|

Getting your Trinity Audio player ready...

|

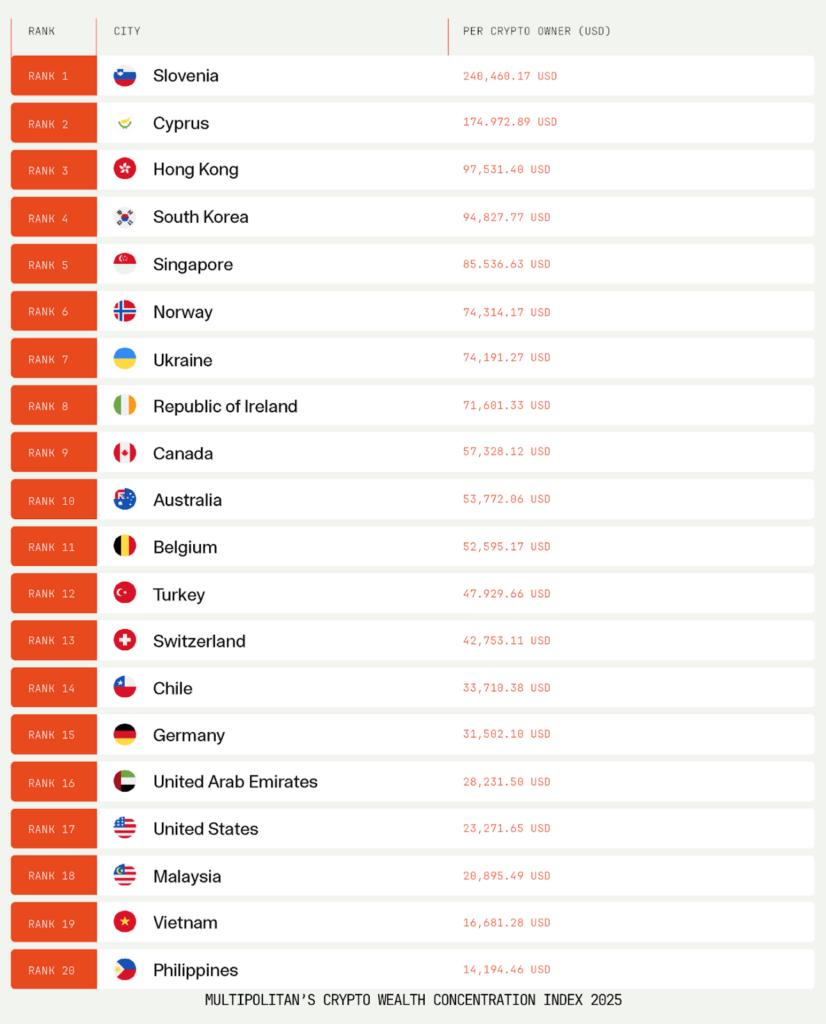

The Philippines is fast emerging as a crypto wealth hub, with Filipino crypto owners now ranking among the top globally in terms of average holdings. According to the Crypto Friendly Cities Index 2025 by global financial migration platform Multipolitan, the country ranks 20th in crypto wealth concentration, with Filipino crypto holders owning $14,194.46 (PHP790,000).

This marks a shift from the early days when crypto interest in the Philippines was largely driven by play-to-earn (P2E) gaming. The report noted, “Axie Infinity in the Philippines became a lifeline for thousands of gamers looking to earn income through play-to-earn mechanics.” At the height of its popularity, Filipinos made up 40% of Axie Infinity’s global user base.

While the value of Axie’s tokens has dropped from its peak during the pandemic, crypto ownership in the country continues to expand. Multipolitan highlighted that the Philippines is no longer defined solely by speculative activity or gaming but is part of a larger transformation in global finance.

Southeast Asia’s crypto powerhouse: Where the Philippines stands

Within Southeast Asia, the Philippines trails Singapore (ranked 5th globally), where each crypto holder owns an average of $85,536.63. Malaysia is placed 18th with $20,895.49 per holder, followed by Vietnam at 19th, with each owner holding $16,681.28 in crypto assets.

Globally, Slovenia leads with an average of $240,460.17 per crypto owner, followed by Cyprus ($174,972.89), Hong Kong ($97,531.40), and South Korea ($94,827.77). These high averages indicate concentrated crypto wealth, typically associated with jurisdictions that provide regulatory clarity and strong digital infrastructure.

“Crypto wealth no longer belongs exclusively to traditional finance capitals like New York, London, or Singapore. It’s borderless, fluid, and finding new homes wherever innovation and clarity converge,” the Crypto Friendly Cities Index 2025 stated.

Regulatory environment shapes crypto-friendly cities

The report emphasized that cities and countries offering clear, consistent, and crypto-supportive regulations are increasingly drawing both talent and capital.

“Regulatory clarity isn’t just beneficial—it’s essential,” it noted, citing cases such as Binance relocating operations and Coinbase (NASDAQ: COIN) threatening to leave the U.S. due to hostile regulations.

In the Philippines, regulators are gradually catching up. In 2024, the Securities and Exchange Commission (SEC) drafted rules for Crypto Asset Services Providers (CASPs), aiming to protect consumers and create a more stable legal framework for digital assets. This comes as fraudulent activity and unclear rules continue to pose risks.

Cities compete for crypto capital

Multipolitan’s analysis clearly shows where the future of finance is headed and which cities are positioning themselves to lead. Cities like Dubai, Singapore, and Zug are drawing global crypto entrepreneurs, institutional investors, and digital nomads, thanks to clear regulations, tax advantages, and high quality of life.

“These cities aren’t just friendly to crypto—they’re building entire financial ecosystems around it,” the report said. “The next epicenter of global finance won’t just embrace crypto—it will thrive on it.”

Among the key drivers identified are regulatory arbitrage, digital infrastructure, and crypto culture. In the Crypto Friendly Cities Index 2025, cities such as Zurich, Lisbon, Abu Dhabi, and Singapore ranked highly across all five measured metrics: regulation, tax regime, wealth & lifestyle, digital infrastructure, and crypto infrastructure. The report emphasized that “first movers aren’t just leading—they’re dominating.”

Crypto wealth concentration: Who holds the keys?

Beyond adoption, Multipolitan also introduced a Crypto Wealth Concentration Index, which adjusts ownership data using a Gini coefficient to assess the inequality of crypto holdings. This sheds light on how deeply integrated crypto is among populations and whether it’s concentrated among a few elites or broadly distributed.

The United Arab Emirates stood out as the global adoption leader, with over 25% of its population holding crypto, thanks to “proactive government policies and clear regulations.” Meanwhile, the United States continues to lead in trading volume, recording $2.07 trillion, largely due to institutional involvement.

By contrast, countries like Slovenia and Cyprus, despite smaller populations, showed higher average holdings per user, suggesting high wealth concentration among a relatively small but active group.

“The question now isn’t who’s adopting crypto—it’s who will hold the keys to crypto’s immense wealth in the future,” the report concluded.

The future financial capital

Multipolitan sees the race toward becoming a global crypto hub as more than a trend—it’s a foundational shift in financial geography.

“The global financial landscape is shifting,” the report declared. “Cities that move quickly to embrace crypto aren’t merely positioning themselves for relevance—they’re securing their place as the financial centers of tomorrow.”

This shift is especially relevant for countries like the Philippines, where crypto adoption has gone from grassroots use in gaming communities to broader financial integration.

Watch: The Philippines is moving toward blockchain-enabled tech

03-04-2026

03-04-2026