|

Getting your Trinity Audio player ready...

|

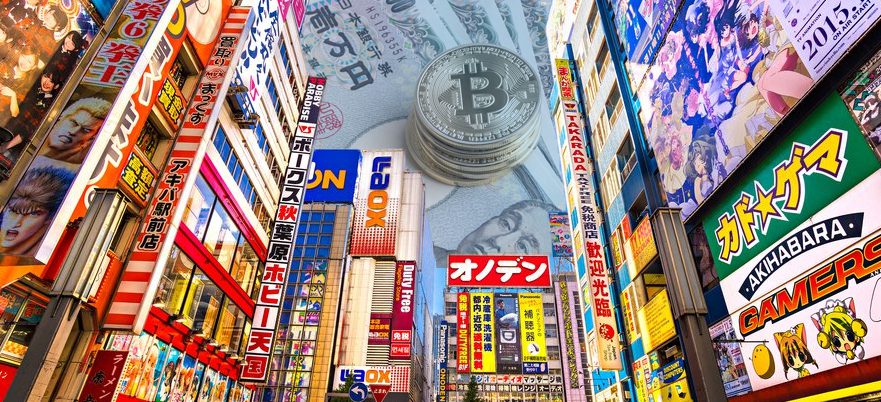

Authorities in Japan have arrested the head of an exchange handling virtual currency Ripple on suspicion of fraud, local media outlets reported.

Yuki Takenaka, 31, was accused of persuading a customer to transfer JPY1.4 million (USD12,446) in cash to the bank account of the Ripple Trade Japan (RTJ), which he managed, according to Jiji Press. The transaction took place in March 2015, when the company was effectively bankrupt and unable to make repayments, investigators said.

Takenaka is also suspected of defrauding more than 40 other customers out of an estimated JPY17 million (USD151,130) between February and March 2015. Police said Takenaka is believed to have illegally manipulated the company’s system and issued IOUs amounting to more than JPY120 million, which they said may been spent on entertainment.

Police officials said Takenaka has “largely admitted” to the charge.

Established in May 2014, RTJ collected money from its users in exchange for online IOUs, which can be exchanged with other users or converted into cash or XRP tokens via the exchanges that handle Ripple. RTJ, however, had reportedly run out of money in early 2015, and customers had been unable to contact Takenaka starting March 2015.

Takenaka’s case bears comparison with the now defunct bitcoin exchange Mt. Gox, whose chief executive was found to have embezzled funds to fund his personal expenses, including rent and to pay for women that “offer sexual services.”

Tokyo-based Mt. Gox was once the world’s largest exchange platform for bitcoin until it filed for bankruptcy in 2014, claiming it had lost 850,000 of its bitcoins, which are worth more than $450 million at the time, to hackers that exploited the site’s “transactional malleability.” CEO Mark Karpeles was eventually arrested on charges of data manipulation and embezzling a total of JPY341 million (US$2.98 million) in customers’ money between September and December 2013.

03-07-2026

03-07-2026