|

Getting your Trinity Audio player ready...

|

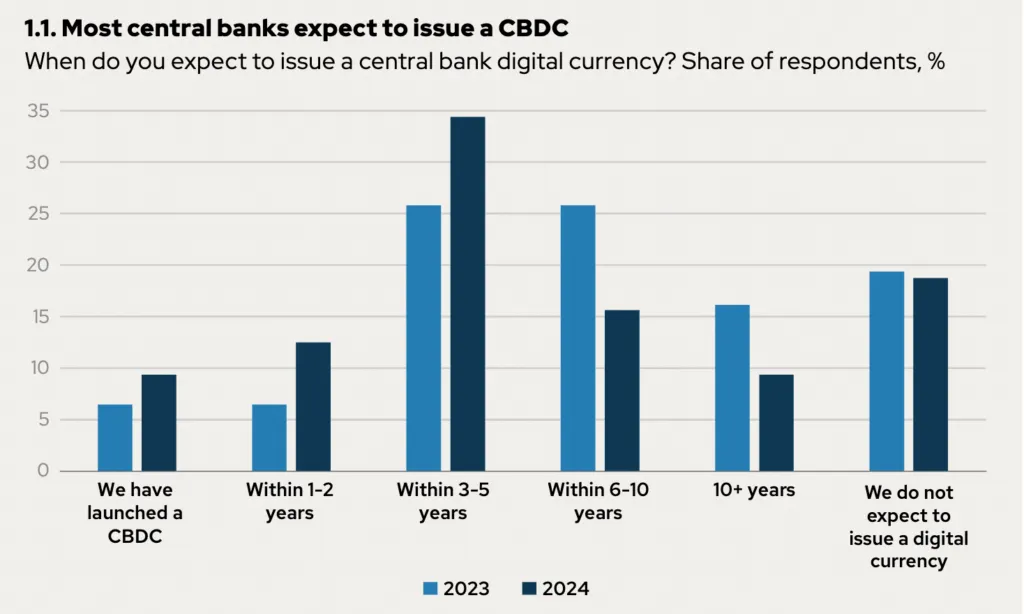

A new report has revealed that three-quarters of global central banks plan to issue a central bank digital currency (CBDC), but an increasing number are pushing their launches back as challenges emerge.

The Official Monetary and Financial Institutions Forum (OMFIF) report found that 48% of the respondent central banks expect to issue a CBDC in the next 3-5 years; 12% aim for a launch within the next two years, twice the number from 2023.

Overall, the number of central banks intending to launch a CBDC has slightly declined. However, the number of those expecting to launch within the next five years has increased.

OMFIF’s study found that emerging markets are pushing harder for a CBDC than their developed counterparts. One in five central banks from emerging economies expects to launch a CBDC within the next two years. In contrast, no developed nation expects a digital currency at that time.

The study also found that most central banks have already decided whether to pursue a CBDC, with the share of countries uninterested in digital currencies remaining constant at 19% over the past two years.

However, while their commitment to CBDCs hasn’t changed, some central banks have revised their timelines. OMFIF found that 31% of respondents have delayed the issuance, but only 10% reported accelerating the timeline. The two most common reasons were a lack of enabling legislation and exploring other solutions besides digital currencies. Banking heads acknowledged that their hands are tied with the former as legislators have the final say over whether central banks can issue a digital currency.

Globally, CBDCs have become a divisive political issue, denting their chances of quick launches. Some political factions, such as Republicans in the United States, have claimed CBDCs are a ploy by governments to spy on their people’s spending and restrict free will. Such political stances have taken the spotlight away from the technical and financial merits of CBDCs and made them a partisan issue.

However, not all CBDCs are created equal. The report found that retail CBDCs face a tougher battle than their wholesale counterparts. Respondents who reported delaying their issuance timeline were disproportionately skewed toward the retail CBDCs, aligning with previous findings by the Bank for International Settlements (BIS).

The study also found that the most important CBDC features for central banks were offline payments, overtaking privacy. Instant settlements and programmability also rank highly, although the latter has proven controversial as critics say it would potentially give central banks control over citizens’ money.

What’s next for CBDC after Trump shuts the door for digital dollar?

Donald Trump has been one of the fiercest critics of a potential digital dollar. It was, therefore, no surprise that among the many executive orders he signed as the new president, one explicitly prohibited U.S. federal agencies from “undertaking any action to establish, issue, or promote CBDCs.”

The digital dollar is as good as dead, at least for as long as Trump is president and Republicans have control of both houses. And if there was any hope left, Federal Reserve Chairman Jerome Powell snuffed it out when he committed before the Senate that no CBDC would be developed under his leadership.

The U.S. government’s stance has split opinion. Supporters say it was long overdue after years of the Fed’s unclear stance on whether it would pursue a digital dollar. Others pointed out that it was just a formalization of what the world already knew: that the Fed wasn’t interested in a retail CBDC.

However, critics say that its broader impact will be massive, especially on America’s fintech leadership.

“The most significant impact of the executive order is the signal it sends to the rest of the world. It tells Europe that they have the playing field to themselves to set privacy and cybersecurity standards through the digital euro,” says Josh Lipsky, who heads the CBDC tracker at the Atlantic Council.

Lipsky also worries that China could now become the uncontested global leader in CBDCs, with other countries looking to the Asian giant for leadership and standards. China has the world’s most advanced CBDC for a major economy with its digital yuan.

Trump’s order also left questions over whether the ban extended to wholesale CBDC solutions and other currency tokenization projects in which the Fed has been involved. One of these is Project Agora, which is led by the BIS and focuses on tokenizing deposits.

Speaking recently, Federal Reserve Governor Christopher Waller distanced Agora from CBDC links, adding that the project is merely finding more efficient ways to trade bank reserves.

Waller doubled down on the Fed’s pivot from CBDCs, noting that “we have completely stopped using this word.”

Watch: Finding ways to use CBDC outside of digital currencies

08-09-2025

08-09-2025