|

Getting your Trinity Audio player ready...

|

The Philippines is eyeing to roll out its central bank digital currency (CBDC) in two years, Bangko Sentral ng Pilipinas (BSP) Governor Eli Remolona Jr. told journalists on Monday.

Remolona, however, said the Philippine central bank would not develop a retail CBDC for the local market. He added that the wholesale CBDC will be deployed on a custom-built infrastructure independent of blockchain technology.

According to a Philippine Daily Inquirer report, Remolona said the wholesale CBDC will be deployed on the BSP-owned Philippine Payment and Settlement System.

The report quoted Remolona explaining that “other central banks have tried blockchain but it didn’t go well.”

Remolona added that with wholesale CBDC, “banks will be the only counterparties and then, retail will ride on them.”

The BSP believes that wholesale CBDC has the potential to improve the efficiency, safety, and robustness of domestic and cross-border payments.

CBDC is also seen to provide banks with another option, apart from reserves, to deposit money with the BSP for use in real-time interbank payments and settlement systems.

The future with digital peso

In 2022, the BSP launched its wholesale CBDC pilot project, coined CBDCPh, as part of its efforts to promote the stability of the country’s payment system. The CBDCPh was in collaboration with the International Monetary Fund (IMF).

The IMF said its role will be to advise the country’s central bank on the technicalities of creating the CBDC. Apart from offering technical help, the IMF noted that it will be involved in training BSP staff on the application of digital versions of the currency.

The BSP has also earlier disclosed other plans to convert the country into a cashless economy in the coming years. The central bank’s goal is to move 50% of all transactions to digital-based in 2023 and to increase the number of residents with a bank account to 70%.

The agency recently said it has reached its target of 50% digital-based transactions in 2023.

The BSP added it is bullish that the sustained rise of digital payment technologies will continue to facilitate the efficient delivery of financial services to unbanked Filipinos and micro, small, and medium enterprises (MSMEs).

Development of CBDCs worldwide

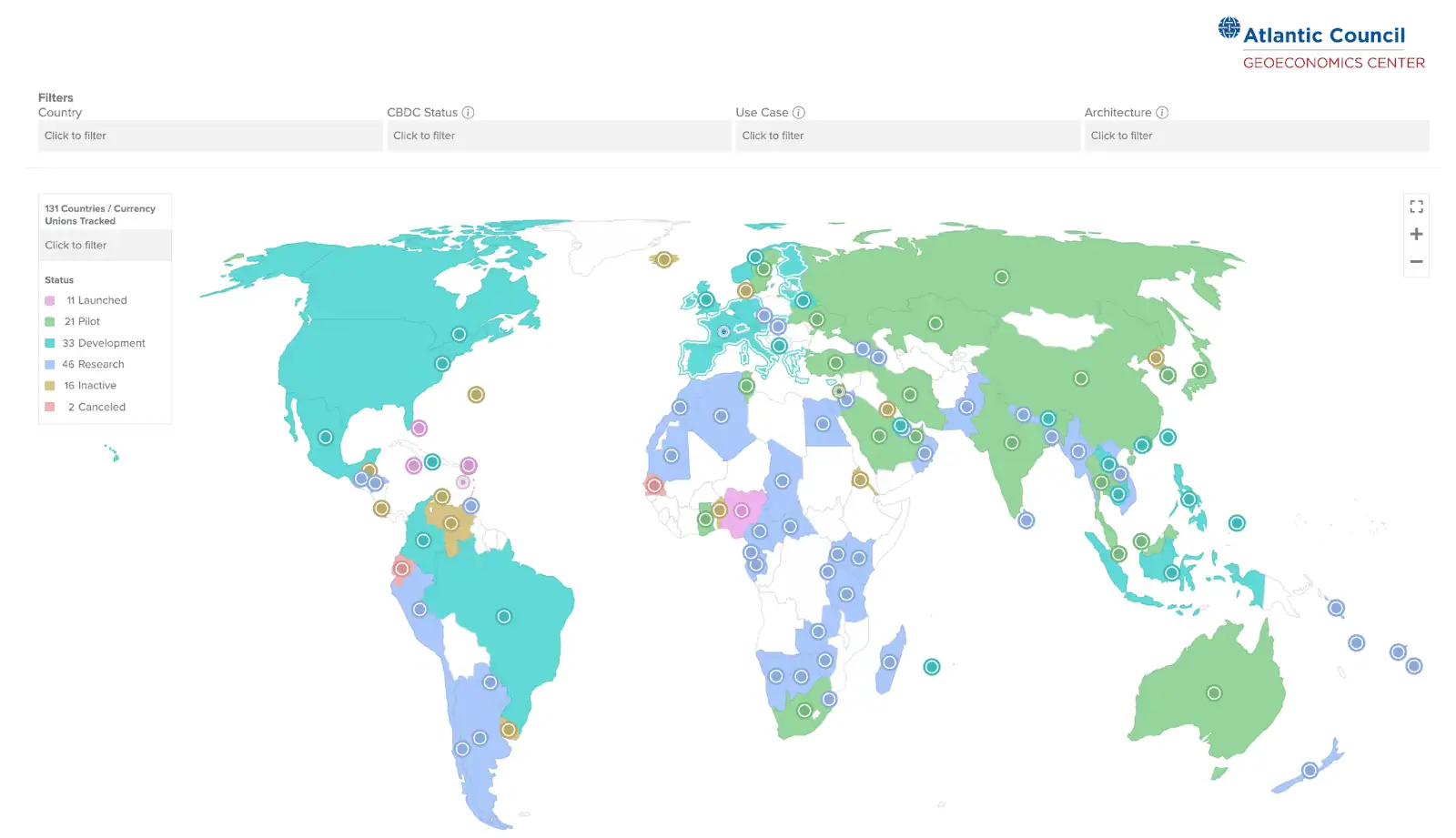

As of December 2023, the Atlantic Council reported that 130 countries, representing 98 percent of global GDP, are exploring a CBDC. The figure is an improvement from May 2020, with only 35 countries considering a CBDC.

According to the report, 19 of the G20 countries are now in the advanced stage of CBDC development. Of those, nine countries are already in the pilot.

It added that 11 countries have fully launched a digital currency. China’s digital yuan pilot, which currently reaches 260 million people, is being tested in over 200 scenarios, some of which include public transit, stimulus payments, and e-commerce.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: Digital identity for digital Philippines—here are some use cases

06-30-2025

06-30-2025