|

Getting your Trinity Audio player ready...

|

Africa’s digital asset and blockchain industry has continued to grow over the years, unfazed by regulations (or a lack thereof), price volatility, or infrastructural deficiencies. In 2021, the sector made its mark; in 2022, it came of age; in 2023, it matured and moved beyond speculation; and this year, regulators have caught up, with some of the virtual asset service providers (VASPs) that have operated unchecked for years feeling the heat.

For BSV blockchain, 2024 was yet another great year in Africa as adoption continued to rise, with the BSV Association’s (BSVA) education initiatives across the region bearing fruit.

Adoption soars

Africa has often been cited as the next frontier for digital asset adoption. However, in 2024, the region proved that its time is now.

Across the region, blockchain and digital asset adoption soared. Unlike in other regions where speculation dominates, especially in a bullish year like 2024, Africa’s adoption focused on actual use cases, from cross-border payments with digital assets to certificate verification with blockchain.

The Consensys Web3 Perception report in December identified Nigeria and South Africa as the two global leaders in digital asset adoption. The 2024 Chainalysis adoption index also found that Nigeria has the second-highest adoption rate after India.

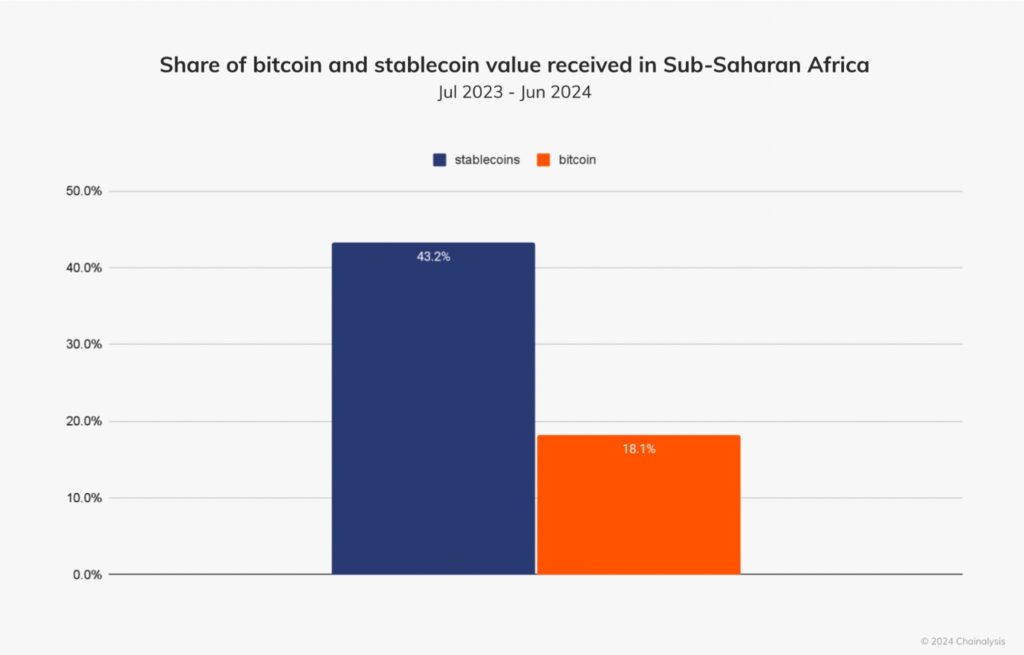

This adoption is reflected in the rise of stablecoins as the most popular digital asset in the continent, accounting for over 40% of the activity. Africans have been using stablecoins for payments, especially in cross-border transfers, as they don’t suffer from volatility.

Social media platforms have played a central role in this rising adoption, none more so than Telegram. A report by Seychelles-based exchange Bitget found that digital asset-focused Telegram groups recorded nearly 200% growth in Africa and now boast millions of users.

This adoption is making its way into national initiatives. Earlier this year, the South African Reserve Bank (SARB) published its digital payments roadmap, citing stablecoins and tokenization as some of the key priorities.

