Article by Jordan Atkins

-

7 June, 2023

Kleiman v Wright: Florida judge denies Ira Kleiman’s final attempt to strike new W&K lawyer

The attorney, Paul Huck, was appointed by W&K’s owners in an attempt to re-take control of the company after Kleiman...

-

6 June, 2023

New Republican digital asset framework introduces strict definitions for ‘decentralization’

Republican lawmakers have revealed a proposed digital asset bill that intends to clarify the responsibilities of the SEC and the...

-

5 June, 2023

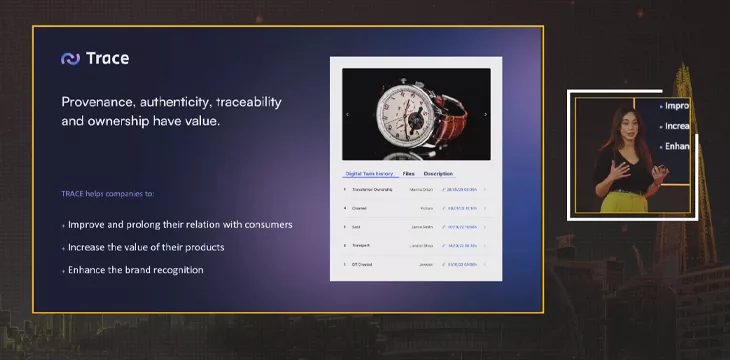

Putting the world on chain with Trace, by IBM and Gate2Chain

Trace, the brainchild of IBM and Gate2Chain, is a blockchain-powered platform that facilitates the creation and tracking of ‘digital twins’...

-

4 June, 2023

On-chain scaling vs layer 2 scaling: What are the differences?

In this discussion moderated by Kurt Wuckert Jr. at the London Blockchain Conference, industry experts zoom in on blockchain's ability...

-

3 June, 2023

Telling stories with data at the London Blockchain Conference 2023

In this discussion moderated by Joshua Henslee, panelists talked about massive data collection and how blockchain serves as a medium...

-

3 June, 2023

Spotlight On at London Blockchain Conference 2023: Blockchain apps offering real-world utility

Vaionex's Robin Gounder and Cain Nussdorfer, with Tokenovate CEO Richard Baker and SmartLedger's Greg Ward, took the stage at the...

Recommended for you

A shared order book involving non-EU licensed exchanges would be a breach of MiCA rules, the European Securities and Markets...

June 30, 2025

Responding to Reggie Middleton's fraud allegations, the SEC firmly rejected any claims of fabrication of evidence regarding securing an asset...

June 25, 2025

07-15-2025

07-15-2025