|

Getting your Trinity Audio player ready...

|

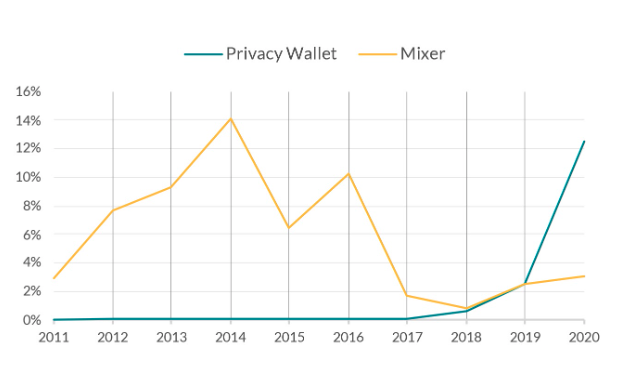

New research from the blockchain analytics company Elliptic shows that criminals are laundering more money through privacy wallets than they are through digital currency mixers.

Elliptic believes that in 2020, at least 13% of funds that originated from BTC-related crime were laundered through privacy wallets like Wasabi Wallet–this is a 2% increase compared to 2019. According to Elliptic, this represents $160 million from darknet markets, thefts, and scams being laundered through privacy wallets.

A decline in mixing service usage

As the use of privacy wallets is on the rise, the use of digital currency mixing services has plummeted over the years.

“Mixers have significant drawbacks – you have to trust that it isn’t a law enforcement honeypot (they are usually operated anonymously), or that they won’t simply disappear with the deposited Bitcoins,” said Elliptic in their official announcement. “Regulators have also started to crack down on these services with the operator of Helix, one of the largest mixers, fined $60 million for violating anti-money laundering regulations.”

Privacy wallets come with less risk than mixing services while effectively accomplishing the same goal–obfuscating the user’s transaction history.

However, Elliptic says that using a privacy wallet is not as spot-clean as users may think it is.

The fact that a customer has used a privacy wallet is itself useful information, even if the ultimate source of funds cannot be determined. This insight can be used to trigger enhanced due diligence on the customer’s source of funds, in a similar way that a large cash deposit at a bank might trigger additional checks,

said Elliptic.

To learn more about red flag indicators, or in other words, events and actions in the digital currency industry that make service providers and analytic companies more inclined to flag your wallet address, you can find more information in Elliptic’s recently released guide, “Financial Crime Typologies in Crypto Assets.”

08-06-2025

08-06-2025