|

Getting your Trinity Audio player ready...

|

When David Garrett sold his tech startup, he turned to winemaking, and for the past three decades, he has been managing his winery in Argentina. At that time, he unearthed some of the industry’s most pressing challenges, and in his presentation at the London Blockchain Conference, he discussed how he was using blockchain to solve them.

Wine is beloved globally, with U.S. President Benjamin Franklin famously describing it as “constant proof that God loves us and loves to see us happy.” The wine industry generates $435 billion annually from 250 million consumers, who are served by over 30,000 independent winemakers.

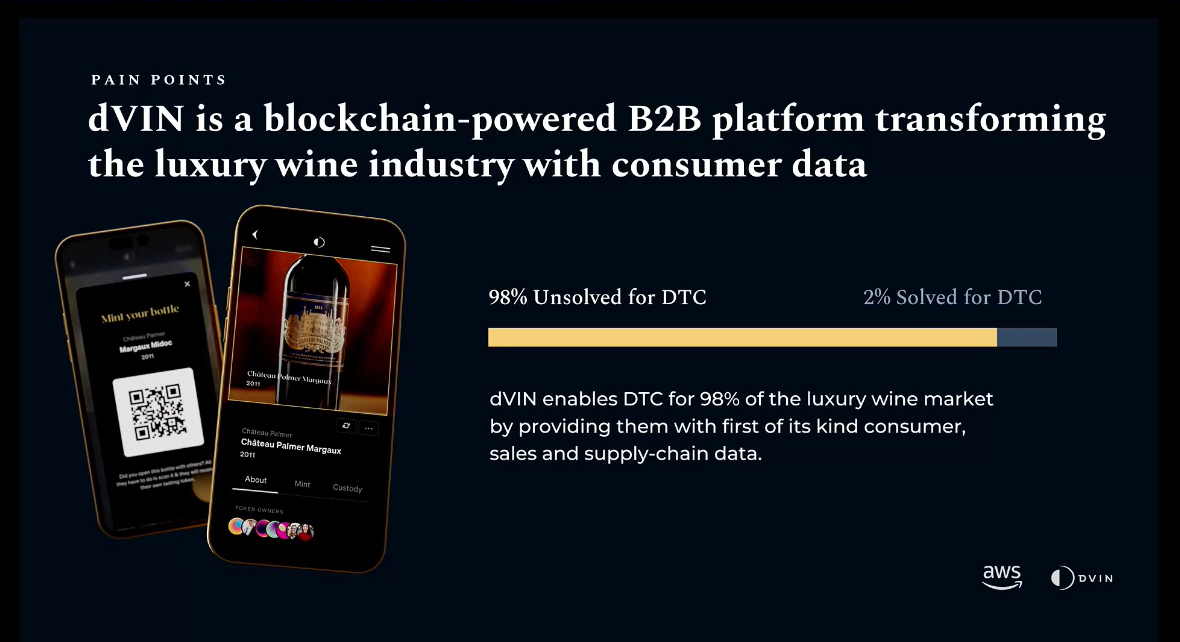

Within the wine industry lies a niche market for luxury wine, and while it only accounts for 10% of the volume, it represents 25% of the revenue. This is the sector Garrett targets with dVIN, a blockchain-powered B2B platform for the luxury wine industry.

Despite being a $100 billion industry, luxury wines don’t receive the same attention or privileges as similar assets. Garrett believes this is due to a lack of verifiable data.

To solve this, dVIN has created the digital cork non-fungible token (NFT), a decentralized proof of ownership for luxury wine owners.

This digital deed provides a chain of ownership and custody, enabling users to track the bottle from grape to glass.

The digital cork NFT also comes equipped with anti-fraud and anti-counterfeit protections and price transparency, transforming a wine bottle from a possession into an asset.

Tasting token NFT and VIN token

While the digital cork NFT changes the game, wine bottles have to be opened at some point. To account for this, dVIN destroys the original digital cork NFT to show that the bottle is no longer authentic. It then mints a new token—the tasting token NFT, an authentic proof of experience.

Garrett revealed that his company is working with some wineries to include RFID and NFC chips on the bottles, which will make it easier to directly detect when a bottle has been opened.

