|

Getting your Trinity Audio player ready...

|

A U.S. court has granted class status to investors in GAW Miners LLC. The company has grabbed the news in the past after its founder was sent to prison for defrauding investors. Now, the case against the company’s co-owner will be trialed as a class action lawsuit, Bloomberg Law reports.

Judge Michael Shea, of the U.S. District Court for the District of Connecticut, presided over the request to grant class action status to the investors. He wrote, “Whether the company made misrepresentations about its computing capacity is an issue common to all class members.”

Class action lawsuits have many advantages over private lawsuits, especially for the plaintiffs. For one, they allow the plaintiffs to receive just compensation, even when the individual claims are relatively small. These types of lawsuits also have a higher likelihood of financial recovery compared to private lawsuits.

The class could possibly include over 212,000 users who collectively made 33 million transactions. The aggrieved investors allege that the company wasn’t directing their computing power to any crypto mining pools as they promised their investors.

The suit alleges that the scheme violated several laws including the Securities and Exchanges Act, Connecticut securities laws and common fraud laws. The report states that the court modified the class definition to avoid standing problems. It also gave the parties until July 5 to raise any concerns about the definition.

As we reported last year, the founder and CEO of GAW Miners, Homero Joshua Garza, was sentenced to 21 months in prison for defrauding investors. After his release, he is expected to have three years of supervised release, including six months spent in home confinement.

Garza was found guilty of running a Ponzi scheme for nine months, defrauding investors of at least $9.2 million. The presiding judge, Robert Chatigny, ordered Garza to pay back the money he had scammed the investors.

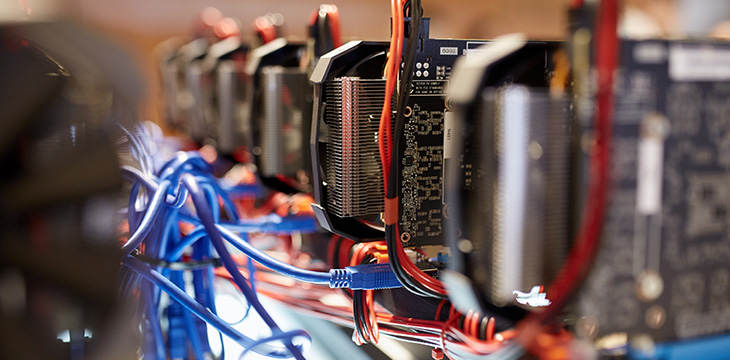

GAW Miners, together with associated companies ZenMiner and ZenCloud, promised their investors that they would profit from its crypto mining activities. However, the companies sold more shares than they had the mining capacity to cover, essentially turning their company into a Ponzi scheme that used money from new investors to pay off the old investors.

03-05-2026

03-05-2026