|

Getting your Trinity Audio player ready...

|

New Zealand‘s central bank has launched a public consultation for its prospective central bank digital currency (CBDC), focusing on its design and principles, including whether the digital dollar should be interest-bearing.

The Reserve Bank of New Zealand (RBNZ) published a consultation paper discussing some of the options it’s considering as it explores the digital dollar. The paper delved into the CBDC’s features, motivations behind the project, benefits and impact on the country’s financial system.

The paper noted that a digital dollar is crucial for the RBNZ to keep up with digital payment innovations.

“We want the certainty and safety of using digital cash to be available to all New Zealanders and businesses alongside physical cash,” the central bank noted.

According to the paper, the prospective digital dollar would be available without a bank account, indicating that the RBNZ might not rely on commercial banks to distribute the CBDC.

Other considerations include offline availability, physical debit cards, and integration with existing digital payment systems.

With privacy being a contentious issue with CBDCs globally, RBNZ noted that it intends to develop the digital dollar with maximum privacy.

“The Reserve Bank will not be able to see or control how you spend your money,” it said.

New Zealand weighs holding limits, interest payment

RBNZ invited the public to submit feedback by July 26. It listed 12 questions in four categories: objectives of digital cash, its benefits, strategic design, and managed issuance.

Some questions include whether the CBDC can boost financial inclusion, what support they would need from the top bank, any major concerns, and what risks they expect.

On issuance, the central bank seeks to know whether the public expects the digital dollar to bear interest. Initially, every other CBDC, including those that have gone live like Nigeria’s eNaira, was non-interest-bearing.

However, the Bank of Israel has recently upended this principle, indicating that it’s exploring interest payments on its digital shekel. Most recently, a top executive at the Bank of Israel doubled down on it, stating that this would push commercial lenders to offer better rates and services, growing the Israeli economy.

Lastly, the RBNZ is seeking the public’s opinion on whether there should be a holding limit for the digital dollar. The bank is considering putting the cap at NZ$2,000 ($1,180); a scenario without a cap would limit interest payment to the first NZ$2,000.

Most central banks have settled on imposing a holding limit. The European Central Bank has proposed a €3,000 ($3,232) limit, while the Bank of England’s proposed limit was much higher at £10,000 – £20,000 ($12,500 – $25,000), although banks and industry associations have opposed the latter.

China relies on a tiered approach, with the lowest type of wallet—created with just a mobile phone number—handed a $281 daily cap. A digital yuan wallet connected to a bank account and having undergone ID card verification enjoys a $70,000 holding limit and a daily cumulative payments cap of $14,000.

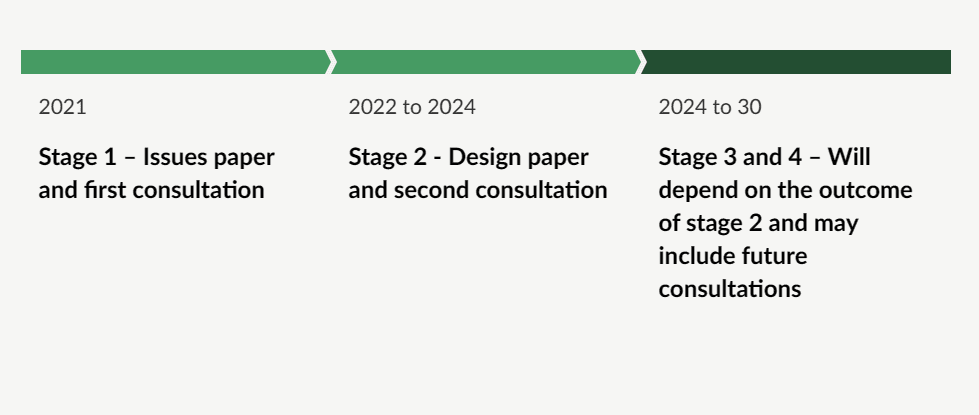

Like most other major economies, New Zealand has yet to decide whether to issue a CBDC and is only exploring its feasibility. It’s currently in the second stage of its four-stage process. The first started in 2021 with the issuance of a consultation paper. The following two stages will depend on the findings of the first two stages.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: Deploying CBDCs on the original Bitcoin

07-02-2025

07-02-2025