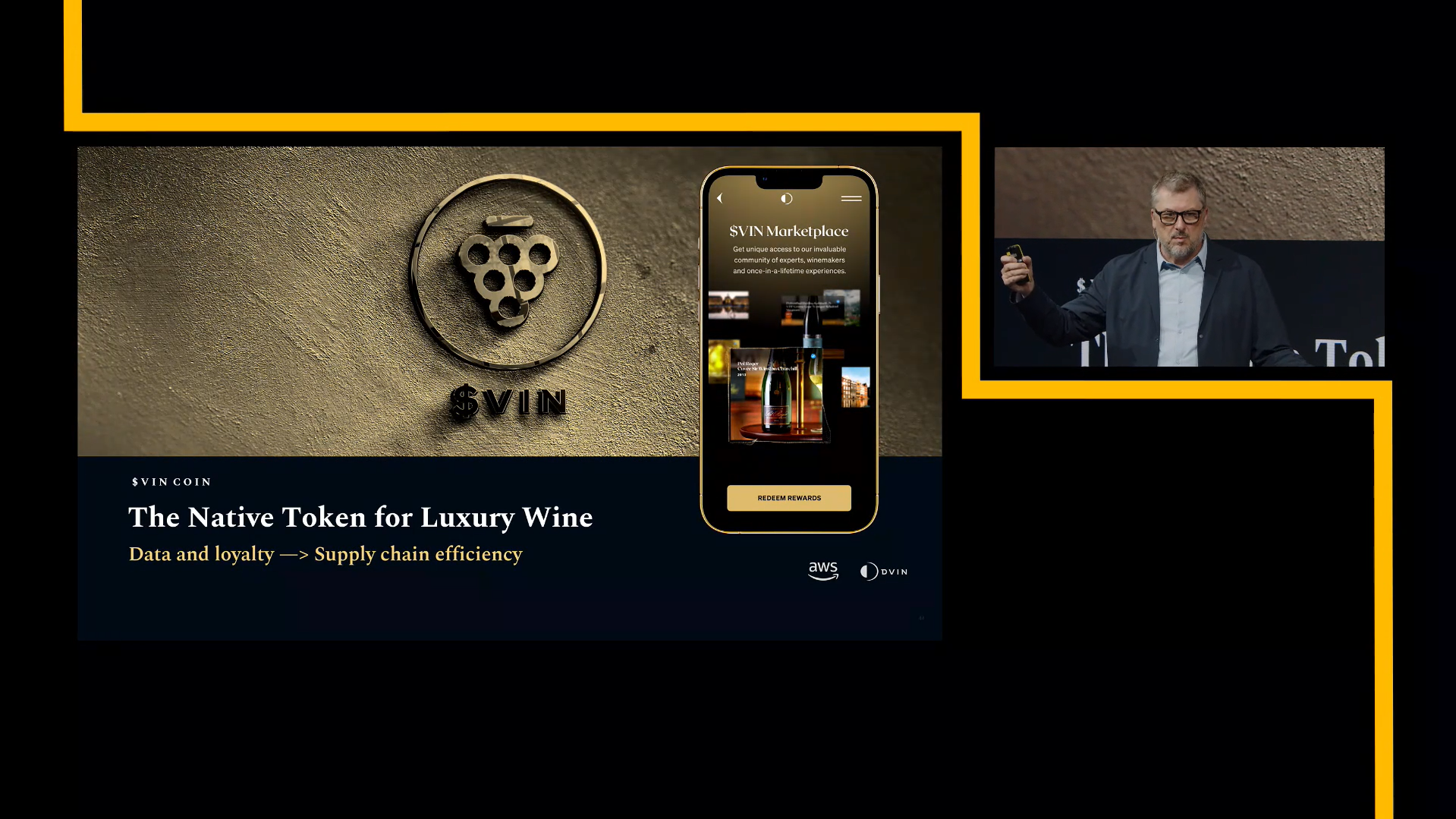

Garrett told the attendees that dVIN is launching the VIN coin later this year to bring all these facets together. Winemakers will incentivize consumers to share data such as when and where they consume their wine with VIN coin.

VIN coin will be especially important in the luxury wines sector, where purchasing and consumption are usually over a decade apart. Consequently, manufacturers rarely have any data to optimize their production or supply.

Research shows that it takes a winery in Napa Valley $450 on average to acquire a new customer.

“With VIN coin, we hope to reduce that to single-digit dollars.”