Beyond digital assets, blockchain adoption has also soared in 2024. At the national level, African leaders have been calling on their governments to adopt the technology to fight graft and improve efficiency. Earlier this year, Ghana’s Vice President Mahamudu Bawumia cited blockchain as the technology that can deliver Africa from the prevalent corruption. Nigeria’s anti-graft agency is also exploring how blockchain can stamp out corruption in the continent’s largest economy.

Nigeria has remained the regional leader in blockchain adoption. The country is now training thousands every year on blockchain and artificial intelligence (AI). Its civil aviation authority has also adopted blockchain to boost efficiency, while one local higher learning institution launched the country’s first blockchain platform to authenticate certificates.

Nigeria could also become Africa’s first country to have its own sovereign blockchain network, with plans underway to develop Nigerium.

BSV’s adoption has continued in Africa, with the BSVA’s education initiatives playing a big part. This year’s highlight was the launch of KitePesa, a new stablecoin in Uganda, backed one-to-one by the country’s shillings. KitePesa will complement the country’s mobile money systems, which serve 64% of the population, making it easier to pay, transfer and store funds. Reginald Tumusiime, whose company developed KitePesa, says the stablecoin’s advantages over mobile money include cheaper transactions, enhanced security, and micropayments.

Tumusiime is also the leader of the Blockchain Association of Uganda (BAU), and in this role, he organized the Kampala Blockchain Summit in November. BSVA was highly involved, and its Utilization Director, Thomas Giacomo, was among the speakers.

In Southern Africa, BSVA has been conducting workshops in Lesotho and South Africa, spearheaded by BSV Ambassador and VX Technologies executive Catherine Lephoto. In Western Africa, the Association has partnered with the Nigerian government and Domineum to impart blockchain skills to thousands in Nigeria.

The year of regulatory reckoning

While adoption was in high gear, regulators also stepped up their game, cracking down on dozens of VASPs that have operated unchecked for years.

The crackdown was most rampant in Nigeria. It started early this year, with the economic crime watchdog, the Economic and Financial Crimes Commission (EFCC), setting its sights on unlicensed offshore exchanges. It accused these exchanges, led by Binance, of conducting a “sophisticated heist” on the Nigerian economy by offering backdoor access to the forex market through USD-backed stablecoins. It even led to the shutdown of Bureau de Change operations in Abuja as they protested the unlicensed exchanges.

After ordering all unlicensed offshore exchanges to shut down, the EFCC pursued those it deemed to have broken specific laws. As expected, Binance was at the top of the list. The watchdog accused the exchange of helping users launder over $35 million, a case still ongoing amid a scandal involving the arrest and eventual release of Binance executive Tigran Gambaryan.

In South Africa, the regulators took a different route. The financial industry watchdog has issued dozens of licenses to VASPs this year as the country seeks to legalize digital assets to better protect investors.

Ghana’s central bank also issued draft guidelines for VASPs this year, as Kenya formed a ‘crypto’ working group as it continues to struggle with regulating the ever-growing sector. Still, the East African nation collected over $78 million in taxes from the sector.

Central banks have also been exploring central bank digital currencies (CBDCs). Eswatini, Rwanda, and Ethiopia have all published papers exploring the possible design and operation principles for their digital currencies.

What’s next for Africa

As we head into 2025, Africa’s digital asset and blockchain sector is poised for what could be its best year yet. Unlike in previous years, when VASPs operated under regulatory shadows, 2025 will bring them to the masses in a regulated and controlled manner. Nigeria has already licensed three exchanges for the first time ever, while South Africa has issued over 70 licenses. Others, like Ghana, Kenya, and Egypt, are exploring options and are expected to issue draft guidelines in the first half of 2025.

Adoption will also continue to soar. The region’s tech-savvy and young population has proven it’s ready to leverage the power of blockchain and digital assets to compete with more developed nations. Today, Africa is already producing some of the best talent in the blockchain world, and with education initiatives in Uganda, South Africa, Uganda, and elsewhere kicking up a notch, this will only improve.

Watch: Boosting financial inclusion in Africa with BSV blockchain

02-26-2026

02-26-2026