|

Getting your Trinity Audio player ready...

|

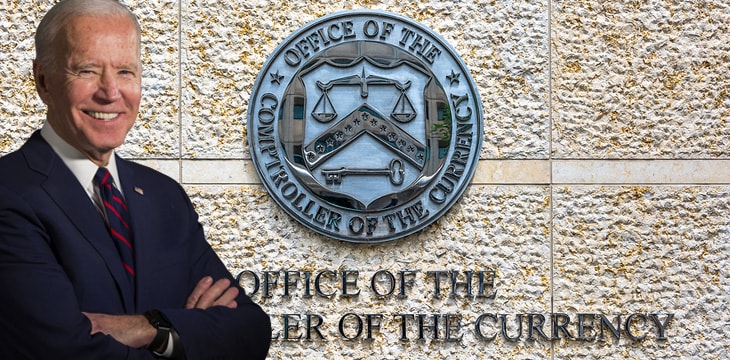

President-Elect Joe Biden should overturn guidance issued by the Office of the Comptroller of the Currency (OCC) relating to digital currency, embarking on a new policy direction for the U.S. government towards cryptocurrency, according to a letter from a senior lawmaker.

In remarks sent to the President-Elect, the chair of the House Financial Services Committee, Rep. Maxine Waters, said the incoming government should ‘rescind or monitor’ recent cryptocurrency guidance outlined by the department, following sustained criticism from several key Democrats in recent weeks.

The move from Rep. Waters is being reported as the latest in a series of steps being taken by senior Democrats to overturn what is seen as a Trumpian embrace of digital currency, part of a wave of new regulation expected for the sector.

According to Rep. Waters, this should include imposing more significant levels of regulation on digital currency and stablecoin use across the United States.

In her letter, the Californian representative said that this was one of the areas of policy the incoming administration should immediately reverse.

“As you begin to carry out the mandate given to you by the American people to restore trust in the federal government, I would like to highlight several areas where you and your team should immediately reverse the actions of your predecessors.”

In particular, she highlighted guidance suggesting banks may hold reserves in stablecoins as a particular area of concern.

“Your appointed officials at the Office of the Comptroller of the Currency (OCC) must also not assume, as their predecessors have, that a law Congress passed over 150 years ago somehow gives them authority to provide a national bank charter to non-bank fintech or payment companies.”

The position creates a challenge for the current acting Comptroller of the Currency, who must now navigate between the extremes of the current administration and the incoming administration, with what look to be diametrically opposed views on digital currency and stablecoin regulation.

See also: U.S. Rep. Darren Soto’s keynote talk at CoinGeek Live on Balancing Innovation & Regulation for Growth of Blockchain Technology

Recommended for you

British lawmakers of the parliamentary national security committee have called for a temporary ban on political parties receiving donations in

Circle (NASDAQ: CRCL) soared in 2025 thanks to U.S. ‘regulatory clarity,’ but can this momentum survive a ban on crypto

02-26-2026

02-26-2026