|

Getting your Trinity Audio player ready...

|

As the saying goes, “The only constant in life is change.” This is what the Fintech Revolution Summit, held at New Coast Hotel Manila last May 24 and 25, taught its attendees. Since the rise of the pandemic, the fintech space—especially banking—has been coping with many changes because of the world’s need for digitalization. Finance leaders across the Philippines and the world gathered to talk about the latest inventions and ideas across the industry and how COVID-19 and nascent technologies like blockchain and AI have been making way for innovation within the digital banking system.

We’re here at the Fintech Revolution Summit at New Coast Hotel! 📢

Follow this thread to be updated with the event’s highlights! ⬇️🇵🇭@RealCoinGeek | @TraiCon_Events #FRS2023 #FRSphilippines #fintechtraicon pic.twitter.com/uwrGNR2mjc

— CoinGeek Philippines (@RealCoinGeek_PH) May 24, 2023

Fintech and banking’s driving force for the future

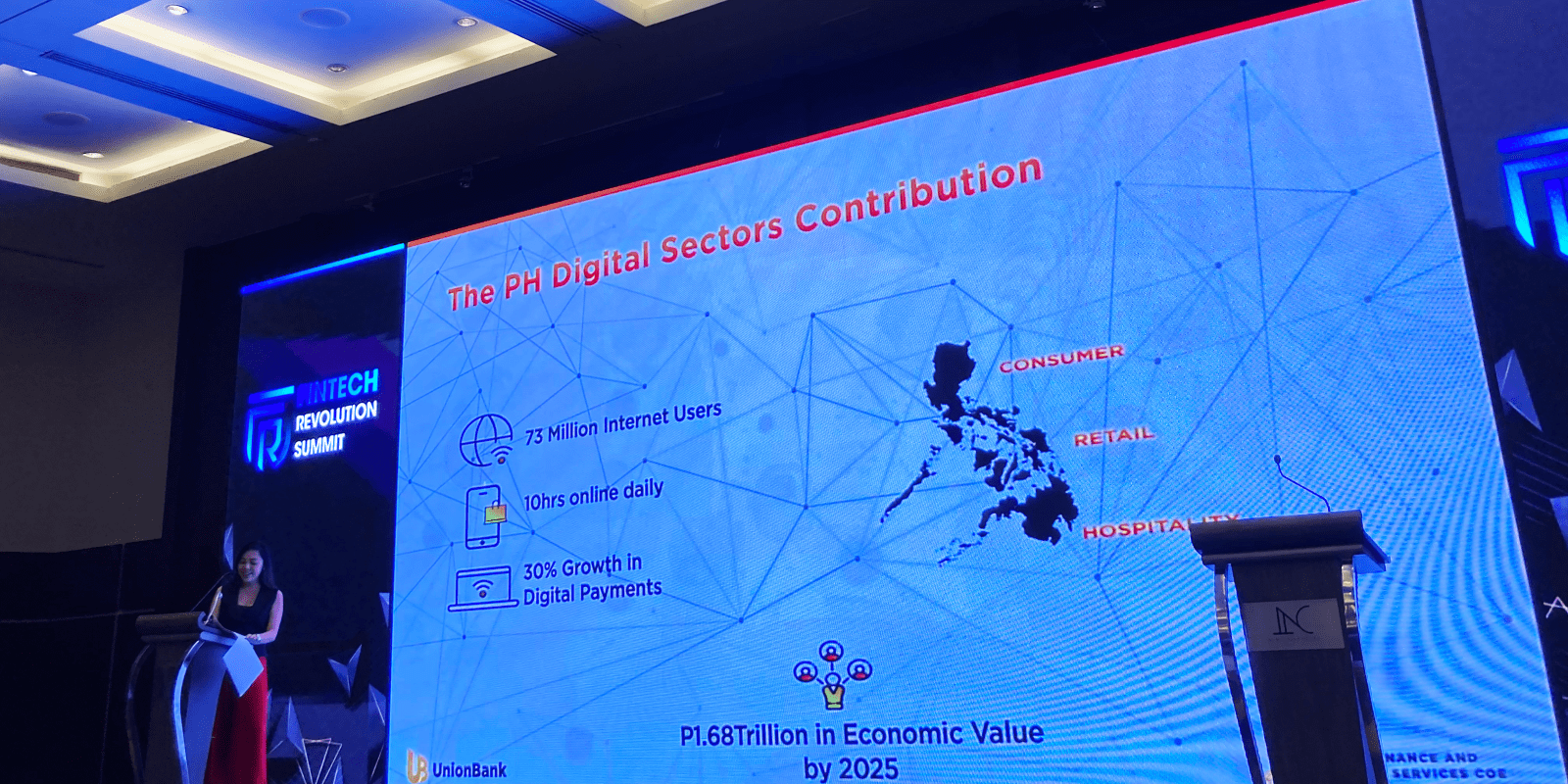

First to talk about how fintech, banking, and digital services drive the future was Erika Dizon-Go, SVP and Director Fintech Business Group Head of UnionBank of the Philippines. Dizon-Go pointed out that the Philippines is not only one of the countries with the youngest tech-savvy population but also one of the leading adopters of different fintech solutions like digital payments and digital currency. The UB Philippines head thinks this is partly thanks to the pandemic because, since 2019, the Philippines has seen more fintech investment.

