|

Getting your Trinity Audio player ready...

|

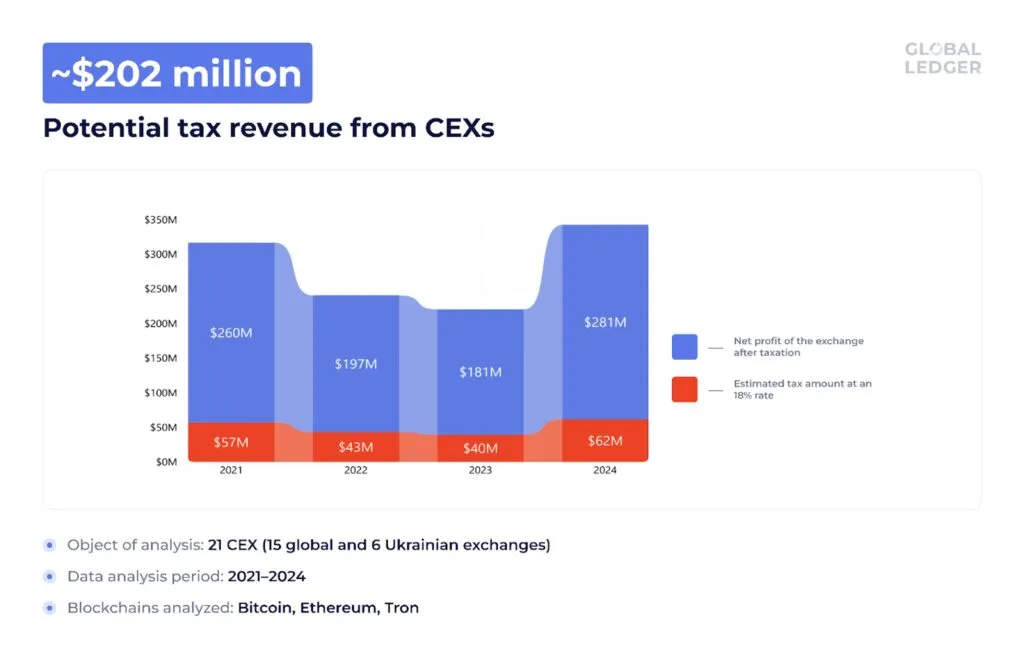

Ukraine lost out on taxes worth over $200 million from digital asset exchanges in the past four years, a new report by blockchain forensic services provider Global Ledger has revealed.

Global Ledger undertook the study as part of an initiative by the Ministry of Digital Transformation of Ukraine, the company revealed in a press release shared with CoinGeek. It analyzed 64 centralized global exchanges, some Ukrainian, and found that 2.5% of global traffic to these centralized exchanges (CEXs) is from Ukrainian investors.

Global Ledger offers cutting-edge blockchain visualization technology and digital asset anti-money laundering solutions. In September, it partnered with the BSV Association (BSVA) to bring its solutions to the global BSV community.

The research found that the exchanges made over $1.12 billion in profit from Ukrainian operations, translating to $202 million in taxes they should have paid in that period. The report further broke it down to $57 million in 2021, $43 million in 2022, $40 million in 2023 and $62 million this year.

It gets better: Global Ledger further estimated that Ukrainian traders could have earned between $630 million and $3.16 billion in profits from digital asset trading this year alone. Applying a 5% tax rate, the country could have earned up to $158 million.

Digital asset taxation isn’t a challenge specific to Ukraine. Globally, nearly every government has struggled with taxing gains from the sector, which is now valued at $3.75 trillion. Some, like Russia, have aligned digital asset taxation with stocks, making calculating and reporting taxes easier. Others, like South Korea, have opted to refrain from dealing with the tough questions, recently postponing new taxation measures by another two years.

In other countries, like India and Kenya, digital asset traders have gone to court to protest proposed taxation frameworks. In India, the Income Tax Appellate Tribunal stepped in this week, ruling that digital assets are capital assets and that profits should be subjected to capital gains, not as income from other sources.

Beyond the missed taxes, the Global Ledger report revealed that Ukrainian miners contributed roughly 1% of the global hashrate and generated $113 million over the past four years. Additionally, by May this year, Ukrainians had downloaded 1.7 million non-custodial digital asset wallets.

While it’s yet to implement a comprehensive taxation framework, Ukraine is seeking to legalize digital assets early next year. A parliamentary working group is set to table a draft bill before legislators, with input from the central bank and the International Monetary Fund (IMF).

Watch: How blockchain tech can help reduce costs for businesses

08-26-2025

08-26-2025