|

Getting your Trinity Audio player ready...

|

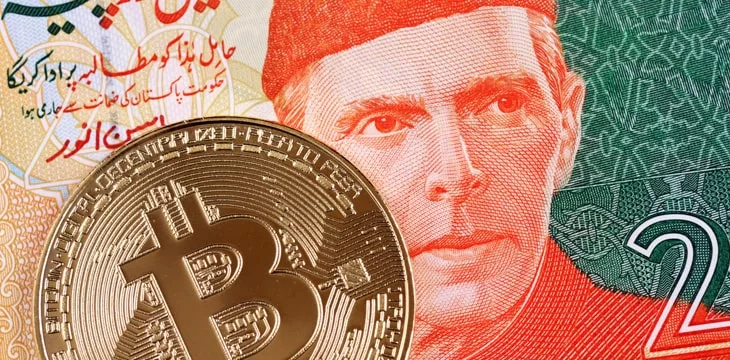

Pakistan is moving closer to a blanket ban on digital currencies following an announcement from its Finance Ministry that the asset class will “never be legalized in the country.”

Minister of State for Finance and Revenue Dr. Aisha Ghaus Pasha told members of the Senate Standing Committee Finance that a ban on digital currencies is likely to happen to comply with the directives of the Financial Action Task Force (FATF). Pasha revealed that part of the conditions set by the FATF to remove Pakistan from its “grey list” was the ban on digital currencies.

Pasha’s comments drew support from the State Bank of Pakistan (SBP), with the banking regulator noting that digital currency transactions could potentially disrupt the financial ecosystem. Sohail Jawad, an SBP director, cited the implosion of Terra and FTX and the subsequent contagion effect as proof of the dangers posed by digital currencies.

Already, the SBP and the Ministry of Information Technology have put things in motion in anticipation of the ban following the directive from the Ministry of Finance. Customers of commercial banks in Pakistan have begun receiving messages from their banks reminding them of the illegal status of digital currency trading.

However, reports of an impending ban on digital currencies sparked outrage on social media on the grounds that “the officials have been destroying Pakistan in the name of FATF and IMF.” Millions of Pakistanis turned to digital currencies to hedge against galloping inflation amid brewing economic and political turmoil.

“I suspect that many people are buying USDT on crypto platforms as a way to get exposure to the US dollar,” Ali Farid Khwaja, CEO of BlockTech Pakistan, said. “Even [BTC] has performed well against the Pakistani rupee. During the crypto run, reportedly more than 20 million Pakistanis had opened accounts on crypto platforms.”

Last week, the Pakistani rupee tumbled to an all-time low against the dollar as citizens braced themselves for a sovereign default. Politically, things are looking grim for Pakistan following the corruption charges against former Prime Minister Imran Khan and the attendant widespread protection.

Faith in CBDCs and blockchain

Despite the staunch antagonism of digital currencies, Pakistan’s government appears to have faith in blockchain technology. The country’s president Dr. Arif Alvi extolled the benefits of blockchain, noting that it has the potential to improve processes in the country following a meeting with representatives from the BSV Blockchain Association.

Pakistan is gearing up to launch a central bank digital currency (CBDC) in 2025, with pundits expecting the country to rely on blockchain for its digital currency. The country’s banking regulator has ordered the making of new regulations to guide the issuance and distribution of the incoming state-backed digital currency.

Watch Ejad Labs’ Arzish Azam: Pakistan must take advantage of blockchain tech

02-27-2026

02-27-2026