|

Getting your Trinity Audio player ready...

|

Switzerland has launched an instant payment system to catch up with the rest of Europe and transform its cash-loving people into a digital payments society.

The Swiss National Bank (SNB) announced that its new digital payments system is now available to 60 financial institutions, covering over 95% of the country’s retail transactions. It plans to integrate the remaining institutions in the coming months, putting Switzerland’s payments industry on par with fellow European nations that have had instant payments for years.

“Instant payments allow private individuals and companies to perform account-to-account transactions with immediate execution and final settlement in seconds, around the clock,” the central bank said in its statement.

It pledged to continue pushing for digital payments to make Switzerland a cashless society by 2026.

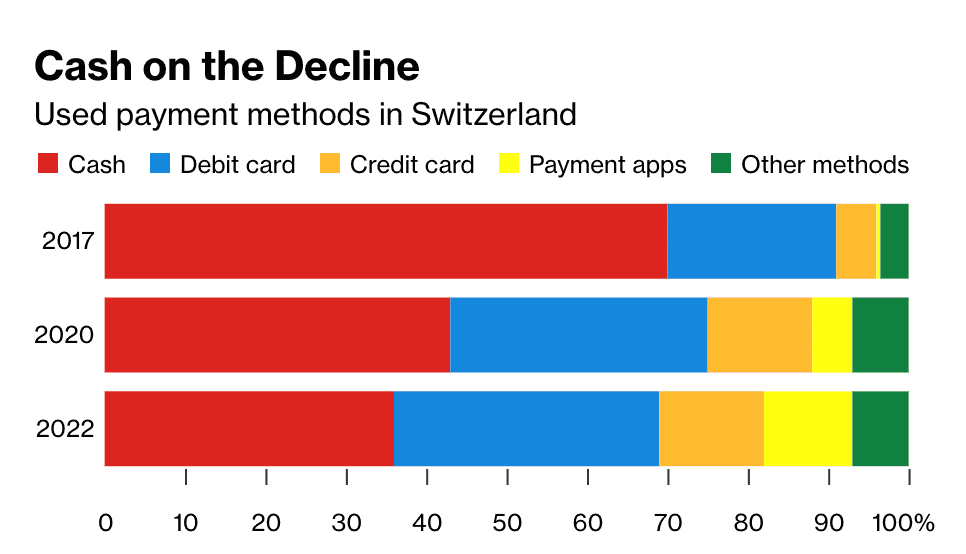

This is an ambitious target for SNB as Switzerland remains one of Europe’s most cash-loving nations. In 2017, a staggering 70% of the transactions were in cash. Even when the COVID-19 pandemic struck in 2020, 43% of the retail payments were still in physical notes and coins. According to some reports, the average Swiss holds over $11,000 in cash, the most of any country in the world, ahead of Hong Kong and Japan.

This figure has dipped slightly; according to the SNB’s report last year, cash usage in retail transactions stood at 36%.

Another SNB report earlier this year showed that 92% of Swiss companies operating face-to-face businesses accept cash, while only 59% accept payments via digital apps.

This contrasts starkly with most European nations where cash usage has been declining. Norway leads the charge, with less than 5% of its transactions being in cash. In other countries like Sweden, new regulations have boosted the transition to a cashless society; it’s legal for Swedish businesses to refuse cash payments.

For the Swiss, access to cash is an emotive political issue. A substantial section of the population supports enshrining this right in the constitutions, and a referendum is on the cards.

SNB’s new system is years later than its peers. In some European countries, instant payments have been around for years, such as the Faster Payments System in England. Beyond Europe, India and Brazil have proven a high demand for instant payments with the success of their Unified Payments Interface (UPI) and PIX systems, respectively.

The U.S. Federal Reserve was also late to the party, launching FedNow last year. Since then, it has onboarded 900 institutions, with the Fed revealing that community banks and credit unions account for nearly 80% of the total FedNow transactions.

Watch: Universal Blockchain Asset unlocks the future of payments

08-15-2025

08-15-2025