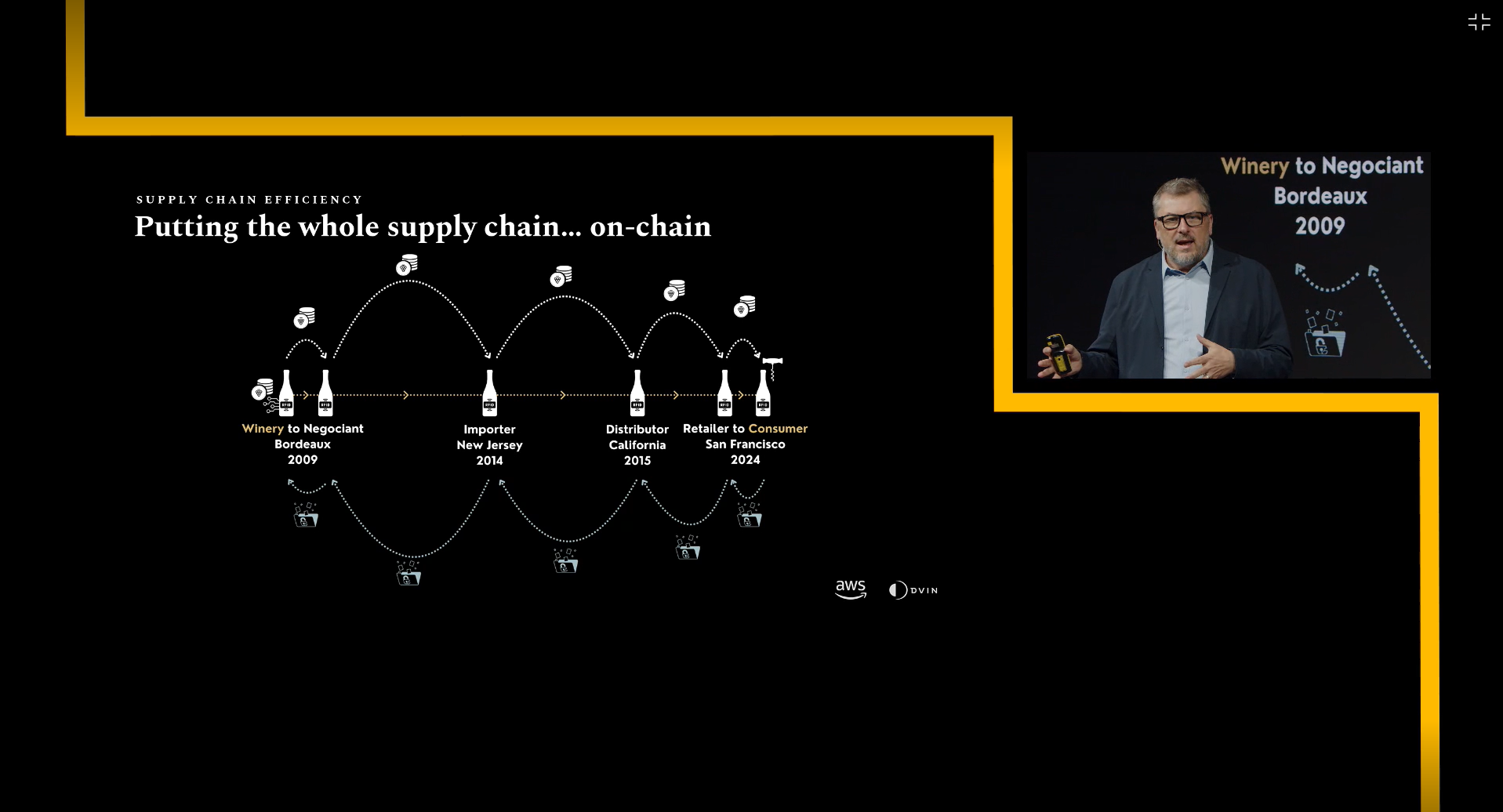

The end goal for dVIN is to put the entire wine manufacturing, supply and consumption processes on-chain. With over ten million counterparties in the industry, blockchain smart contracts would present a trustless mechanism for billions of transactions annually.

Additionally, dVIN is targeting payments cross-border with blockchain. Studies show that, on average, wine industry players lose $6.15 for every $50 worth of payments they receive.

“We think that taking the entire supply chain and moving it on-chain will save money for the winemaker, for consumers and create a much better experience—[we’re] taking a 1,000-year industry and building the platform for the next 1,000 years,” he concluded.

Garrett was joined on stage by Steven Bacci, the Specialist Solutions Architect at Amazon Web Services (AWS). Bacci discussed how AWS works with dVIN and other blockchain firms, doing most of the “heavy lifting” with its Amazon Managed Blockchain solution.

Watch: Supply chain traceability powered by blockchain tech

03-05-2026

03-05-2026