|

Getting your Trinity Audio player ready...

|

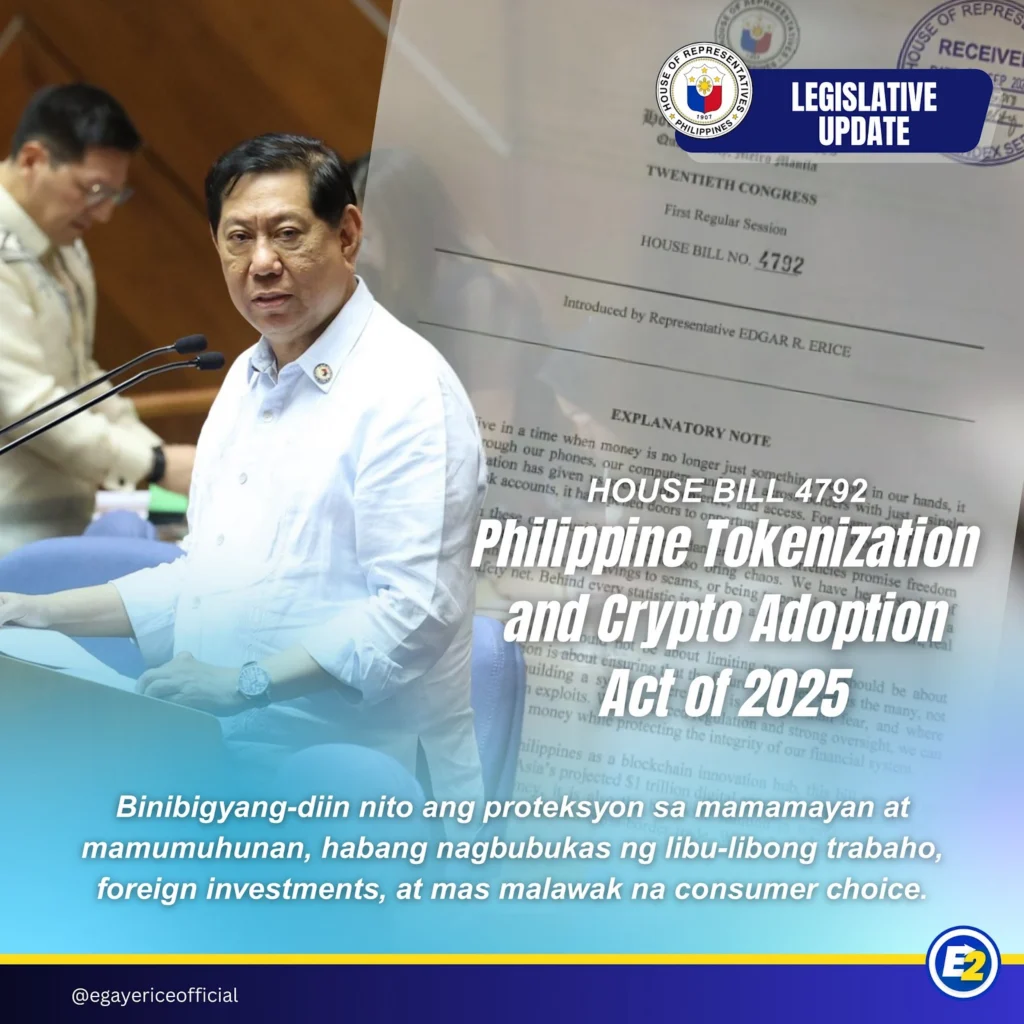

The Philippines’ House of Representatives has formally recorded the filing of House Bill No. 4792, authored by Caloocan 2nd District Rep. Edgar “Egay” Erice, which proposes the creation of the National Council on Digital Assets and Tokenized Investments (NCDATI).

