|

Getting your Trinity Audio player ready...

|

In the second article of CoinGeek’s series of interviews with token protocol founders on BSV, Joshua Henslee interviews Attila Aros, founder of the SuperAsset protocol and creator of BlockPress, “The World’s First NFT Marketplace on Bitcoin.”

What can SuperAsset do that no other token protocol can?

Attila Aros: SuperAsset NFT is the first layer 1 (or layer 0 as some call it) token contract on BSV that is available and functional right now.

The major distinction of SuperAsset is that the code is 100% on-chain and governed by the code written in Bitcoin Script and executed directly by Bitcoin miners. There is no requirement to run a specific programming language to interpret the data in the tokens.

Another key feature of SuperAsset is that each token can have satoshis (small amounts of bitcoin) embedded into the token giving it a price floor and an intrinsic value. As an analogy, a gold bracelet can be manufactured with gold and therefore has intrinsic value and price floor—because the owner can always melt down the bracelet to retrieve the gold.

What do you hope to achieve with SuperAsset in 2021?

Attila Aros: We will release a set of tools, components and smart contract building blocks that will allow anyone to build complex applications. The goal is to democratize access to the code and components and have the first 20 projects come alive.

What was your motivation to pivot the BlockPress domain to an NFT minter and marketplace?

Attila Aros: BlockPress was originally founded as a social media platform for sharing and conversations back in 2018. However, the “Grand Vision” even back then was to have ownable and collaborative communities—it just was not possible given the state of tooling and technology at the time.

By focusing on NFT’s, BlockPress will showcase how to create a layer 1 token marketplace that does not lock users into a specific smart contract or website. Once we have established the foundation and built the components to support it—then we will build, and reveal, our social communities feature that uses the NFT technology at almost every level of the product stack.

SuperAsset lacks any wallet support at the moment, how do you achieve that?

Attila Aros: SuperAsset is the world’s simplest NFT and extremely simple to trace through the blockchain—it is a very simple construction, yet maximally flexible.

We believe it will get adopted by virtue of the fact that it is simple to index and account for the token asset without having to run heavy weight libraries or custom off-chain logic. Wallet developers will be able to rely on a powerful open-source indexer, in a manner similar to how miners rely on the open-source Bitcoin SV node component.

What are you most excited to see built with the SuperAsset protocol?

Attila Aros: This is a dream project that will change many areas of the internet we look at today: digital identity, distributed collaboration and financial tools powered by Bitcoin. It combines techniques and insights from over 3 years from the lowest level to the larger scale search and indexing insights.

The most exciting thing is to release our open-source indexer and platform to give it away for everyone to easily index and manage layer 1 tokens. There are many internet-changing applications that will be built using this including digital identity, income-generating memes and collaborative communities.

Can you give your thoughts on the “Layer” labels for Tokens? (ex. STAS as L0, SuperAsset as L1 and Tokenized as L2)

Attila Aros: The labels are used largely as a marketing term that we use to compete and jostle for mind share.

I define the layers as follows:

L0 (Layer 0): All the code and ownership transition rules are encoded in native Bitcoin Script and enforced by the miners. In particular, a token can be said to be L0 if when an owner of a token attempts to broadcast a forgery (or already spent token) then the miners will reject it and be unable to timestamp the transaction into a block.

Note that only the UTXO data structure itself is L0 in Bitcoin. In other words, the native unit of account (“satoshi”) is operating on this same plane.

L1 (Layer 1): Just like L0, all the code and ownership transition rules are encoded in native Bitcoin Script and enforced by the miners, however the key distinction is that an external observer or agent must make sense of the lineage of a token through multiple transfers. If an external party can be convinced to receive a forgery or invalid token (because they did not validate the entire lineage themselves or through their trusted delegate) then attempting to spend the UTXO that houses the token with a miner will still result in a successful broadcast and be accepted into a block.

L2 (Layer 2): Unlike L0 or L1, the rules and interpretation is on an external party. The bitcoin transactions themselves are used as a kind of data carrier substrate. A record of time stamped data packets. The key distinction is that the ownership transition rules are not encoded in Bitcoin script and instead are interpretations by “following the thread” in the external agent.

Using these definitions, we can classify different approaches as follows:

Native Bitcoin UTXO: L0

SuperAsset: L1

STAS: L1

RUN: L1+L2 (Hybrid)

Tokenized: L2

I’ve frequently referred to SuperAsset as a “zero overhead” protocol for asset management. I think it is disingenuous to refer to SuperAsset, or any other token protocol as “L0” without introducing a new OP code into Bitcoin Script which I call OP_MINT that can be used to tag asset IDs at the UTXO level and then have the state merklized into a block.

This unfortunately would require a Bitcoin protocol consensus change which I do not support because it has scaling implications in the future, but it is an interesting thought experiment.