“We are already at the tipping point of change for digital adoption,” she noted. Dizon-Go also revealed that there is a 30% growth in digital payments in the Southeast Asian country, sharing that its economic value is expected to grow even higher to PHP 1.68 trillion (nearly $30 billion) by 2025.

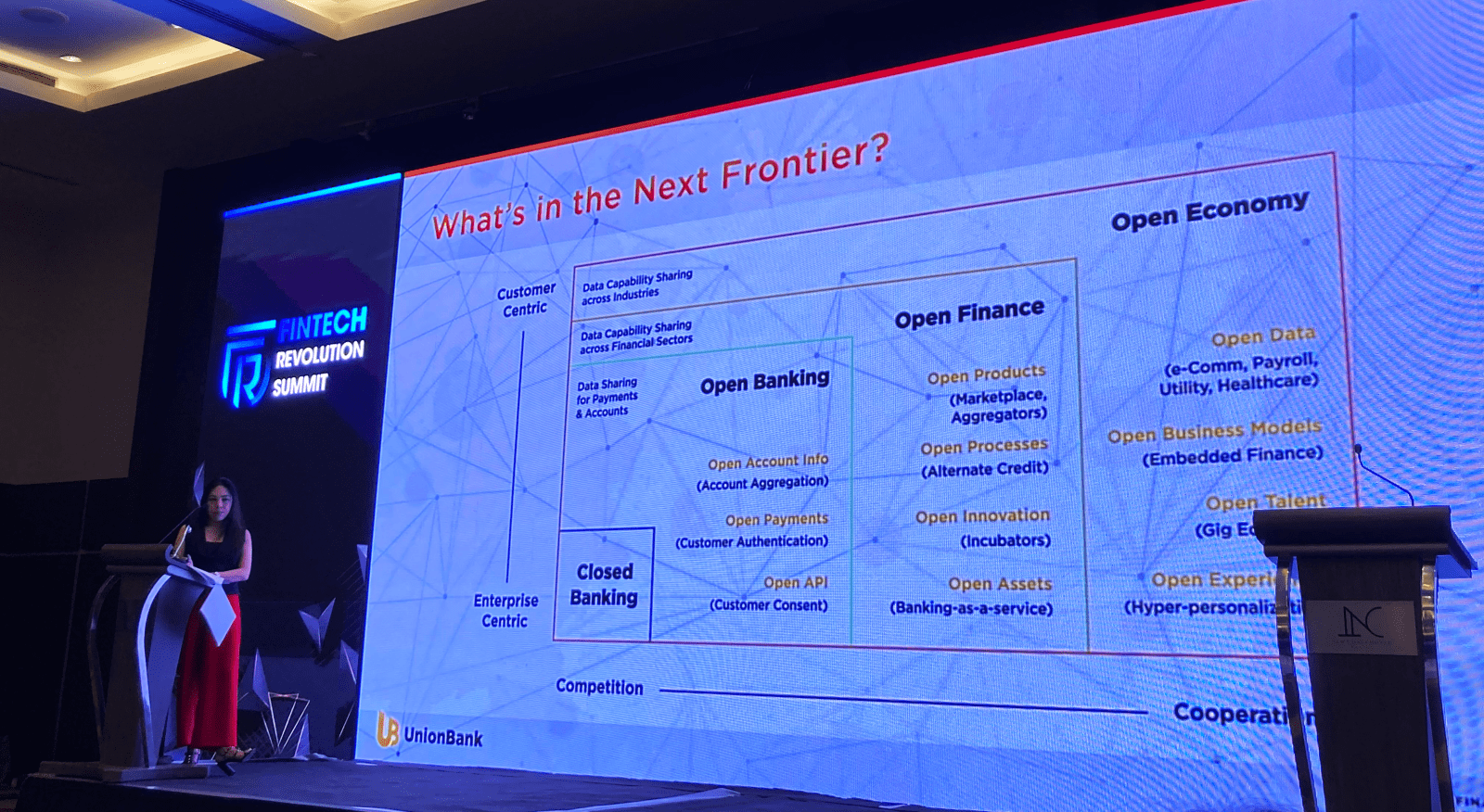

“We think that the landscape is changing. Where banks used to operate in a silo, our mindsets have to be able to keep up with the signs of the times that you and I are experiencing. Where banks need not be in the middle, but a part of the entire value chain,” she said, noting that open finance with an open economy is the next frontier for banks and the digital space.

