|

Getting your Trinity Audio player ready...

|

GCash, the largest mobile wallet platform in the Philippines, has reportedly made its digital asset services available to a select group of its users.

GCash has been working on digital asset integration for close to two years now, with the company’s president Martha Sazon first announcing the plans mid-2021. Last year, the VP and Head of New Business, Niel Trinidad, reiterated that the mobile wallet was working on the integration.

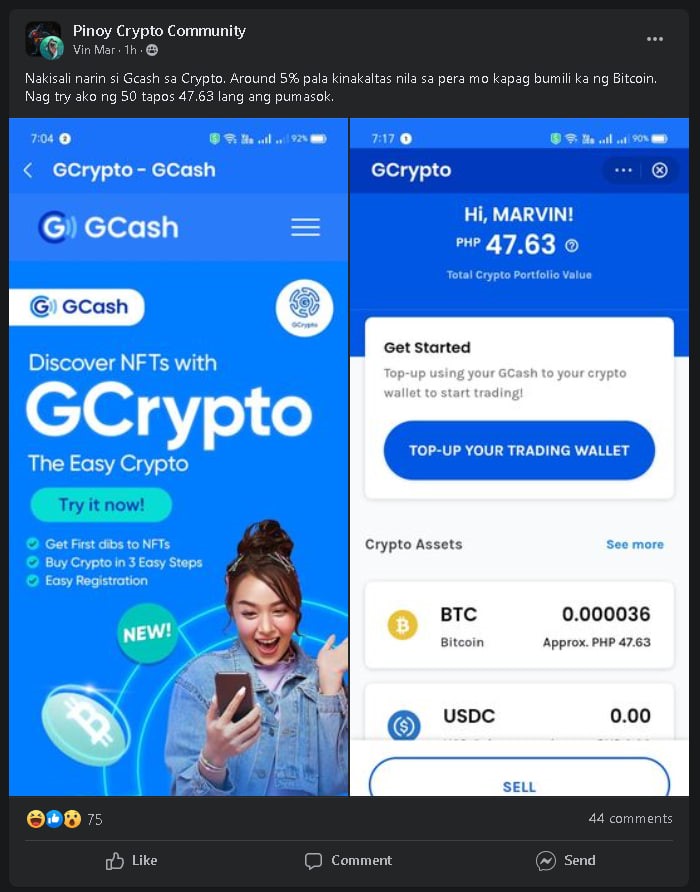

GCash’s digital asset offering, GCrypto, is now available to a select group of users. While the company has yet to make any official announcement, users took to social media to share details of the new feature.

The new feature received mixed reactions from the mobile wallet’s users. While some are excited at being able to easily purchase digital assets directly from the popular wallet, some are dissatisfied with an alleged high fee. Users claimed to be charged close to 5% for every purchase.

Some users are also concerned about the custodial nature of the GCrypto wallet.

“When you buy crypto from them… it’s not yours; it’s theirs because you don’t hold the private keys to your wallet,” one social media user noted.

GCrypto is a partnership between GCash and the Philippines Digital Assets Exchange (PDAX), one of the more popular exchanges in the Southeast Asian country. While still in its infancy, the offering has a huge market to tap into, with GCash being one of the Philippines’ largest fintech companies. The wallet has 60 million users, accounting for over 85% of the country’s adult population.

While GCash is only now dipping its feet in the Bitcoin waters, its rival Maya has gone all in. Maya, a digital banking platform formerly known as Paymaya, holds a virtual asset service provider (VASP) license from the Bangko Sentral ng Pilipinas (BSP), the country’s central bank.

The Filipino market continues to grow aggressively despite the downturn in digital asset prices. The country ranks as one of the world’s largest digital asset, NFTs, play-to-earn, and metaverse hubs.

Watch: Turbocharging Philippines digitalization via blockchain

03-07-2026

03-07-2026