|

Getting your Trinity Audio player ready...

|

The Consumer Finance Institute of the Federal Reserve Bank of Philadelphia has published the results of a 2022 survey asking Americans their views on central bank digital currencies

(CBDCs).

CBDCs were defined as a digital form of cash issued by the central bank. Respondents were asked to select potential design features that would be important to them and why they might use CBDCs, among other things.

The survey was designed to elicit answers from various Americans representing different races, genders, income levels, urban and rural living situations, etc.

The majority is now ‘warm’ to CBDCs

Overall, 52.6% of the respondents were deemed ‘warm’ to CBDCs, representing a slight majority. Young people, high earners, non-whites, and males were most likely to be warm.

Respondents were deemed ‘warm’ when they selected some design features important to them and ‘cool’ when they selected ‘None of these – I would not use a CBDC.’

What features are most important in a CBDC?

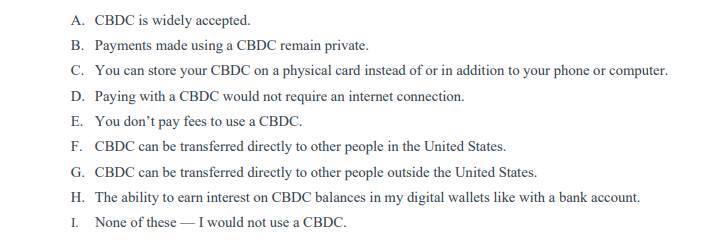

The survey gave the following options as potential design features. Respondents were asked to pick the ones that were most important to them.

Only 42% of the respondents selected the privacy of payments as a top concern. Others selected no fees (63.5%) and widespread acceptance (57.3%) as the most desirable features. The ability to transfer a CBDC outside the United States was the least picked feature (10.6%).

When asked about situations in which they were most likely to use CBDCs, 69.9% of people said they would use them to make payments online. 64.3% said they could use them in a store, and 63.8% might use them for person-to-person payments.

Like them or not, CBDCs are coming

While the U.S. is taking a more tentative approach to a CBDC, other countries are advancing at full speed. China’s digital yuan is already live, the digital euro is well into the experimentation phase, and countries from Israel to the Caribbean either have live CBDCs or are experimenting with them.

While the Philadelphia Fed survey respondents are mostly warm to the idea of CBDCs, that’s not the case everywhere. Attitudes to CBDCs differ widely from country to country, and in some cases, there is strong opposition to them. Where this is the case, privacy, and unchecked government control tend to be the main concerns.

A scalable peer-to-peer electronic cash system like BSV can act as an alternative to CBDCs or even a ledger on which they could operate, mitigating many privacy and control worries. However, for that to be possible, BSV must scale unboundedly with low fees and true peer-to-peer payments.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: CBDCs are more than just digital money

03-05-2026

03-05-2026