The measure is titled “An Act to Create the National Council on Digital Assets and Tokenized Investments (NCDATI) for the Purpose of Establishing a National Framework for Real-World Asset Tokenization, Responsible Cryptocurrency Adoption, Stablecoin Utilization, Development of Local and Foreign Exchanges, Promotion of Decentralized Finance, and Retail Acceptance of Crypto Payments, Providing for Citizen Participation, Investor Protections, and for Other Purposes.”

“We live in a time when money is no longer just something we hold in our hands, it now flows through our phones, our computers, and even across borders with just a single click,” Erice said in the explanatory portion of the bill. He added that digitalization has given Filipinos “speed, convenience, and access,” especially for those who previously had no bank accounts.

However, he warned that “with these opportunities also come dangers. Cryptocurrencies promise freedom and innovation, but without rules, they can also bring chaos.”

Protecting people from risks

The explanatory note of the bill emphasizes the risks ordinary Filipinos face in the fast-evolving digital finance environment.

“We have heard stories of hardworking Filipinos losing their savings to scams, or being trapped in the wild swings of a market with no safety net. Behind every statistic is a father, a mother, a student, in short, real lives are affected.”

Erice stressed that the bill is not designed to restrict innovation but to prioritize safety.

“This is why regulation should not be about limiting progress, it should be about protecting people. Regulation is about ensuring that the future of money serves the many, not just the few. It is about building a system where trust is stronger than fear, and where innovation uplifts rather than exploits.”

The proposed framework also introduces rules for responsible cryptocurrency adoption, safeguards for investors, and measures to allow the voluntary use of stablecoins and crypto for payments.

As the bill outlines, “This bill simply expands consumer choice, allowing payments in stablecoins or crypto at stores, online, and even for government services, with receipts always in peso equivalents. Importantly, adoption is voluntary. No one is forced to use crypto, but every Filipino gains the freedom to choose.”

Blockchain as economic opportunity

According to the measure, positioning the Philippines as a blockchain hub would bring long-term economic benefits.

“By positioning the Philippines as a blockchain innovation hub, this bill can help us capture a share of Southeast Asia’s projected $1 trillion digital economy by 2030.”

The note stresses that blockchain applications go beyond cryptocurrencies.

“Blockchain is not limited to cryptocurrency, it is also the backbone solution in supply chain, digital identity, government transparency, and cross-border trade. With this framework, we attract foreign direct investment and create thousands of high-skilled jobs in tech, finance, and compliance.”Citizen representation in policymaking

Erice also highlighted the bill’s emphasis on inclusivity. Unlike earlier financial legislation, the measure calls for direct public participation.

“Unlike most financial laws written by and for elites, this bill mandates representation from citizens, OFWs, and civil society in the National Council on Digital Assets and Tokenized Investments (NCDATI). Policies will no longer be crafted behind closed doors but shaped with the voices of ordinary Filipinos.”

This provision is intended to ensure transparency in governance, prevent policy capture, and provide accountability in the regulation of digital assets.

Toward a national framework

House Bill 4792 outlines several priority areas under the proposed framework such as real-world asset (RWA) tokenization; responsible cryptocurrency adoption by developing safeguards and oversight rules; stablecoin utilization with clear policies for the use of peso-backed or foreign stablecoins; development of both local and foreign exchanges; promotion of decentralized finance (DeFi) in a regulated manner; retail acceptance of crypto payments in everyday transactions; citizen participation in policymaking; and, investor protections.

These areas, the bill notes, are meant to provide a comprehensive structure that both encourages innovation and secures public trust.

Confidence in the digital future

“If we regulate wisely, we can embrace the digital future with confidence. We can create a Philippines where technology empowers every Filipino, and where no one is left unprotected in the new age of money,” Erice said.

House Bill 4792 is now pending its first reading in the House of Representatives. Erice summarized the intent of the bill by stressing that regulation is about trust and empowerment: “With balanced regulation and strong oversight, we can unlock the benefits of digital money while protecting the integrity of our financial system.”

Watch: eGov super app opens the best opportunities for Philippines

03-05-2026

03-05-2026