|

Getting your Trinity Audio player ready...

|

As digital currency prices trend sideways in summer of 2022, many communities seem to be hopeful that coin prices and NFT values will inevitably return to and surpass their previous highs.

However, this space has never faced a global economic recession, nor extremely high inflation. Digital currencies had the benefit of depressed interest rates for nearly their entire lifetime, and a relatively strong global economy during that time. In 2022, all these factors have changed.

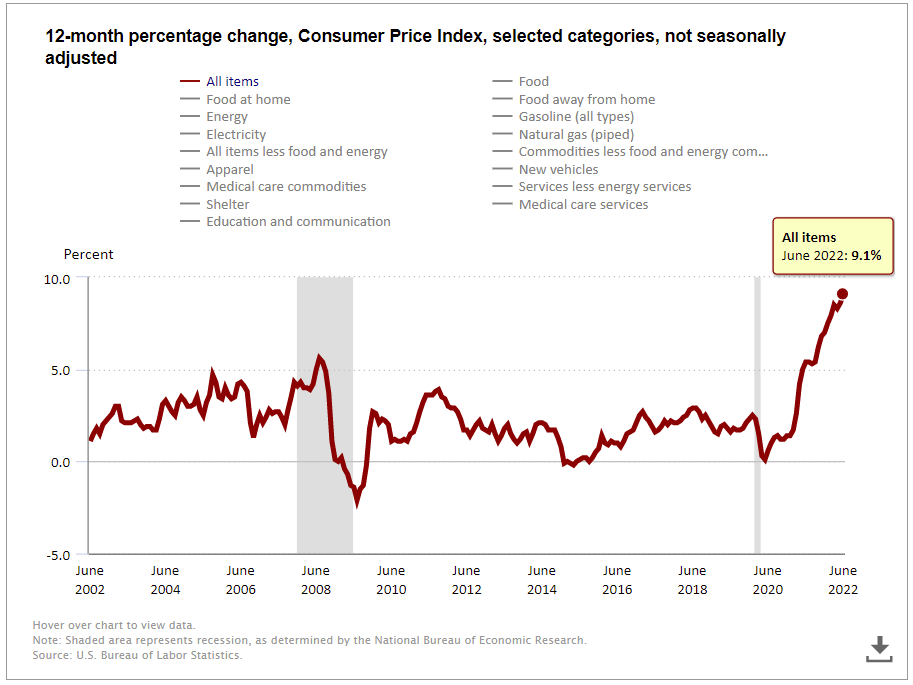

The federal funds rate which has been at 0% for the greater part of the last 14 years is at its highest level (2.25%) since late 2018 and likely going higher. The CPI (Consumer Price Index) was steady between 1-3% during that same period.

While digital currency investors may have considered that the true inflation rate has nothing to do with the above chart and a significant factor in why they invested in the first place, clearly inflation is an issue if even the government admits it. Digital currencies suffered a collapse in the first half of 2022, largely due to the Terra/Luna Ponzi scheme imploding and fund Celsius halting withdrawals and later filing bankruptcy.

Both projects that failed promised high percentage returns on investment via the staking of various tokens. Likely, investors were attracted to these risky ventures by understanding that the inflation rate was rising due to the excessive money printing by governments since 2020. In the chart above, the CPI starts to break out above 5% in May 2021. Notably, BTC’s price hit its previous all-time high of around $60,000 around that time.

Digital currency investors correctly foresaw that inflation was going to be an issue but took extreme risk to combat it—just like the founders of the companies that went bust in the summer of 2022. The historical average annual return in the stock market is around 10% for the last century, ignoring inflation. The invention of an alleged new asset class is not going to change this long-lasting paradigm.

The excessive returns from the “free tendies era” of 2020-2022 fueled by government money printing created a euphoric high that has still yet to wear off. In 2021, anyone with a freshly printed stimulus check could put that money into a random collectible, real-estate property, digital currency (except BSV), trading card game, LEGO set or monkey JPEG NFT and likely amassed a greater than 10% return.

In 2022, the story is reversed. Investors will be lucky to fetch a 10% nominal return, let alone a significant real one. Digital currencies are down on average 50% year to date, and equities are down around 10%. Commodities will tend to be beneficiaries of inflation, but that has yet to play out.

The point is no one is going to wildly speculate on coins and NFTs with zero usage when the prices of real, necessary goods and services are rising rapidly. The beneficiaries of freshly printed money are the ones who receive it first. Investors correctly front ran the resultant rising prices from money printing but became blinded by greed. As 2022 continues, investors will have to wise up and actually put money in value, revenue generating companies if they hope to truly sustain a fight against the beast that is inflation.

Watch: BSV Global Blockchain Convention panel, The Future of Digital Exchanges & Investment

https://www.youtube.com/watch?v=AsD1na3VgxE

03-06-2026

03-06-2026