|

Getting your Trinity Audio player ready...

|

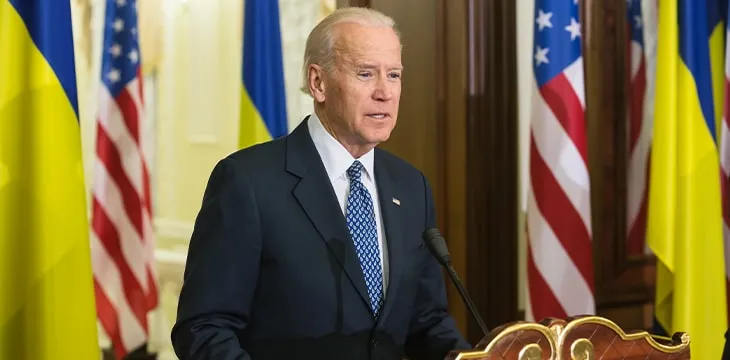

U.S. President Joe Biden is driving forward plans for a 50% increase in the budget allocated to the Financial Crimes Enforcement Network (FinCEN), in a bid to tackle rising levels of financial crimes, according to reports.

FinCEN has previously called for new rules that would require digital currency exchanges to take Know Your Customer (KYC) details for private digital currency wallets, in a move that would shine the light on transparency on more wallet users.

The budget increase would see funds of $191 million allocated to the agency, up $64 million on its original budget for the year. It is hoped the move would better allow the body to identify “illicit actors,” by focusing on shutting down “loopholes in financial reporting requirements.”

The budget will also be targeted towards building a database that tracks the ownership structures of different companies, in order to better uncover the use of complex company structures in avoiding the glare of regulators and other authorities.

The proposed increase is still yet to meet the approval of lawmakers in Congress, and President Biden is expected to flesh out the proposals in more depth later on this year.

The developments are set to be the latest flashpoint between FinCEN and the digital currency sector, after a number of measures in recent months, including most recently proposals that would require individuals to disclose any digital currency amounts held overseas.

The KYC on private wallet proposals have already generated significant pushback from the crypto community, with many stakeholders arguing the move would create “perverse incentives” in encouraging individuals to stay away from regulated operators.

However, FinCEN maintains the move is a necessary step in preventing digital currencies from being used for illegal purposes, and tackling the rise in financial crimes conducted via digital currencies such as BTC.

See also: SEC Commissioner Hester Peirce discusses “Blockchain Policy Matters” with Bitcoin Association’s Jimmy Nguyen

09-18-2025

09-18-2025