|

Getting your Trinity Audio player ready...

|

The Securities and Exchanges Commission (SEC) has approved Props as the first Regulation A+ (RegA+) tokens. According to a press release by the company, the regulator deems its token as compliant with the current regulations.

RegA+ tokens offer an alternative method for anyone to gain a financial stake in a company, extending the privilege to unaccredited investors.

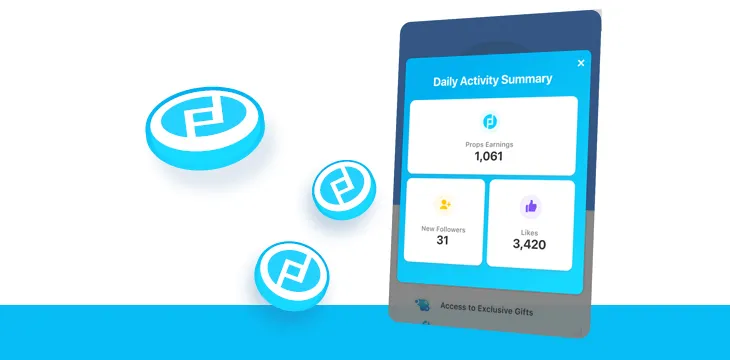

Props is a consumer-facing utility token that integrates with non-blockchain applications, enabling their users to earn tokens for engaging with the platforms. Props, built on the Ethereum blockchain, is open source and allows for plug-and-play functionality for platform owners, who can use it to develop their own token-based loyalty programs.

Props was developed by YouNow, an American live-streaming platform with over 47 million users. YouNow has previously announced that it will begin rewarding content creators on its platform with Props tokens for engaging in activities that drive community engagement. These include creating live broadcasts, watching other people’s broadcasts and tipping creators. According to an SEC filing, YouNow will distribute 187 million tokens to its users. The platform currently has in-app proprietary credits known as Bars which it claims to have sold over $70 million worth.

Props also revealed that XSplit, a game streaming platform, will integrate its tokens. This will enable the platform to “become even more aligned with its loyal users” who stand at over 13 million.

While Props isn’t the first token offered on streaming platforms, it claims to be significantly different from its peers. YouNow said the tokens aren’t limited to one platform since the user who earns the tokens on YouNow can use them to purchase items on XSplit and any of the other platforms that may join the network.

While the Props tokens aren’t redeemable for fiat currency, they were valued at $0.1369 each on the SEC filing. The company is, however, working on getting them listed on Alternative Trading Systems, Props CEO Adi Sideman told TechCrunch. The supply of the tokens is capped at 1 billion, with 600 million already mined so far.

Props has been working with the SEC for over two years now to ensure that they weren’t planning on defrauding investors, Sideman stated. Even then, the regulator is still monitoring its progress, forcing Props to be strict with any platform that integrates its tokens.

The SEC also granted a similar RegA+ qualification to Blockstack’s token, allowing it to fundraise for $28 million through a token offering. Previously, Blockstack could only raise funds from accredited investors but by acquiring this qualification, it can now attract investment from the wider public.

07-03-2025

07-03-2025