|

Getting your Trinity Audio player ready...

|

As part of a series called ‘Technology Fundamentals for Digital Finance,’ the International Monetary Fund (IMF) released a working paper titled, “ASAP: A Conceptual Model for Digital Asset Platforms.”

In it, authors Victor Budau and Herve Tourpe introduce a conceptual model called ASAP – Access, Service, Asset, Platform. They explore examples and use cases of tokenized assets, seeking to demonstrate the possible usage and merits of a Digital Asset Platform with four layers.

Problems and a potential solution

The ASAP paper draws parallels to the Internet and how it achieved interoperability, noting that introducing the seven-layer TCP/IP protocol was instrumental. It recognizes that many of the same problems facing the Internet back then face the digital asset ecosystem today, and it seeks to find the TCP/IP equivalent for them.

The paper recognizes how proposed solutions over the years have inadvertently introduced new problems, too. The absence of consensus on architecture and standards, as well as the diversity of architectures and design patterns, technologies, protocols, and implementations, has complicated things.

Introducing the concepts of Digital Asset Platforms and tokenization, the paper looks at how the four-layered ASAP model could be a solution to many of the problems outlined.

What is the ASAP model?

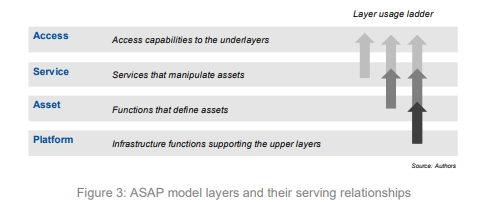

As outlined previously, ASAP stands for Access, Service, Asset, and Platform. These four layers are interconnected and “encompass high-level functional components necessary for the interoperability of DAPs.” Each layer fulfills separate objectives.

Existing models by Banco Central do Brasil, the Monetary Authority of Singapore (MAS), and others inform the ASAP model, which is designed to be inclusive of all platform types “irrespective of their technology, governance, or the types of assets they handle.”

While each layer is multi-faceted, the following is a quick overview:

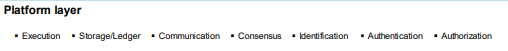

The Platform layer acts as the settlement layer and is primarily used to implement the transfer of the financial assets of the above layer.

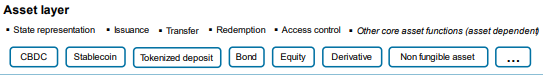

The Asset layer encompasses core functions that define a financial asset. Different asset classes require distinct functions (e.g., bonds are different from currencies), and these are defined here.

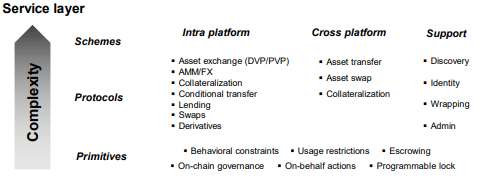

The Service layer covers functions that handle or utilize the financial assets deployed on the platform. Rules and mechanisms that encompass services like swaps or lending are included here.

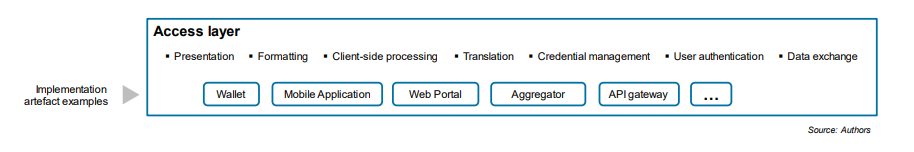

Finally, the Access layer contains functions and interfaces to allow users and other clients, applications, and other market components to engage with the other Service, Asset, and Platform layers.

Bitcoin is the TCP/IP protocol of digital assets

While something like the ASAP model may have a place in enabling applications to interact with different tokenized asset types, the fundamental question this paper seeks to answer, “What is the TCP/IP equivalent for digital assets?’ was answered long ago.

Bitcoin, as outlined in the 2008 white paper, is the base layer protocol that will enable unbounded scalability, interoperability, and complete stability. While Bitcoin has taken a meandering path over the past 15 years and has been fundamentally altered by misguided developers, the original protocol has been restored in the form of BSV and delivers everything TCP/IP did for the Internet.

The difference is that Bitcoin does not need to be scaled in layers—it scales unboundedly at the base layer. While standards have to be agreed upon to ensure interoperability between applications, Bitcoin, and only Bitcoin can act as the base layer for Digital Asset Platforms and the global financial markets.

Central bank digital currencies (CBDCs), stablecoins, non-fungible tokens (NFTs), and tokenized financial assets like stocks and bonds can be stored, transferred, and exchanged directly on the Bitcoin blockchain. While applications will have to be built to interact with these assets, and rules and standards defined to allow them to do so, the base layer protocol is already in place, and unlike BTC, Ethereum, and other competing blockchains, it is set in stone.

With the advent of Teranode, the BSV blockchain can scale to 1.5 million transactions per second with fees of fractions of a cent. Each transaction is time-stamped and logged on the blockchain, making tracking and tracing every transaction and tokenized asset possible. The protocol rules are clearly defined and set in stone, meaning developers can build with the confidence that things won’t change in the future.

The question of what will act as TCP/IP for digital assets was solved long ago. BSV is now waiting for the world to catch up and begin building on the world’s most scalable public blockchain.

Watch: Dr Mohamed Essaaidi—BSV’s scaling will change governance, banking, agriculture

02-25-2026

02-25-2026