|

Getting your Trinity Audio player ready...

|

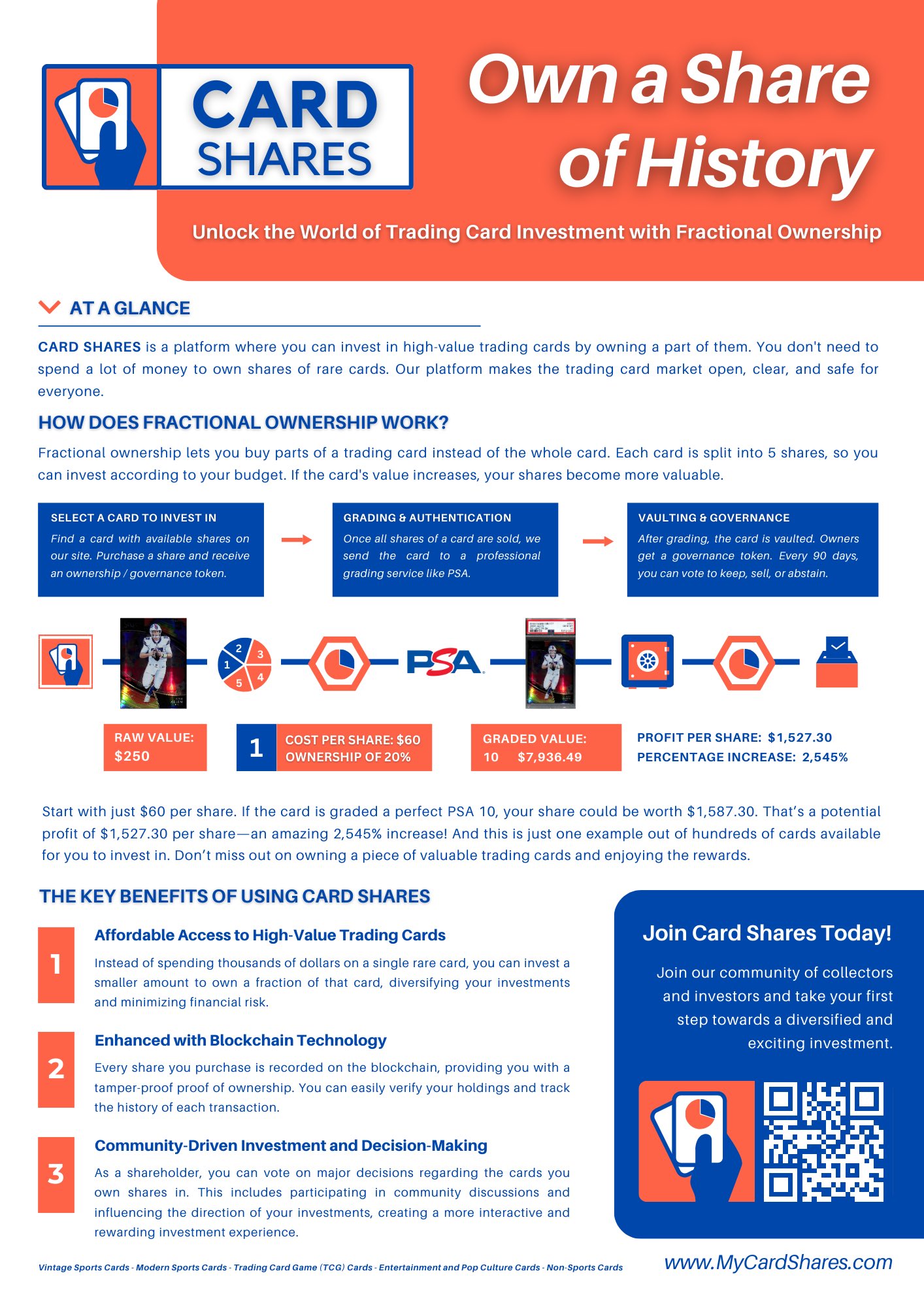

Before NFTs, there were trading cards. In fact, trading cards are still very much around—today’s market contains over US$20 billion in value. It’s been growing so fast that “high rollers” dominate the industry just as they do every other, and it’s increasingly hard for newcomers to take a seat at the table. Enter CardShares, which has developed a BSV blockchain-based market that can fractionalize ownership of rare cards, allowing groups to acquire 20% shares in a valuable asset at a more affordable price.

CardShares arrives via the developers at SmartLedger, known for its work-building systems that rely on secure, auditable data records. SmartLedger created CardShares’ blockchain-based account module, designed to have rock-solid security and will likely have applications far beyond this particular use case.

The platform launched officially this week at Fanatics Fest NYC 2024, a celebration of sports fandom billed as an “immersive sports festival” and “the largest collectibles show ever in NYC.”

This idea has much more value than initially meets the eye. Some out there will read this and think, “Fractional ownership of collectible trading cards, good grief, what next?” Others will notice that if you can fractionalize ownership of one physical asset, then that technology can be deployed to fractionalize any other asset traditionally sold in whole units: real estate, art, copyrights, industrial machinery, jewelry, antiques/artifacts, and other large-ticket items.

CardShares is promoting its launch with a competition to win a 20% share of a one-of-a-kind Lionel Messi signature card, which will be given away when 10,000 new users have signed up.

That is the point CardShares’ creators are making. As SmartLedger’s Greg Ward writes: “This is more than just a marketing gimmick; it’s a statement of intent. By offering a share in such a rare and valuable card, CardShares is demonstrating the real-world benefits of fractional ownership, making high-value collectibles accessible to a broader audience.”

Creating new markets with greater levels of participation

The idea of a syndicate of investors pooling their resources to acquire an expensive asset isn’t new, but once again, it’s blockchain that takes an otherwise complex and risky arrangement and makes it simple. Fractional owners no longer need to personally trust or even know their co-investors. Blockchain records keep track of every transaction and owner, keeping it transparent for all involved. It also makes shares in these asset fractions far more liquid than they would be otherwise and creates a secondary market that will likely increase the total market value of the underlying asset.

Once all shares in a card are sold, CardShares submits the card to a professional grading service like PSA to guarantee its condition and authenticity. It’s then stored in a secure physical vault. CardShares shareholders receive “governance tokens,” which, like the shares, are blockchain tokens that give their owners voting rights on key decisions concerning the card, e.g., to hold or sell. Decisions are made on a 51% majority rule.

Inviting collectible fans to participate in decision-making processes like this at far higher levels than they might have access to otherwise also boosts engagement and a sense of community.

Card shareholders also have access to a personalized dashboard on the CardShares platform, which tracks the value of each asset in real-time. It’ll also send notifications and alerts for large market shifts and other news.

Trading cards was probably a good place to demonstrate the potential of a blockchain platform like this. They’re simple, easy to store, and the factors affecting their market value are (relatively) easy to learn. Giving tokens decision-making/voting power is also a compelling feature and one that could be expanded to accommodate more complex physical assets with a greater range of value variables.

With a fast, cheap, and scalable blockchain like BSV, there’s really no limit to the assets that can be “democratized” this way, creating new investment opportunities for everyone and encouraging smaller-time participants to gain deeper knowledge in their industry of interest.

Watch Building the future with blockchain: Insights with Ty Everett

03-12-2026

03-12-2026