|

Getting your Trinity Audio player ready...

|

Israel is weighing a digital shekel that has the option of bearing interest, a new report by the country’s central bank has revealed.

The Bank of Israel (BOI) published the ‘Logical Architecture for the Digital Shekel System’ report. It delves into various central bank digital currency (CBDC) design and implementation options, some markedly different from those of other central banks.

One outstanding difference is BOI’s proposal to have a digital shekel that supports the option of bearing interest. Most central banks have proposed designs in which CBDCs don’t pay interest, as this pits them directly in competition with commercial banks.

Some, like the European Central Bank (ECB), have acknowledged that paying interest on CBDC holdings could force commercial banks to raise their interest rates, leading to a rise in bank deposits. The increased deposits would lead to increased lending and profitability for the banks.

BOI also proposed a new designated solution for the CBDC off- and on-ramps. With most central banks, CBDCs are designed to be directly connected to one’s bank account.

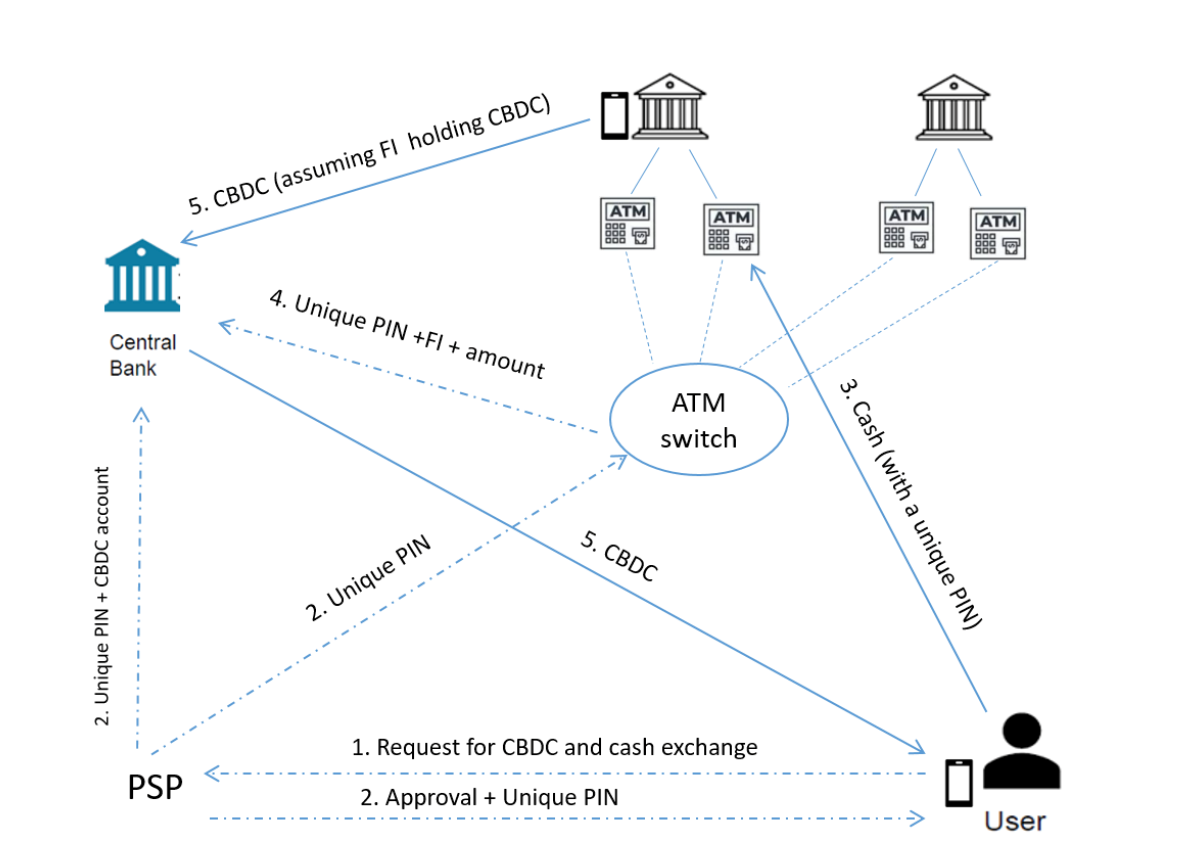

However, Israel proposes a new system in which the end user can fund and defund their wallet through any payment service provider or bank. The user can deposit their funds at an ATM using a unique code, and the central bank will debit the institution and credit the user’s wallet. This transfer can also be done directly without the involvement of the top bank, but this “might raise privacy and AML compliance issues for the institution.”

BOI maintains that at this stage, it remains agnostic to the technology underpinning the CBDC, noting that it could consider blockchain technology or traditional database technologies.

As with other central banks, BOI reassured users that it wouldn’t have access to users’ personally identifying information. Privacy has been one of the biggest topics around CBDCs, with critics blasting them as surveillance coins that governments will use to control the masses.

To learn more about central bank digital currencies and some of the design decisions that need to be considered when creating and launching it, read nChain’s CBDC playbook.

Watch: CBDCs: The rules will apply, like it or not

02-19-2026

02-19-2026