|

Getting your Trinity Audio player ready...

|

As artificial intelligence (AI) continues its upward climb, experts at Research and Markets are predicting regulatory technology (Regtech) to be the next biggest driver of adoption.

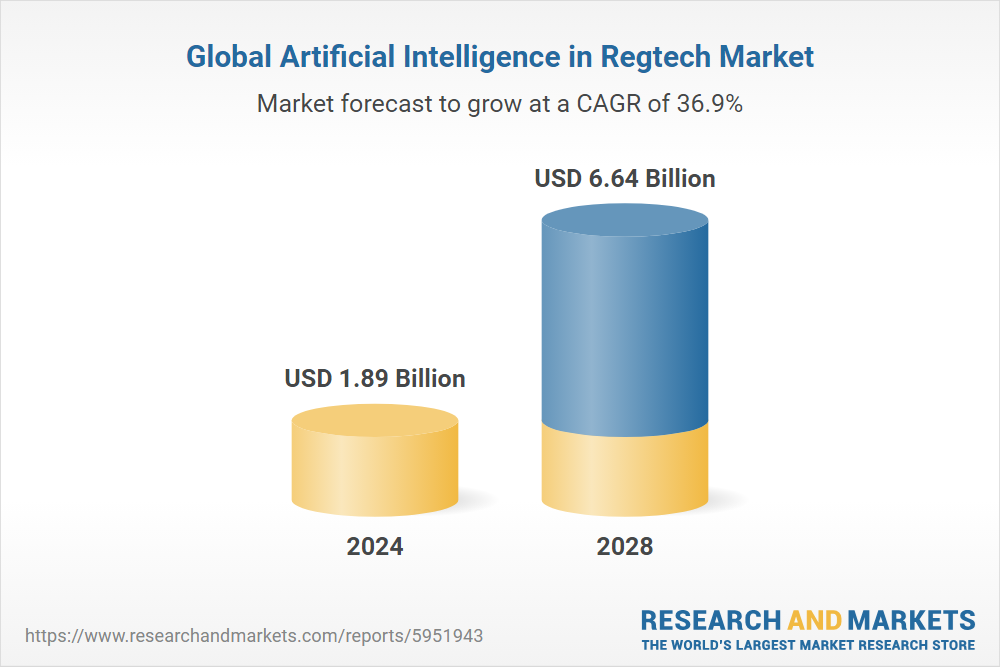

According to a report, AI in the regtech vertical is expected to soar to $6.64 billion before the end of 2028 from its current $1.37 billion. The massive jump represents a compound annual growth rate (CAGR) of 36.9%, with several enterprises turning their gaze to AI for regulatory compliance.

The report highlights several factors responsible for the surge of AI in regtech, including the requirement for real-time monitoring and reporting to protect consumers. Other growth drivers fuelling a pivot to AI systems include the soaring cost of compliance and difficulty keeping pace with sprawling data sets.

Already, experts are seeing an upward trajectory in AI adoption in regtech, with the market valuation on course to hit $1.89 billion in 2024.

“Major trends expected in the forecast period encompass the adoption of machine learning (ML) and natural language processing (NLP), the incorporation of explainable AI (XAI), the utilization of predictive analytics, the automation of compliance processes, risk assessment and management, and the establishment of regulatory sandboxes and innovation hubs,” read the report.

It adds that the financial industry is expected to pioneer AI-based regtech products, with the bulk of services revolving around fraud detection and anti-money laundering (AML) tools.

Several firms have been angling for AI-back regtech applications in recent months amid an uptick in regulatory supervision. In the U.K., regtech giant CUBE announced the completion of the purchase of industry rival The Hub in anticipation of the predicted industry growth before the end of the decade.

The 117-page report lists North America, particularly the U.S., as the biggest drivers of AI-backed regtech applications by the end of the survey period. However, the European Union (EU), the Middle East, and Southeast Asia are expected to contribute impressive adoption numbers in the coming years to remain compliant with global regulatory standards.

Bracing for an avalanche

Regtech is not the only sector expected to receive significant AI growth in the coming years. Experts predict that the mobile AI market could balloon into a $39.91 billion industry, with industry leaders Samsung and Intel (NASDAQ: INTC) spending millions to maintain a competitive lead.

The social media market is bracing for its fair share of growth, but amid the buzz, regulators are keen on matching the tempo of emerging technologies to protect the interest of consumers and social order.

“The FTC has been exploring the risks associated with AI use, including violations of consumers’ privacy, automation of discrimination and bias, and turbocharging of deceptive practices, imposter schemes, and other types of scams,” the U.S. Federal Trade Commission (FTC) said November 2023.

In order for artificial intelligence (AI) to work right within the law and thrive in the face of growing challenges, it needs to integrate an enterprise blockchain system that ensures data input quality and ownership—allowing it to keep data safe while also guaranteeing the immutability of data. Check out CoinGeek’s coverage on this emerging tech to learn more why Enterprise blockchain will be the backbone of AI.

Watch: Improving logistics, finance with AI & blockchain

02-19-2026

02-19-2026