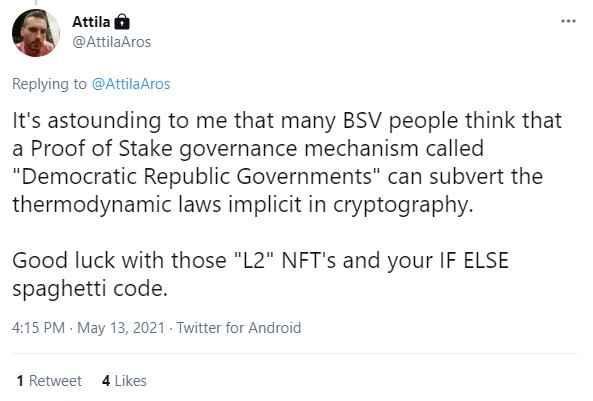

Related to this topic, could you elaborate on what you meant this tweet?

Attila Aros: I was referring to the fact that the key characteristic of Bitcoin is the ability to “follow through” the chain of valid digital signatures to arrive at authenticity and ownership at the base layer (L0 and L1). If there is an off-chain system such as legal court orders, or arbitrary changes to the rules off-chain, then it will be extremely complicated and practically infeasible to have consensus at scale because the L0 or L1 protocols will basically operate at L2.

What are your thoughts on using satoshis for tokens?

Attila Aros: It is the best unit of account for the best money in the world, why not use it for user-defined tokens? It gives a price floor to the price of a token and makes it easy to account for balances.

As an analogy, a gold bracelet can be manufactured with gold and therefore has intrinsic value and price floor—because the owner can always melt down the bracelet to retrieve the gold. So too can the owner (or issuer) melt a token down, effectively destroying it, to extract the base “metal” ‘satoshi’ content.

Do you think multiple Token protocols atop BSV can co-exist?

Attila Aros: A “token” is a way to trace ownership. There will be many different contracts for different domains and usage scenarios. Most of what people refer to as “Token Protocols” in BSV are just umbrella names to refer to the brand or company behind the solution. There will certainly be many companies or brands providing competing solutions with some overlap and some features exclusive to the domain they are serving.

In Bitcoin, one size does not fit all, nor is it desirable. Scalability is of utmost importance and trying to fit all kinds and manners of NFTs into a single “ERC-721” like smart contract is a waste of compute resources and then forces NFTs into a “digital collectible” frame.

Instead, we want polymorphic smart contracts and history tracking which necessarily means there is no “standard” protocol. We can say there is a standard way of doing things, but that’s more similar to how there are multiple web frameworks and application development approaches.

A BSV “protocol” is closer to the choice between say using Angular, VueJS, or React for web application development than calling it a “protocol.”

How is this claim different than asserting that multiple crypto currencies can co-exist?

Attila Aros: Multiple crypto currencies do exist. Thousands of them. And they will continue to exist, there is no evidence in the facts to indicate otherwise. The moment Bitcoin was invented it was forked into Namecoin, Dogecoin, and many others. This trend will continue and so will the coexistence of multiple “protocols” and techniques for digital asset tracking.”

How can BSV out-compete Ethereum?

Attila Aros: By this I presume you mean how can developers and businesses achieve greater profit by building on the BSV platform versus developing for the Ethereum platform.

At a certain level I do not think BSV will ever out-compete Ethereum. The problem or statement is ambiguous: who is competing and to what end, what does “winning” look like?

I will say this though: we must make it extremely easy to write and manage smart contracts and make it easy to have complex interactions between smart contracts. This will involve writing a Bitcoin node-like software that can serve end users well and not just miners.

How can BSV profit from picking various positive aspects from ETH and DeFi?

Attila Aros: Pick the ones with the most rabid and loyal followers. They are a clear signal of interest and opportunity for growth.

What impact do you think the LAW narrative has had on BSV with respect to tokenization?

Attila Aros: It is hard, impossible to quantify. For sure there are many great things and some bad things that came out of using this narrative. I will not speculate or dwell on that as there is no point.

I will say this however: Those people that make repeated use of some word, concept, or phrase (a “meme”) are usually doing it to conceal their own future plans. That is what a good entrepreneur does is conceal their plans for the future long enough for them to manifest it before their competitors realize what they themselves are trying to accomplish.

If you could wave a magic wand and change something about the BSV culture or business environment, what would it be?

Attila Aros: Many talented developers should consider remaining independent and as long as possible. They should create components and tools that they themselves want to use which is a good sign that there are other developers who have the same problem—and are willing to pay for those solutions.

Thank you, Attila, for taking the time to answer our questions. Stay tuned for the next interview of our token protocol founder series.

This article was lightly edited for grammatical and clarity purposes.

02-20-2026

02-20-2026