|

Getting your Trinity Audio player ready...

|

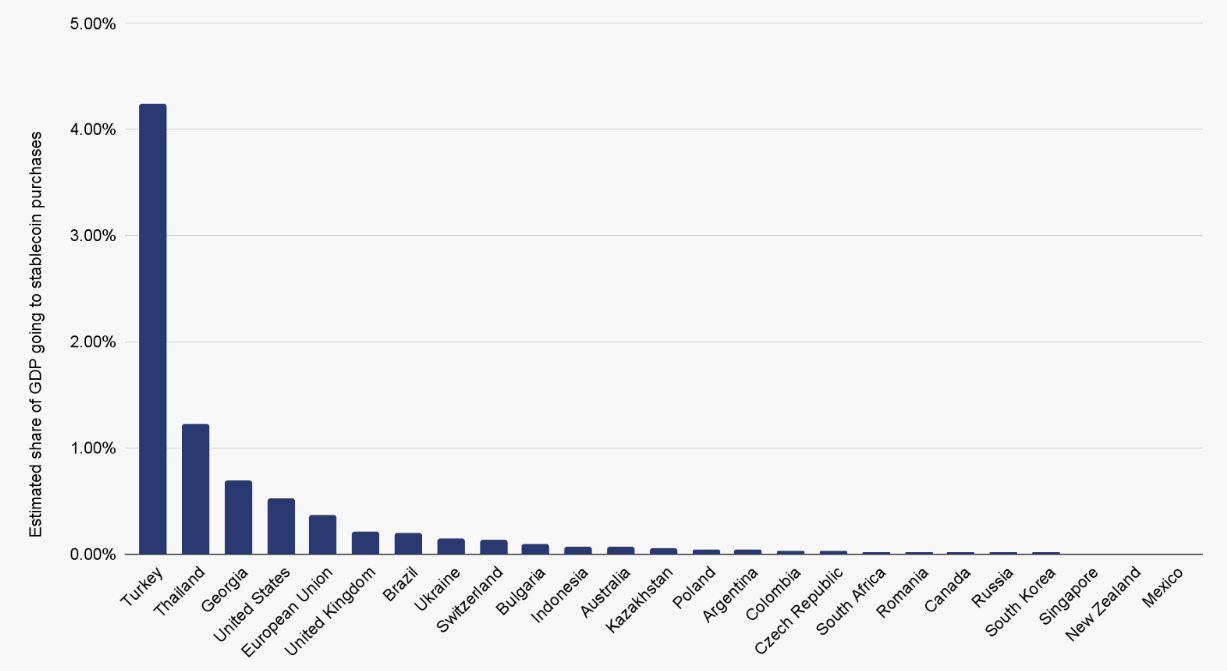

A new report has revealed that Turkey leads the world in stablecoin purchases relative to the gross domestic product (GDP).

Data gathered by the New York-based blockchain analytics firm Chainalysis shows that Turkey leads the pack, with Thailand and Georgia following suit. The United States, despite its significantly higher volumes, ranks a distant fourth.

“The 2024 Crypto Spring Report” revealed that Turkey’s total stablecoin purchases hit $38 billion. With the country’s GDP at around $900 billion, this accounts for around 4.3%.

The company’s director of research, Kim Grauer, disclosed that Chainalysis considered all transactions between the Turkish lira and any stablecoin, leaving significant room for error.

“This is an aggregate figure of transfers of the Turkish lira to stablecoins and stablecoins to the lira, that stablecoin activity does not impact the GDP; rather, we expressed the stablecoin activity as a percentage of GDP in order to provide context for readers,” Grauer told one outlet.

Turkey’s stablecoin purchases reflect the country’s struggles with its lira. Over the past decade, the currency has been on a spiral, a trend that’s accelerated over the past five years, where it has lost 80% of its value against the USD.

Turks have turned to stablecoins to preserve the value of their money, mirroring other countries like Venezuela, Zimbabwe and Argentina, where the continued decline in the value of the national currencies has pushed people to stablecoins.

Thailand is a distant second to Turkey, with stablecoin purchases representing 1.3% of the GDP, and Georgia is third, at 0.7%.

The U.S. is fourth at 0.5%, while the EU rounded up the top five at 0.3%. However, the U.S. is the global leader in stablecoin volumes. In the first three months of the year, the country purchased over $20 billion in stablecoins, the report revealed. This accounted for over half of all stablecoin purchases globally, with the EU second and Turkey third.

The report revealed the growing impact that stablecoins have gained in the world of digital assets. Today, they account for half of all digital asset trading and three of the top five most-traded coins.

This rising adoption has attracted regulators’ attention. The U.S. is leading global efforts with a Senate bill recently proposed by Senators Kirsten Gillibrand (D-N.Y.) and Cynthia Lummis (R-Wyo.).

Watch Spotlight On: Centi Franc—the truly stable stablecoin

03-01-2026

03-01-2026