|

Getting your Trinity Audio player ready...

|

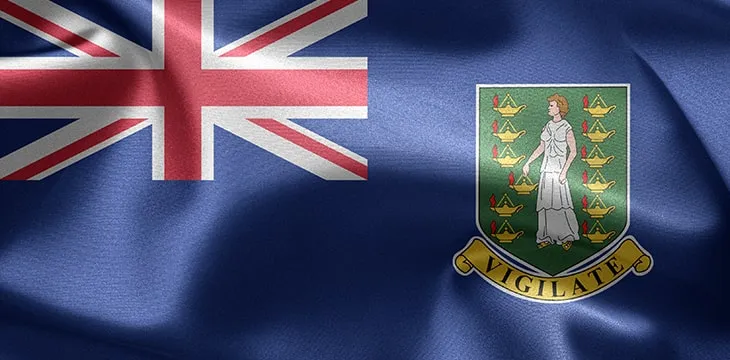

Huobi’s global expansion has received a new boost after the Seychelles-based exchange secured a license to operate in the British Virgin Islands.

The exchange, founded in China close to a decade ago, announced in a recent press release that it had been granted approval by the BVI’s Financial Services Commission (FSC) to operate a digital asset trading platform under its local subsidiary, Brtuomi Worldwide Limited. Huobi didn’t disclose when it would be launching the exchange.

“This landmark approval makes Huobi the first licensed digital asset exchange for institutional-grade derivative products in the British Virgin Islands. It is a testament to our experience, professional knowledge, and track record in the global cryptocurrency industry,” commented the exchange’s CFO, Lily Zhang.

Huobi is one of the world’s largest exchanges, processing over $3.5 billion in combined spot and derivatives trading volume daily from traders in 160 countries.

In the BVI, a British overseas territory, Huobi will offer spot trading, derivatives, and ‘other innovative products.’ In particular, the exchange will focus on derivatives, a sector that accounts for over 75% of its trading volume.

“We see a huge market opportunity in cryptocurrency derivatives, with perpetual futures accounting for about half of global cryptocurrency trading volumes in 2021. Going forward, we will work closely with the British Virgin Islands regulators to develop a suite of licensed trading products and services, and foster the cryptocurrency industry’s growth in the territory,” Zhang commented.

Huobi’s global expansion has been a success in countries like Australia, where it recently received an operating license, and the U.S., where it secured a FinCEN license in July.

However, it has encountered a few snags as well. The most recent was in Malaysia, where the securities watchdog recently added the exchange to its Investor Alert List for serving Malaysians without the regulator’s approval. It responded by claiming to be in discussion with Malaysian regulators over licensing.

In New Zealand, the exchange had to begin phasing out derivative products such as USDT-margined contracts and exchange-traded products. The exchange also had to shut down operations in Thailand in June after its local subsidiary revoked its license from the country’s securities regulator.

Watch: The BSV Global Blockchain Convention panel, The Future of Digital Asset Exchanges & Investment

07-15-2025

07-15-2025