|

Getting your Trinity Audio player ready...

|

For Bitcoin, if 2019 was the Year of Scaling, 2020 is the Year of Enterprise Adoption and Kick Ass Utility.

As I pointed out last year, Bitcoin was hijacked by protocol developers early on in its existence, which stunted its growth and potential over the last decade. Bitcoin was finally freed from its captors a little over a year ago on November 15th 2018, with the emergence of BSV as the name and ticker symbol for the original Bitcoin protocol. Since Bitcoin Independence Day, we have seen an explosion of growth on BSV and it is just getting (re)started in 2020.

Genesis will restore Bitcoin’s true potential

After the Genesis Hard Fork locks in on February 4th, the original Bitcoin protocol will finally be mostly restored and back on track to being “Set in Stone” just like Satoshi Nakamoto intended. Restoring the miners at the center of Bitcoin’s economic incentive model just like Satoshi’s design always envisioned, and removing protocol developers from dictating rules of the network will restore the true potential of Bitcoin in 2020. A stable Bitcoin protocol is exactly what Enterprises want to see before they spend millions of dollars building on it.

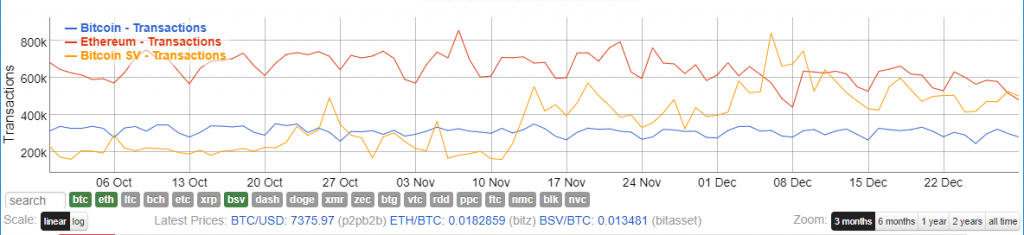

In 2020, more Enterprises will start to realize the economic benefits of harnessing the power of a scalable public blockchain as a universal data ledger for their businesses. We will see several Enterprise use cases roll out as the year progresses on Bitcoin SV. This increase in application development on BSV will drive more and more transactions on-chain. Since Bitcoin Independence Day, BSV has generated significantly more daily transactions than BTC. BSV is currently neck and neck with ETH (and on some days surpassing ETH) for daily transaction volume heading into 2020. By the end of Q1, BSV will be the undisputed highest daily transaction blockchain, massively surpassing all others.

Smart investors will see BSV is the real Bitcoin

As Enterprise usage on BSV increases, the utility value of the token will increase and the price will start to reflect its true value. BSV is considerably undervalued at the moment. The illusions and false narratives of the other chains have started to unravel, we will start to see more and more smart investors in the space realize that BSV is the real bitcoin. This will trigger a shift out of the altcoins, including especially BTC, BCH and ETH, into BSV. There will also be an influx of new savvy investors flocking to Bitcoin SV startups in addition to investing in the token itself, in 2020.

The market cap migration already started on a small scale in early 2019, it was cooled off by the coordinated delisting attacks. But with exchange regulation on the horizon, we will see this migration pattern from the altcoins back into Bitcoin accelerate in 2020. BSV is the only scalable distributed blockchain solution capable of supporting a global enterprise platform. By the end of the year, I think the price of BSV will be higher than any other token including BTC.

