|

Getting your Trinity Audio player ready...

|

They said they are paying users back in DAV tokens, which are now barely 10 cents each.

Texas slaps yet another cease-and-desist order on another cryptocurrency “lending platform.” Barely a month since starting its crackdown on Bitconnect—which has now shut down its platform and is currently facing a plethora of lawsuits—the Texas State Securities Board (TSSB) has issued an emergency cease-and-desist order against DavorCoin.

DavorCoin, which issues the token DAV, has allegedly violated sections of the Texas Securities Act by issuing unregistered securities, and targeting retirees under misleading and fraudulent information.

“We confirmed our suspicion that they were being marketed toward retirees,” says Joseph Rotunda, director of the enforcement division at the TSSB. “They were not disclosing the information that needs to be disclosed to an investor.”

According to the TSSB, DavorCoin operated like Bitconnect, and in fact took advantage of the latter’s collapse, marketing themselves even harder in a bid to take over the market. “DavorCoin appeared to step up marketing of its lending program after the closure of another cryptocurrency lending platform, BitConnect,” the TSSB wrote in a release.

In a Medium post, DavorCoin announced that they are closing down their “lending platform,” blaming the decision on the “crypto-environment dramatically changing recently.” But instead of paying users back with the amount of BTC that they put into the platform, DavorCoin, like Bitconnect, will pay them back using their own tokens—which, compared to the value investors bought at, are pretty much worthless at this point. From a high of over $170 in mid-January, DAV now sits at $.09, and can possibly drop even lower.

“We will release today all lending packages we have and every user will be credited in his account the number of DAV he placed in his/her lending package plus a 10% bonus.”

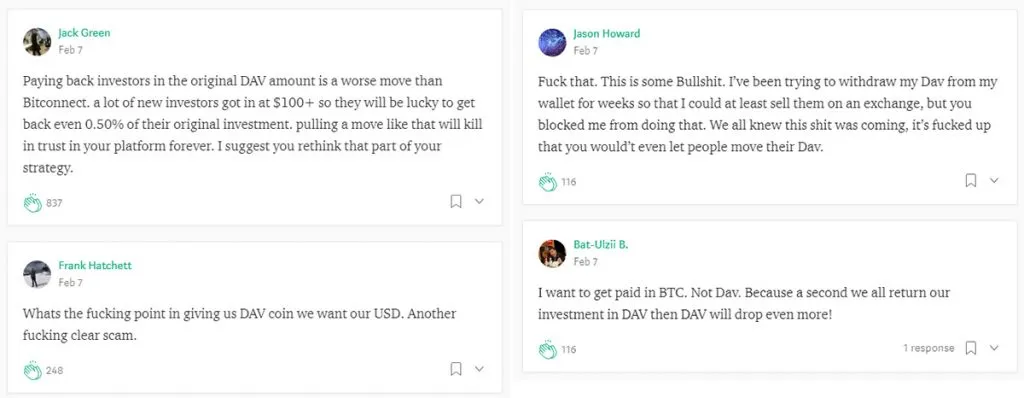

Consequently, users are not pleased, saying the move is clearly a scam, and lamenting that people were blocked from making withdrawals while the token crashed down.

07-05-2025

07-05-2025