|

Getting your Trinity Audio player ready...

|

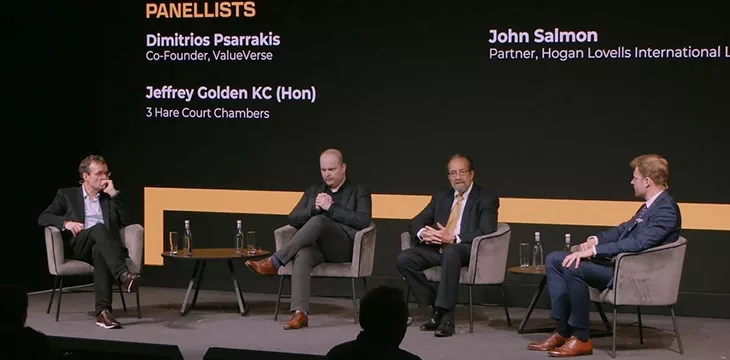

The ‘code is law‘ mantra has been well and truly debunked over the last few years, but nonetheless, it still makes for an interesting discussion. At the London Blockchain Conference 2024, Marcin Zarakowski hosted a panel on the subject.

Panelists included Jeffrey Golden KC, ValueVerse Co-Founder Dimitrios Psarrakis, and Hogan Lovells International LLP Partner John Salmon. As always with lawyers, the conversation was nuanced with few straightforward answers, but it certainly provided much food for thought!

Is code law? Can algos and software alone set up sufficient frameworks?

Salmon tackles this question first, saying that the short answer is no. As a lawyer who used to be a coder, he knows that the law applies regardless of network rules, but code can automate many processes within the bounds of the law.

Psarrakis says that from an economist’s point of view, it doesn’t matter. Firms try to maximize their profits. Rules should be in place, and it doesn’t matter how they are followed as long as they are. Rules can be created by any entity, but laws can only be created by the authority in power. We’ve fought a hard battle in the last 3,000 years to ensure that.

Golden KC jokes that the answer is a typical one from lawyers: what would you like the answer to be? He notes that we don’t have a global parliament and we do have the freedom to contract in most countries. We have to look at each situation on a case-by-case basis.

Why do we need rules for public, permissionless networks?

Salmon believes they’re necessary to create a sense of certainty. We need rules for people to be willing to put their money on the line. We can’t eliminate all risks, but we can eliminate some, and rules are designed to do that. Institutions and governments will not adopt the technology without them.

Psarrakis notes that blockchains do not solve the fundamental problem of contracts’ incompleteness. Conflicts or required changes could occur, and rules need to exist so that they can be amended if necessary.

Golden KC points out that there are some things we can’t control by contract. These matters often come down to local laws. However, there has been an effort to harmonize laws in certain areas, such as bankruptcy and insolvency.

What EU rules are applicable to tokens and other digital assets?

Psarrakis says it starts with the Data Act. We then have the definition of smart contracts and other related matters to consider. The MiCA regulations also apply. He jokes that EU regulators are lazy and prefer to use old regulations and push new concepts into them.

There’s always a debate between more conservative factions and more liberal ones on these matters. For example, when it comes to DAOs, the conservatives say they must be treated as legal entities with management teams that can be sued, etc., whereas the more liberal approach is to treat them as potential vehicles for growth and regulate the activities they conduct.

Wrapping up, Golden KC gives some general advice for making rules. Never compromise on quality, consider processes thoroughly, keep the big picture in mind while attending to the details, and make sure to educate people on how the new rules work and what they mean.

Watch: Regulation leads to good uptick for Web3 operators

04-18-2025

04-18-2025