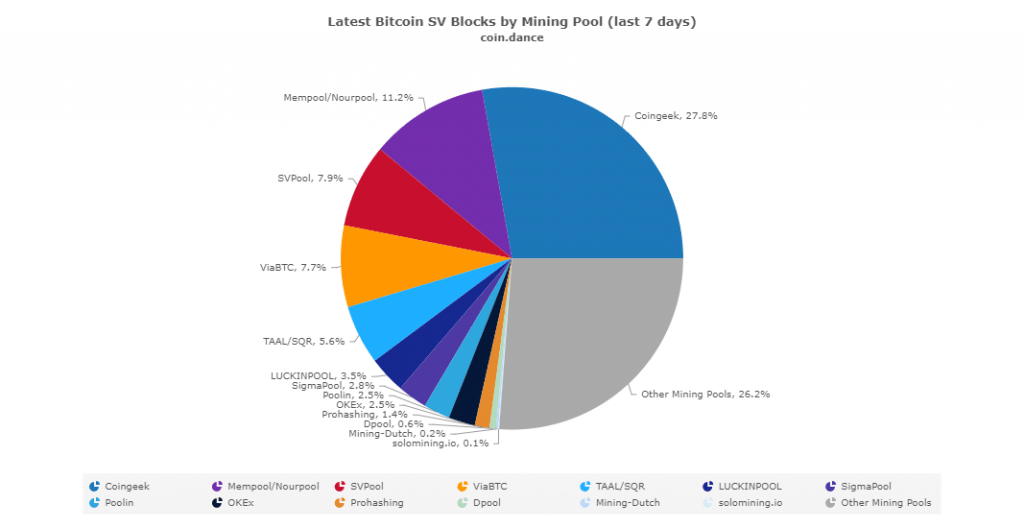

Miners to increase BSV hashing power diversity

Application development, transaction volume and market cap won’t be the only things migrating to the Bitcoin SV blockchain in 2020, miners will as well. New and established bitcoin miners will continue to increase the diversity of hashing power on Bitcoin SV throughout the year. This trend started in the second half of 2019 (after the Quasar protocol upgrade) and shows no signs of stopping anytime soon. The increased competition in the bitcoin mining space will spur benefits to the entire BSV ecosystem as professional mining operations look to innovate and specialize. The inclusion of ‘miner id’ will allow for customized specialty mining business models to evolve.

As transaction volume continues to increase on Bitcoin SV from Enterprise usage, so too will revenue from transaction fees making it the only viable option for miners looking to turn a profit after the halving. As one of the biggest bitcoin miners on the planet, I understand the importance of additional revenue streams required to make that side of my business sustainable long term. That means unlimited block size caps and lots of microtransactions paid for by micropayments. Bitcoin miners will move to the chain that has the most revenue potential for their proof of work. Bitcoin SV is the only chain in town.

The BSV blockchain will also see variable rate mining for the first time in Bitcoin’s history. This will allow the miners to lower the amount they charge per byte of data (and thus per transaction) for high volume customers which will further increase demand for on-chain transactions. New features will also enable miners to dynamically peg their fees to fiat currency prices (rather than only satoshis per byte), to give enterprise users the price certainty they want for budget planning purposes. This type of fiat currency pricing is exactly what publicly traded companies and other big enterprises need to start increasing their use of the Bitcoin ledger for applications, price stability and future clarity.

Teranode is coming

The Genesis upgrade is not the only big scaling development for BSV in 2020. The Teranode Project will also roll out later in 2020; it is an enterprise-class version of the Bitcoin SV Node software, re-building the Bitcoin code from the ground up using a micro-services architecture approach to create better functionality for big business users. Developed by nChain, the global leading research, development and advisory firm for blockchain technology, Teranode will insure Bitcoin SV will scale to massive use as global adoption increases.

Blockchain developers currently working on dead end tech elsewhere, will continue to migrate off what I call the “hobby platforms” on to BSV because it scales. Developers will begin to experience their own FOMO (Fear Of Missing Out), and will start racing to build their existing projects on the stable Bitcoin SV protocol before someone steals their big idea or use case.

Regardless of what others want you to believe, the blockchain protocol wars are over, the other chains are dead men walking. In the end, there will only be Bitcoin SV, don’t take my word for it, take my proof of work.

We have an exciting time ahead in 2020. I look forward to seeing all of you in London February 20-21 for the CoinGeek Conference which is expected to be the world’s largest ever conference focusing on application development on top of a public blockchain, so don’t miss it. Happy New Year!

02-23-2026

02-23-2026