for the Ugandan market that runs on the BSV blockchain. It was founded by BAU president Tumusiime and launched officially at the Kampala Blockchain Summit 2024.

Microtransactions only work on a blockchain network that scales unbounded, and only BSV blockchain meets this standard. With the Teranode upgrade, BSV will process over a million transactions per second, magnitudes higher than any blockchain or even centralized solutions like Visa (NASDAQ: V) and Mastercard (NASDAQ: MA). With bigger blocks, BSV packs millions more transactions per block than other networks, which lowers the fees and makes microtransactions possible. Beyond sending value, this opens up new business opportunities, such as IoT micropayments and the pay-per-use model—the latter replaces the outdated subscription model that restricts a user’s online freedom.

“Our blockchain system can handle up to one million transactions per second. By providing open-source components free of charge, we aim to empower Ugandan businesses and governments to revolutionize mobile payments,” Giacomo stated.

Uganda embraces blockchain beyond ‘crypto’

Like many other African nations, including East African neighbors Kenya and Ethiopia, Uganda has embraced digital assets, with the young tech-savvy population leading the charge. However, speakers at the event called on the nation to embrace blockchain beyond ‘crypto.’

One application that can impact the Ugandan economy is tokenization. In his keynote address, the global head of policy at the CFA Institute, Olivier Fines, stated that tokenization could transform Uganda’s securities industry and unlock billions in value through automation.

“By automating processes, reducing costs, and improving efficiency, blockchain can revolutionize financial markets. Tokenization remains a significant opportunity despite challenges like cybersecurity and data privacy,” he stated.

Josphine Okui, the CEO of the Capital Markets Authority, concurred, noting that the technology can “accelerate transactions, minimize counterparty risks, and improve security” in the securities markets.

Blockchain and tokenization have not taken root in most African capital markets. However, some have started to explore their benefits. Kenya’s Nairobi Stock Exchange (NSE) announced in August that it would launch the region’s first digital asset exchange-traded products (ETPs), partnering with European ETP firm Valour Inc. The bourse is also exploring tokenized securities, which NSE CEO Frank Mwiti says “has the potential to transform industries across Africa, and the NSE is committed to driving this innovation.”

As Uganda dives into blockchain and tokenization, it also needs to be vigilant about the associated risks, speakers at the event cautioned.

“We support blockchain’s potential but must remain cautious. Virtual assets can attract foreign criminals, and we have to ensure Ugandans transact safely,” warned Sherifah Tumusiime, who heads the country’s Financial Intelligence Authority.

Ugandan investors have lost millions of dollars to digital asset scams over the years. Two weeks ago, the government revealed that it had recovered 255 billion shillings ($68.85 million) that had been lost to tech scams, including ‘crypto’ frauds, between 2017 and 2020.

Watch: Blockchain & Metanet’s role in combating fake news

03-06-2026

03-06-2026