Dizon-Go’s presentation was closely followed by another presentation on the future of fintech from EVP/Chief Innovation and Inclusion Officer of RCBC, Lito Villanueva as well as presentations from Xendit Philippines’ Managing Director Yang Yang Zhang; Netbank’s Co-Founder Gus Poston; and Brankas’ Head of Regional Partnerships and Solutions Roopak Haridasan.

Fintech is at the heart of it all

The first and only panel discussion dove into the major trends and evolution to watch in fintech as moderated by Mario Jordan Fetalino, chairman of the Membership Committee of the Fintech Alliance Philippines, together with Sevi Reyes, head of Payment Infrastructure at Xendit, and Gus Poston the co-founder of Netbank.

The group starts by delving into the financial trends slowly gaining traction today. Reyes said that one of the trends he sees is offline to online transactions. As for Poston, he remarked that if the conference had been introduced two years ago, the new trend would be all around digital banking.

Jumping into the discussion on competition, Fetalino asked the two executives from Xendit and Netbank how they deal with it. Poston says they don’t take other fintech entities, such as Grab and FoodPanda, as competitors; instead, they enable them by working on different solutions, which Reyes agreed with.

As for their thoughts on AI and blockchain, Poston told the audience that AI is an incredible technology and shared that some institutions already use AIs like ChatGPT in customer acquisition, marketing, and even press releases.

“Both of these areas are like new age. It seems a little bit like when the internet first came out. People were saying that this was a great place where I could do the work that I wanted to do, but it grew into something else. Both of these two technologies are going to grow to something else, and it will change our world, but it’s going to take a little while,” Poston stated.

Meanwhile, Reyes said the Philippines is still lacking in AI adoption. However, the Xendit head of payment infrastructure believes that in the next few years, the country will see financial institutions and regulators that will safely police the industry.

Discussing how far the Philippines is when it comes to digitalization, both agreed that it is inching slightly. Regarding the challenges in fintech, Poston shared that the recent collapse of financial institutions in the U.S. and regulation are at the top of their mind, while Reyes hopes to have more collaboration with the regulators.

Wrapping up the discussion, the audience got to ask a few questions on policies and infrastructure, data privacy, and money security.

Myriad of problems with cybersecurity

It’s no wonder there are many critical issues in the finance industry as it involves data and money. To educate the public about such problems, Lt. Col. Rodrigo Quinto and Lt. Col. Francel Margareth Padilla-Taborlupa of the Philippine Army tackled hacking and cybersecurity.

Moderator Robert Sanchez Pagua started the conversation by asking both Quinto and Padilla-Taborlupa if the Philippines is ready for cybersecurity and what their recommendations are.

“We can’t really be that prepared in cybersecurity,” Padilla-Taborlupa pointed out, explaining that the Philippine Army promotes cyber resiliency instead.

“The technology is ever evolving, sometimes it only takes a couple of weeks, and new technology is out there. So, we can’t really say that we’re prepared on the dot,” she added.

In line with this, Pagua asked how we can make the Philippines’ finance sector safe. Quinto mentioned that it’s not just a move for the government to take; everyone should be involved in making the country a safe haven. Padilla-Taborlupa agreed and said that Filipinos should devise policies and implement rules to protect everyone in the cyberspace.

Shifting to hacking and data breach, Pagua asked the two officers if they agree that humans are the weakest link yet the strongest solution when it comes to hacking. Quinto agrees; as for Padilla-Taborlupa, she enlightened the audience that hacking is a double-edged sword and differs from the person’s perspective, although she acknowledged that it’s often seen negatively.

“[Cybersecurity] it’s not all tech. It affects us in the physical realm,” she said.

In closing, Padilla-Taborlupa reminds the audience that the Philippine Army seeks to protect the people and improve the cyber domain. With that, she encourages the private companies and government agencies present during the Fintech Revolution Summit to work together to secure the country in cyberspace.

“Cybersecurity is a whole nation approach together with the ASEAN and the whole world…This is not going to be a walk in the park. Still, together with these alliances and partnerships, we can mitigate the risks in the cyber domain,” she concluded.

Watch: Exposure to blockchain will help the Philippines a lot

02-28-2026

02-28-2026